News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Tariff Threats Escalate; Gold and Silver Prices Hit New Highs; US Stock Futures Generally Decline (Jan 20, 2026)2 Bitcoin Market Sentiment Has Changed, Analyst Says: Why 2022 Is the Wrong Comparison3FG Nexus ETH Sale: Nasdaq Giant’s Strategic $8 Million Ethereum Move Reveals Cautious Crypto Stance

JPY: MUFG notes Japan’s ultra-long bond yields jump 27bps on fiscal worries

101 finance·2026/01/20 10:24

Eurozone ZEW Survey rises to 40.8 in January, surpassing the forecast of 35.2

101 finance·2026/01/20 10:24

Copper climbs near $13,000 as Dollar softens – ING

101 finance·2026/01/20 10:24

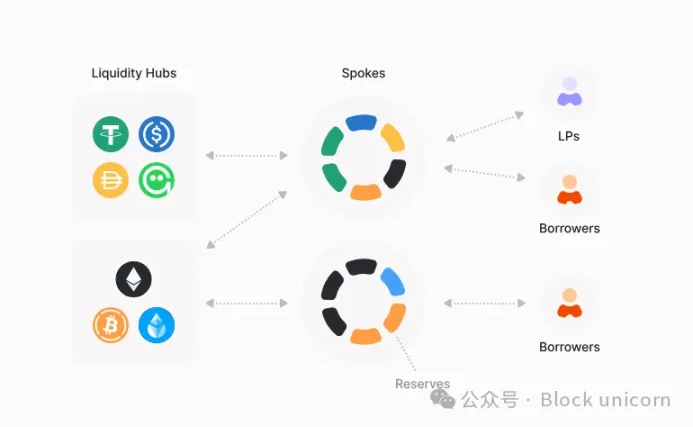

Aave v4 and Capital Efficiency

Block unicorn·2026/01/20 10:18

Glassnode says Bitcoin spot market shows early signs of recovery

Cointelegraph·2026/01/20 10:06

7 Top Crypto Presales: BlockchainFX ($BFX) Trading Super App Will Go Live On Jan 31st, With APP50 Giving 50% More Tokens

BlockchainReporter·2026/01/20 10:03

TROVE token’s 97% wipeout: From $11.5 mln presale to rug-pull accusations

AMBCrypto·2026/01/20 10:03

'White Whale' memecoin plunges 60% as largest holder offloads $1.3 million

101 finance·2026/01/20 10:03

Taiwan's Inventec says decision on Nvidia's H200 chip 'appears to be stuck' on China's side

101 finance·2026/01/20 09:51

EUR/USD rebounds amid EU-US trade tensions – Danske Bank

101 finance·2026/01/20 09:33

Flash

10:27

Wintermute: If BTC can hold above $90,000 this week and ETF inflows continue, the breakout trend is likely to continueForesight News reported that Wintermute stated in a post that bitcoin appears to be entering an upward channel after breaking out of the narrow trading range of the past 50 days. The market landscape changed last week. For the first time since November, bitcoin broke out of its range based on real capital flows (rather than leveraged trading). ETF demand has returned, the inflationary environment is favorable, and cryptocurrencies are starting to catch up with the overall rally in risk assets. Although Monday's sharp drop was severe, it was a healthy correction. Leverage was quickly cleared, and the market did not fall into a vicious cycle, which is a positive sign. The current question is whether the tariff dispute is merely "posturing" or will evolve into substantive policy. The market tends to believe the former. Since the beginning of the year, U.S. stocks and the dollar have continued to rise, and interest rates have not been repriced. In the short term, attention should be paid to Tuesday's opening and Friday's PCE data. If bitcoin can hold above just over $90,000 this week and ETF inflows continue, the breakout trend is likely to continue; if subsequent sell-offs push it below $90,000, the range since November will once again become a resistance level. For now, buying power appears to be real.

10:18

「20M Bag Hunter」 Takes Profit on SOL Short Position, Quick Deleverage of Over $2.36MBlockBeats News, January 20th, according to HyperInsight monitoring, the "20 Million Bandit Hunter" whale (0x880a...) conducted partial profit-taking on its SOL short position in about half an hour, reducing the SOL short position twice for a total of 17,841.27 SOL, with a total value of approximately $2.369 million.

The address first reduced its holdings by 9,871.05 SOL (worth approximately $1.353 million) at 17:00, realizing a floating profit of about $501,000; then at 18:00, it further reduced its holdings by 7,970.22 SOL (worth approximately $1.016 million), realizing a floating profit of about $389,000. The ROI of the two profit-taking operations both exceeded 106%. After completing this round of profit-taking, its SOL short position has been reduced to about $4.008 million.

This address is known for its high-frequency, multi-currency arbitrage trading style, with an average holding period of about 20 hours. Since October last year, with a starting capital of around $20 million, it has accumulated profits of nearly $100 million.

10:14

ZAMA auction will begin on January 21, and registration is now open.Foresight News reported that Zama announced on Twitter that its token auction will begin at 16:00 on January 21 and end on January 24, and registration is now open. The TGE is scheduled for February 2, 2026, at which time tokens purchased through the public auction are expected to be fully unlocked. Participants must complete registration and verification in advance, and submit bids in USDT using a single verified wallet address, specifying the total purchase amount and the maximum price per token they are willing to accept. After the auction ends, the system will calculate a unified clearing price. Bids with a limit price equal to or higher than this price will be allocated tokens at the clearing price, while unsuccessful bids or excess funds will be returned to the original wallet.

News