News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

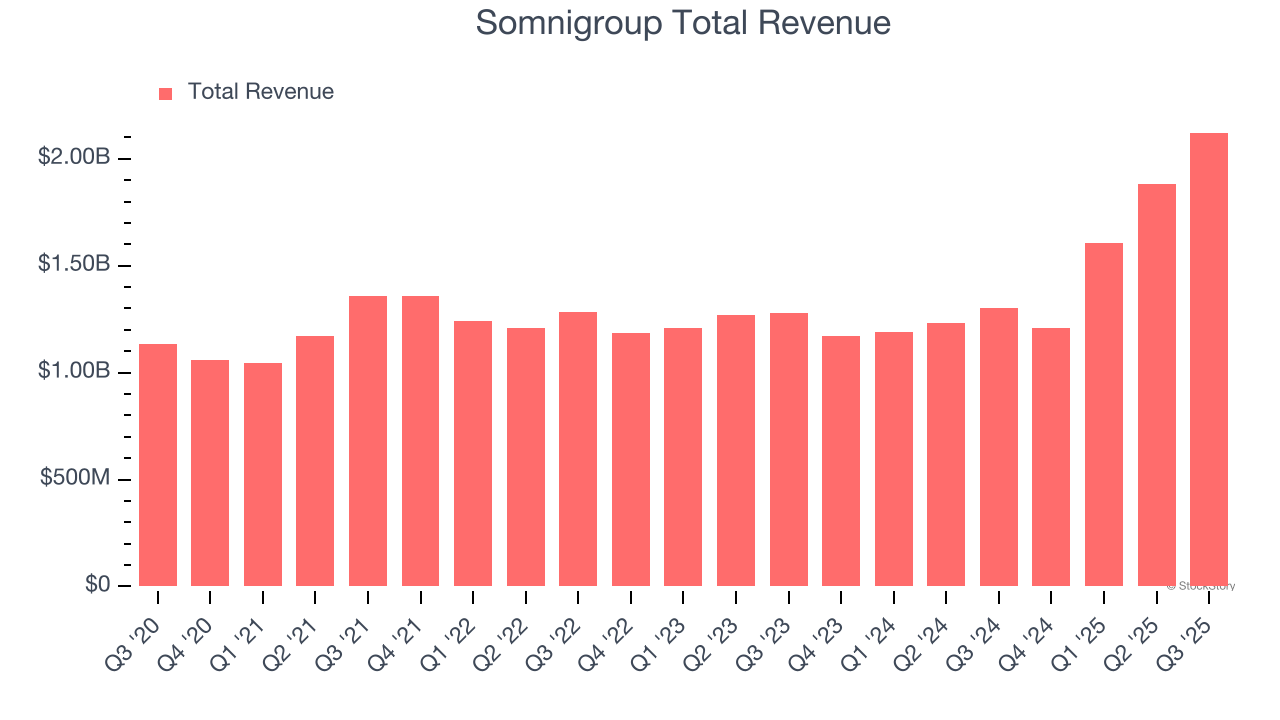

Somnigroup (SGI) Reports Q4: Everything You Need To Know Ahead Of Earnings

Finviz·2026/02/16 03:12

Leidos (LDOS) Q4 Earnings: What To Expect

Finviz·2026/02/16 03:06

Japan bear flips & now bets on yen strength vs dollar, sterling & franc (sees +8% vs. CHF)

101 finance·2026/02/16 03:06

Japan PM Takaichi to hold first meeting with BOJ chief Ueda since election win

101 finance·2026/02/16 03:06

Top Crypto Gainers Today – Pepe and Dogecoin Lead Memecoin Resurgence Amid Market Volatility

