News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | Fed Maintains Hawkish Stance on Rates; Trump Threatens Iran Leading to Gold and Silver Pullback; Storage Sector Strong with Seagate Up Over 19% (January 29, 2026)2Bitcoin companies keep buying as AI pulls capital away – Inside ABTC’s move3DePIN startups raise $1B, generate $72M in onchain revenue in 2025

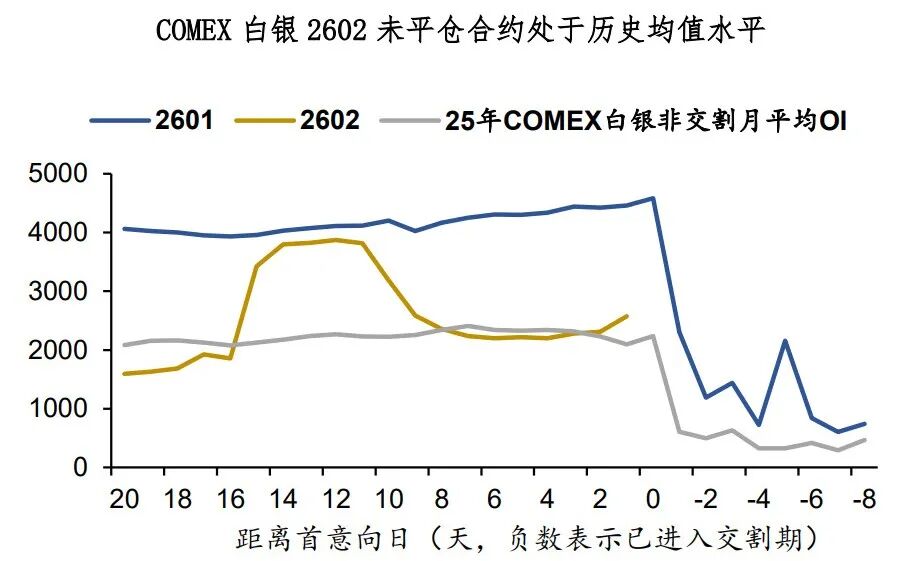

Silver: The Bull Market Needs a Breather

BFC汇谈·2026/01/30 01:02

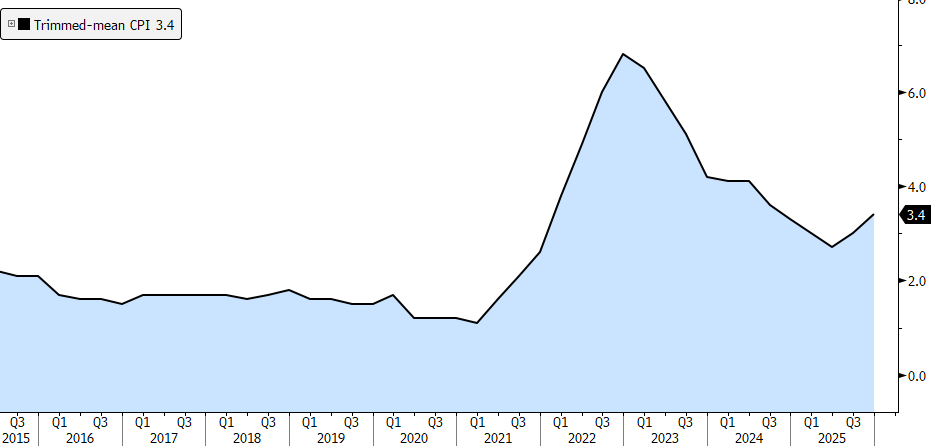

Producer Price Indices, Australia, December 2025

101 finance·2026/01/30 00:33

Optimism votes to approve highly contested OP buyback program

Cointelegraph·2026/01/30 00:15

The iPhone just had its best quarter ever

101 finance·2026/01/30 00:09

AUD: The Strongest King

硅基星芒·2026/01/29 23:58

Strategy, BitMine Share Values Plummet as Bitcoin and Ethereum Decline

101 finance·2026/01/29 23:27

KLA Corp beats quarterly results estimates on strong chipmaking tool demand

101 finance·2026/01/29 23:27

Schneider National’s stock drops following disappointing Q4 results and a subdued forecast for 2026

101 finance·2026/01/29 23:18

Dolby Laboratories (NYSE:DLB) Announces Strong Fourth Quarter Results for Fiscal Year 2025

101 finance·2026/01/29 23:06

The Bancorp (NASDAQ:TBBK) Announces Q4 CY2025 Revenue Falling Short of Analyst Projections

101 finance·2026/01/29 23:06

Flash

01:04

HV-MTL is quietly transforming from a dormant NFT into an active ecosystem asset—this could be significant.According to CoinWorld, the NFT project HV-MTL, acquired by Adam Weitsman, is about to launch an exclusive trading platform that supports direct transactions and bundled swaps between HV-MTL assets. This move aims to enhance internal liquidity and transform assets into actively repositionable holdings. Weitsman's ownership is backed by strong financial support and a long-term development strategy. He emphasizes rebuilding the ecosystem from within and plans to integrate it into Yuga Labs' Otherside platform, which remains a viable direction for future development.

01:04

The US Department of Justice Announces Seizure of Over $4 Billion in Assets Related to Coin Mixing Service HelixBlockBeats News, January 30, the U.S. Department of Justice announced that it has formally obtained legal ownership of over $400 million in assets related to the dark web cryptocurrency mixing service Helix, including cryptocurrency, real estate, and cash assets. On January 21, District of Columbia District Court Judge Beryl A. Howell signed the final forfeiture order.

Helix, operated by Larry Dean Harmon, processed around 354,468 Bitcoin transactions from 2014 to 2017, worth $300 million at the time, primarily catering to money laundering needs of dark web drug dealers. Harmon pleaded guilty to money laundering conspiracy in August 2021 and was sentenced to 36 months in prison, 3 years of supervised release, and asset forfeiture in November 2024.

00:58

Trend Research under Yilihua deploys $109 million to reduce Ethereum liquidation riskBlockBeats News, January 30, according to on-chain analyst Ai Yi (@ai_9684xtpa), Trend Research under Yilihua has withdrawn a total of 109 million USDT from a certain exchange over the past 9 hours. These funds have been deposited into Aave to reduce the liquidation risk of their Ethereum holdings. Currently, Trend Research holds 661,272.65 ETH with an unrealized loss of 192 million USD, and the cost price is 3,104.36 USD.

News