News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Ends Government Shutdown; Software Stocks Hit by AI Tools; Nvidia Plans Massive Investment in OpenAI (February 4, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Ripple adds Hyperliquid to its prime brokerage platform in first DeFi integration

The Block·2026/02/04 14:00

Eli Lilly leaves Novo Nordisk in the dust in weight loss drug race

101 finance·2026/02/04 13:57

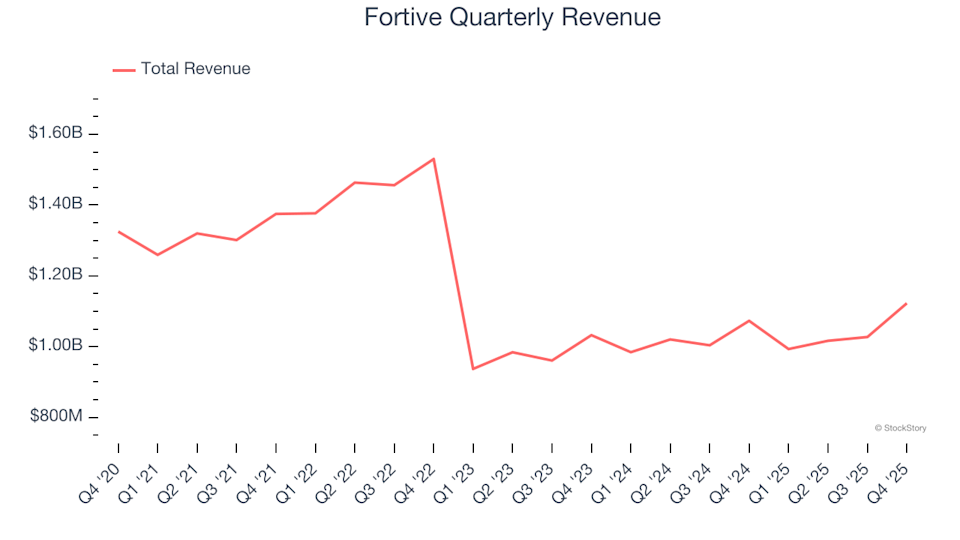

Fortive (NYSE:FTV) Exceeds Q4 2025 Sales Expectations

101 finance·2026/02/04 13:42

Bitcoin Hovers as US Employment Data Surprises the Market

Cointurk·2026/02/04 13:39

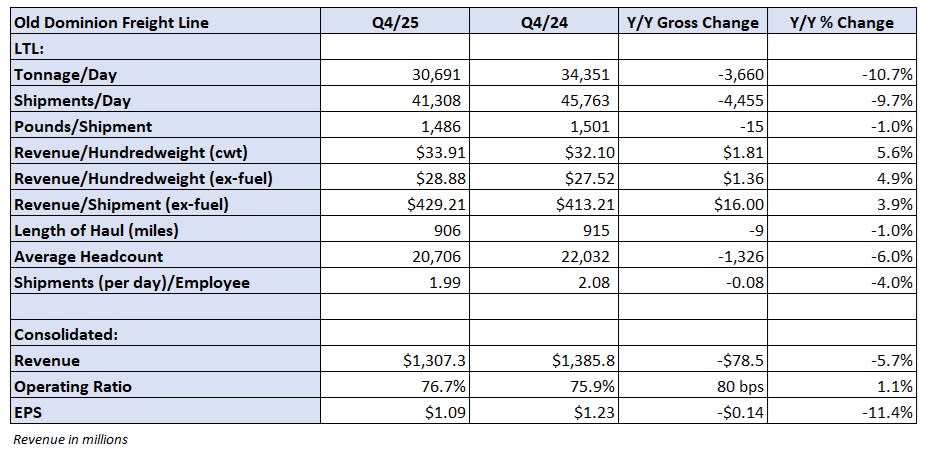

First glance: Old Dominion surpasses Q4 expectations

101 finance·2026/02/04 13:33

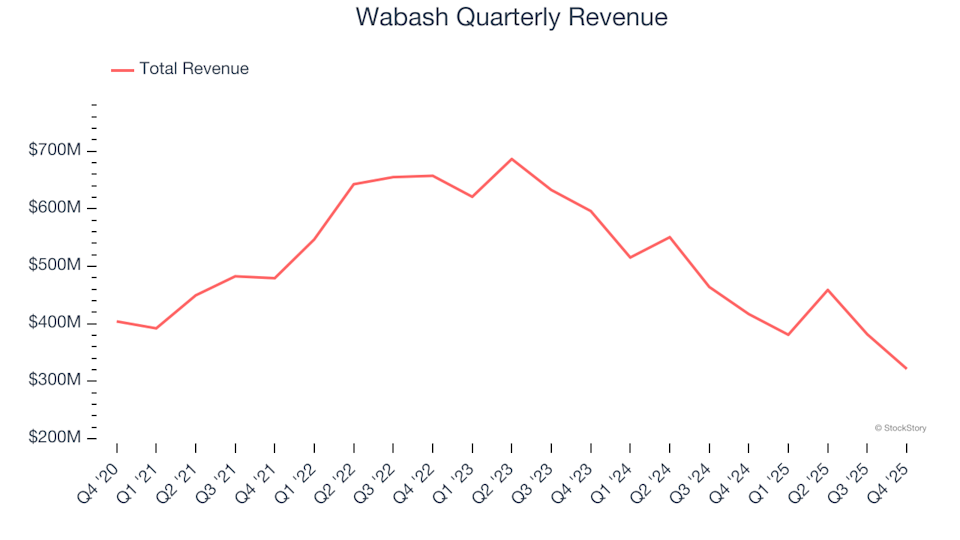

Wabash (NYSE:WNC) Reports Q4 CY2025 Sales Surpassing Expectations, Yet Shares Decline

101 finance·2026/02/04 13:33

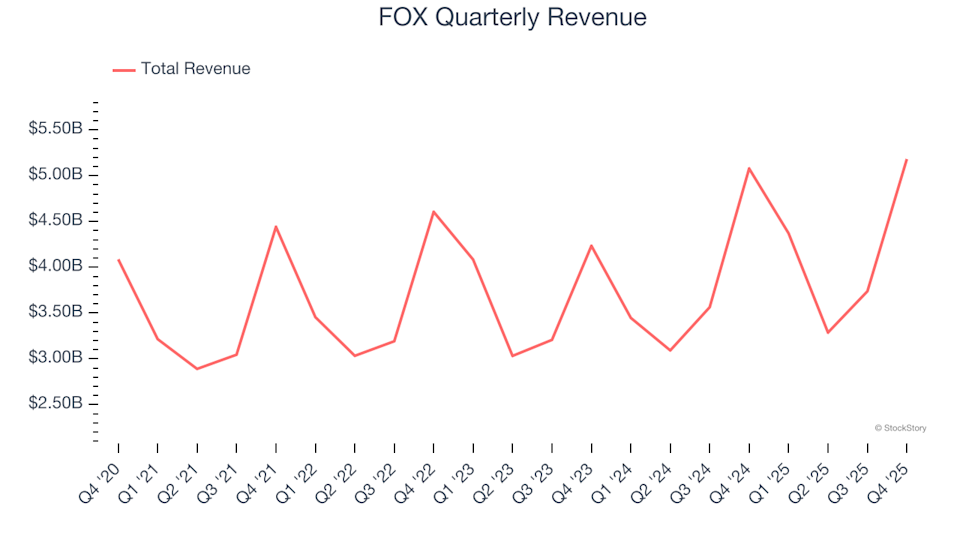

FOX’s (NASDAQ:FOXA) Q4 CY2025 Revenue Surpasses Projections

101 finance·2026/02/04 13:33

Sentiment Shifts on Strategy's Bitcoin Bid as Crypto Market Selloff Deepens

Decrypt·2026/02/04 13:31

Fortive forecasts upbeat annual profit on strong industrial automation business

101 finance·2026/02/04 13:30

Flash

14:02

Data: If BTC breaks $78,450, the cumulative short liquidation intensity on major CEXs will reach $1.843 billions.ChainCatcher news, according to Coinglass data, if BTC breaks through $78,450, the cumulative short liquidation intensity on major CEXs will reach $1.843 billions. Conversely, if BTC falls below $71,055, the cumulative long liquidation intensity on major CEXs will reach $1.254 billions.

14:00

Analysis: Bitcoin Has Not Been "Overbought" Since the End of 2024, Bear Market May Have Lasted Over a YearAccording to Odaily, analysis shows that bitcoin's 14-day Relative Strength Index (RSI) during 2025 and since the end of 2024 has never reached the historical overbought range. This relationship between price and RSI suggests that the previous bitcoin cycle peak may have occurred in November 2024, after which the market entered a bear phase, indicating that the bear market may have lasted for more than a year.

13:57

New York Silver Futures Soar 10.00% Intraday, Now Trading at $91.64 Per OunceBlockBeats News, February 4th, according to Bitget market data, the New York Silver Futures surged 10.00% intraday, now trading at $91.64 per ounce. Spot silver rose by 7.7%.

News