News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

Memecoin market showing 'classic capitulation signal': Santiment

Cointelegraph·2026/02/14 06:27

Software sector downturn: Which European firms are affected?

101 finance·2026/02/14 06:06

Bitcoin’s Unstoppable Ascent: Pompliano Reveals Why Slowing Inflation Can’t Derail Long-Term Growth

Bitcoinworld·2026/02/14 06:03

Cache Wallet Partners Bluepill to Advance Multichain Asset Protection

BlockchainReporter·2026/02/14 06:00

Bitcoin ETF Inflows Surge with $15.2M Rebound, Signaling Renewed Investor Confidence

Bitcoinworld·2026/02/14 05:54

Bitcoin Cash Price Prediction 2026-2030: The Critical $1000 Milestone Revealed

Bitcoinworld·2026/02/14 05:54

Crypto Futures Liquidations: A Staggering $198 Million Purge Shakes Markets

Bitcoinworld·2026/02/14 05:54

Trump Cryptocurrency Price Prediction 2026-2030: Unveiling the Critical Factors That Will Shape TRUMP’s Trajectory

Bitcoinworld·2026/02/14 05:54

Flash

06:37

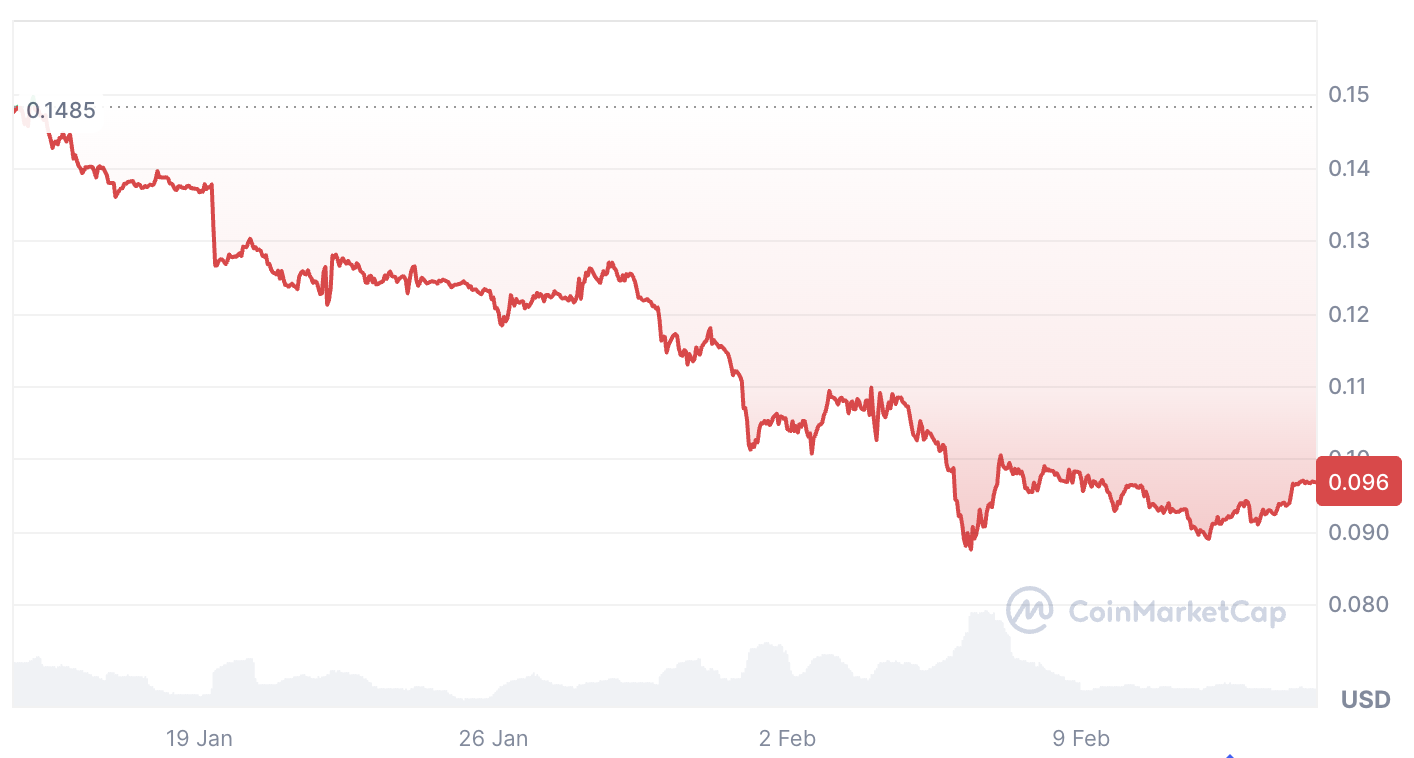

Santiment: Classic Capitulation Signal Appears in Meme Coin MarketPANews, February 14—According to Cointelegraph, on-chain data analytics platform Santiment stated that as traders generally believe the "Meme coin era is over," the market is showing "classic capitulation signals," which often present a contrarian opportunity. Santiment pointed out that when a particular sector of the market is completely out of favor, it often signals that the bottom is near. Data shows that the total market capitalization of Meme coins has dropped by 34.04% over the past 30 days to $31.02 billions. Santiment also observed that pessimism about the crypto market on social media significantly outweighs optimism. This phenomenon, where skepticism persists even as prices rise, is a healthy sign that the market may continue to recover. Analysts noted that, unlike previous broad-based altcoin seasons, the next market cycle may be more selective, with only certain cryptocurrencies benefiting.

05:44

The probability of the "U.S. government shutdown again before February 14" event on Polymarket has plummeted to 3%, with a trading volume of nearly $9.9 million.According to Odaily, data from the Polymarket website shows that the probability of the event "the US government shuts down again before February 14" has plummeted to 3%, with trading volume exceeding $9.89 million. Previously, the probability of the event "the US government shuts down again before February 14" on Polymarket once rose to 97%.

05:32

Odaily Noon News1. Polymarket official personnel posted a screenshot and deleted it seconds later; the POLY token is suspected to be linked to platform fees; 2. Grayscale has applied to convert the AAVE Trust into an ETF; 3. Jupiter has initiated a new proposal to reduce the net future token release to zero; 4. The Dutch House of Representatives has passed a 36% capital gains tax bill, planned to be implemented in the 2028 tax year; 5. SpaceX plans to adopt a dual-class share structure in its IPO to strengthen Musk's control; 6. The US crypto bill has been blocked by Wall Street banking groups due to stablecoin yields; The Digital Chamber has proposed a compromise to promote agreement between both parties; 7. The Dubai Financial Services Authority has released a Q&A document on the crypto token regulatory framework, clarifying the conditions for regulated entities to use crypto tokens; 8. Grayscale: Privacy tokens such as ZEC can enable compliance and privacy to coexist, and is promoting the conversion of the ZEC Trust into an ETF; 9. Crypto data infrastructure project BihuoPro has received a $5 million strategic investment from Gemhead Capital; 10. X product lead: Plans to further combat spam and will conduct detection, suggesting to temporarily postpone the integration of bot programs; 11. The Bitcoin premium index on a certain exchange has been in negative premium for 30 consecutive days, setting the longest “consecutive negative” record so far this year; 12. BTC treasury company Hyperscale Data plans to issue preferred shares to raise $35.4 million; 13. a16z advisor: Only 1.3% of political contracts in prediction markets have liquidity, suggesting the introduction of AI agents to provide liquidity; 14. Hackers exploited OCA deflationary logic to attack the USDC-OCA pool, profiting about $340,000.

News