BlockchainReporter·2026/02/16 03:00

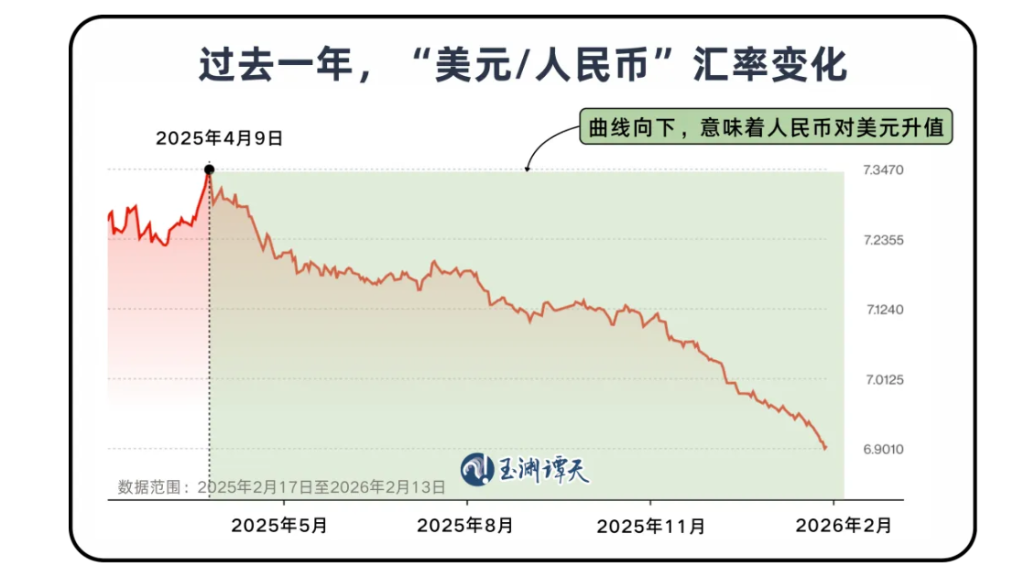

At the beginning of the Lunar New Year, how should we view the appreciation of the RMB?

