News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin companies keep buying as AI pulls capital away – Inside ABTC’s move2Bitget UEX Daily | U.S. Shutdown Crisis Averted; Iran Tensions Boost Oil; Gold Rebounds Amid Microsoft Earnings Split (January 30, 2026)3DePIN startups raise $1B, generate $72M in onchain revenue in 2025

Sandisk forecasts profit surge, secures supply deal as AI fuels storage demand

101 finance·2026/01/30 01:54

How Ethos, supported by Sequoia, made it to the public market as competitors lagged behind

101 finance·2026/01/30 01:39

Altcoin Season Index Stagnates at 32, Revealing a Cautious Crypto Market

Bitcoinworld·2026/01/30 01:21

Dollar set for weekly decline amid escalating global tensions

101 finance·2026/01/30 01:15

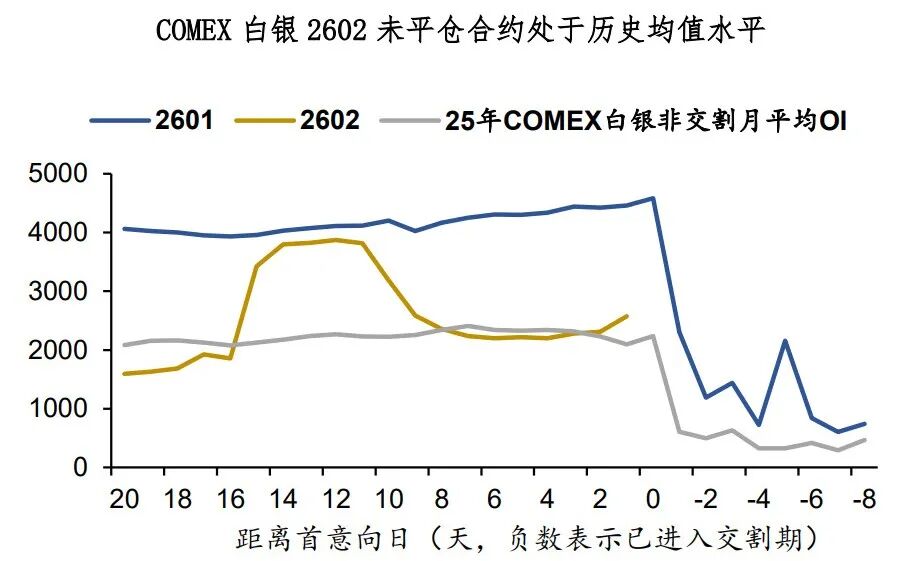

Silver: The Bull Market Needs a Breather

BFC汇谈·2026/01/30 01:02

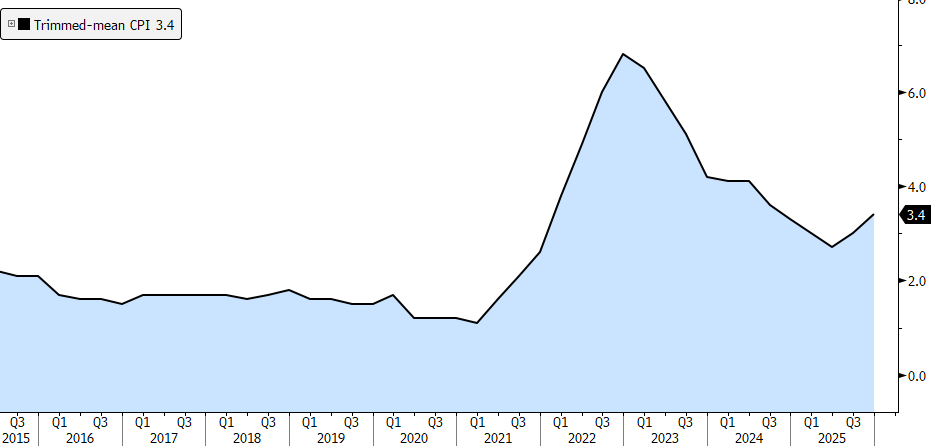

Producer Price Indices, Australia, December 2025

101 finance·2026/01/30 00:33

Optimism votes to approve highly contested OP buyback program

Cointelegraph·2026/01/30 00:15

The iPhone just had its best quarter ever

101 finance·2026/01/30 00:09

AUD: The Strongest King

硅基星芒·2026/01/29 23:58

Strategy, BitMine Share Values Plummet as Bitcoin and Ethereum Decline

101 finance·2026/01/29 23:27

Flash

02:08

In a Flash Loan Attack, two on-chain whales were liquidated for a total of $146 million, representing 8.4% of the total 24-hour liquidation value.BlockBeats News, January 30th, according to on-chain analyst Ai Auntie (@ai_9684xtpa), during the recent flash crash, two on-chain whales were liquidated a total of $146 million, accounting for 8.4% of the total 24-hour liquidation value.

An ETH long position on a certain Hyperliquid was liquidated, worth $65.14 million;

A BTC long position on an exchange was liquidated, worth $80.58 million.

02:08

USD/JPY rises over 0.5% intraday, now trading at 153.84ChainCatcher News, according to Golden Ten Data, the USD/JPY has risen more than 0.5% intraday and is now quoted at 153.84.

02:06

YO Protocol announces tokenomics: 8% allocated to genesis airdrop, airdrop claim to open on February 5PANews, January 30th – According to official sources, YO Protocol has announced the launch of its native governance token YO and released its tokenomics model. The total supply of YO is 1 billion tokens, with the allocation as follows: 30% for community growth and future rewards, 24% allocated to core contributors, 21.5% for ecosystem development and strategic partnerships, 16.5% for early investors, and 8% for the genesis airdrop. The token airdrop claim will open on February 5th, and eligible users can connect their Base network wallets to claim. The YO token will be launched in phases: in the initial stage, the token will be non-transferable, aiming to encourage active participation in governance and promote long-term alignment with real users; this phase is expected to enable transferability through a governance vote when feasible. Holding YO will grant voting rights on key protocol decisions, including future plans, treasury usage, and treasury parameter adjustments. For early users and the community, YO Protocol launched the YO Rewards Program on January 29th, lasting two weeks. Users can earn YO rewards by depositing into yoUSD, yoETH, yoEUR, yoBTC, or yoGOLD vaults or participating in supported DeFi activities. During the first phase, the reward rate for all vaults is set at 14%. Previously, in December 2025 news, the development team behind YO Protocol, YO Labs, completed a $10 million Series A funding round led by Foundation Capital.

News