华尔街见闻·2026/02/16 02:59

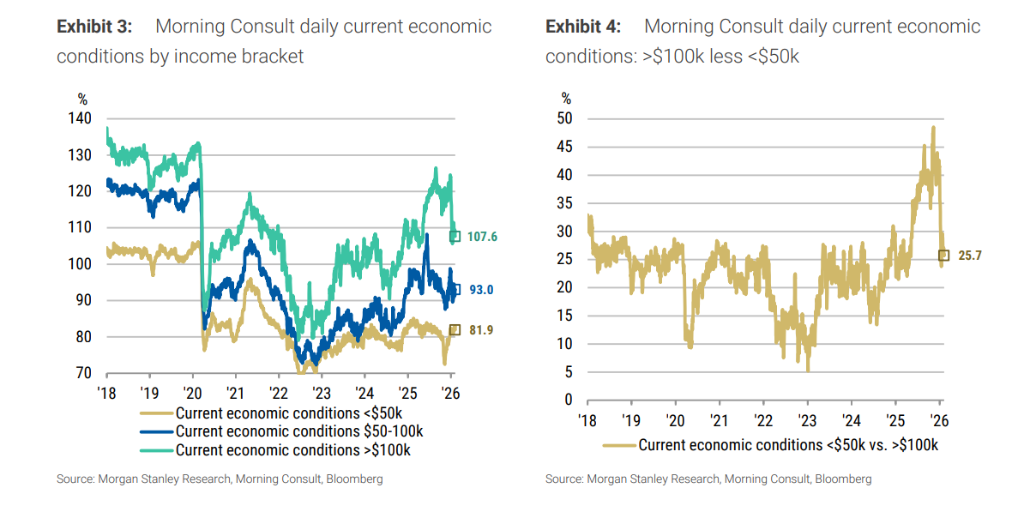

Risk-Off Mode! Morgan Stanley: The Market Has Started Buying US Treasuries

华尔街见闻·2026/02/16 02:41

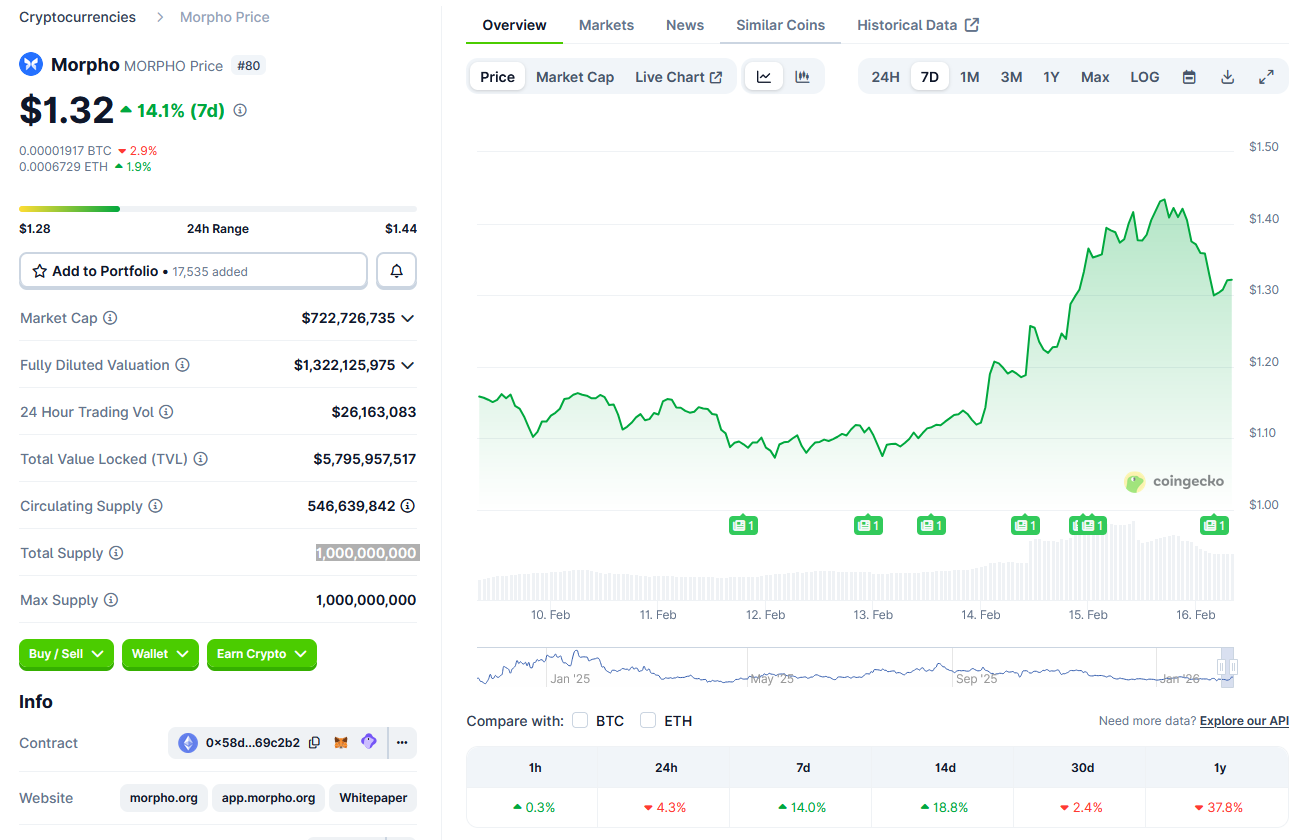

TradFi giant Apollo enters crypto lending arena via Morpho deal

Cointelegraph·2026/02/16 02:30

Flash

03:31

Opinion: Widespread Bitcoin accumulation signals increasing institutional confidenceBlockBeats News, February 16, according to Forbes, one of the most easily overlooked developments during the crypto market downturn is the widespread accumulation signs emerging for bitcoin. On-chain analysis shows that after experiencing large-scale sell-offs, almost all holder groups have resumed buying behavior. Specifically, according to Glassnode data, since the end of 2025, it is the first time that all wallet sizes have shown a general and sustained buying trend. Notably, the data shows that wallets holding 10 to 100 bitcoins have been the most aggressive buyers, once again becoming the main buyers when the price fell back to around $60,000. As institutions continue to deploy on-chain solutions, develop and launch bitcoin-related products (including more ETF and ETF-like products), and overall provide more on-chain services, the demand base for bitcoin and other crypto assets is now broader than during previous downturns.

03:16

「Buddy」 FOMO Longs, Account Shows $330k Unrealized LossBlockBeats News, February 16th, according to HyperInsight monitoring, "Brother Ma Ji" Huang Licheng's address has just closed a VVV long position at a small profit and added to a long position in HYPE. Currently, he is long 13,888.88 HYPE with 10x leverage, with an unrealized loss of $4,400, and long 5,250 ETH with 25x leverage, with an unrealized loss of $326,000.

03:07

Polymarket shows an 8% probability that BTC will drop to $55,000 in February.Foresight News reported that according to the latest data from Polymarket, the market estimates an 8% probability that BTC will fall to $55,000 in February, a 24% probability that it will fall to $60,000, and a 37% probability that it will rise to $75,000. Currently, the total trading volume on this prediction market exceeds $64 million.

News