News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Ends Government Shutdown; Software Stocks Hit by AI Tools; Nvidia Plans Massive Investment in OpenAI (February 4, 2026)2BitMine adds 41,000 ETH to its balance sheet, while its unrealized losses amount to $6B3XRP price prediction: What the loss of the $1.77 swing low means for you

Trump administration intensifies actions to secure vital mineral resources from sources beyond China

101 finance·2026/02/04 05:12

Are We in a Bear Market for Bitcoin? Anthony Pompliano Responds

BitcoinSistemi·2026/02/04 05:03

Amazon Q4 Earnings Preview: AWS Momentum + AI Investments = Another Explosive Beat?

Bitget·2026/02/04 04:58

Ripple Custody Powers $280M Diamond Tokenization on XRP Ledger

Cryptotale·2026/02/04 04:54

The Commodities Feed: Oil prices climb amid renewed US-Iran tensions

101 finance·2026/02/04 04:30

Bitcoin $40K Doom Incoming? Monero and Litecoin Lose Momentum, While APEMARS Sparks as the Best Altcoin Investment – Top 1000x Crypto Presale

BlockchainReporter·2026/02/04 04:15

Bitcoin Whale’s Stunning $118M Loss: Analyzing the Strategic Sell-Off of 5,076 BTC

Bitcoinworld·2026/02/04 04:06

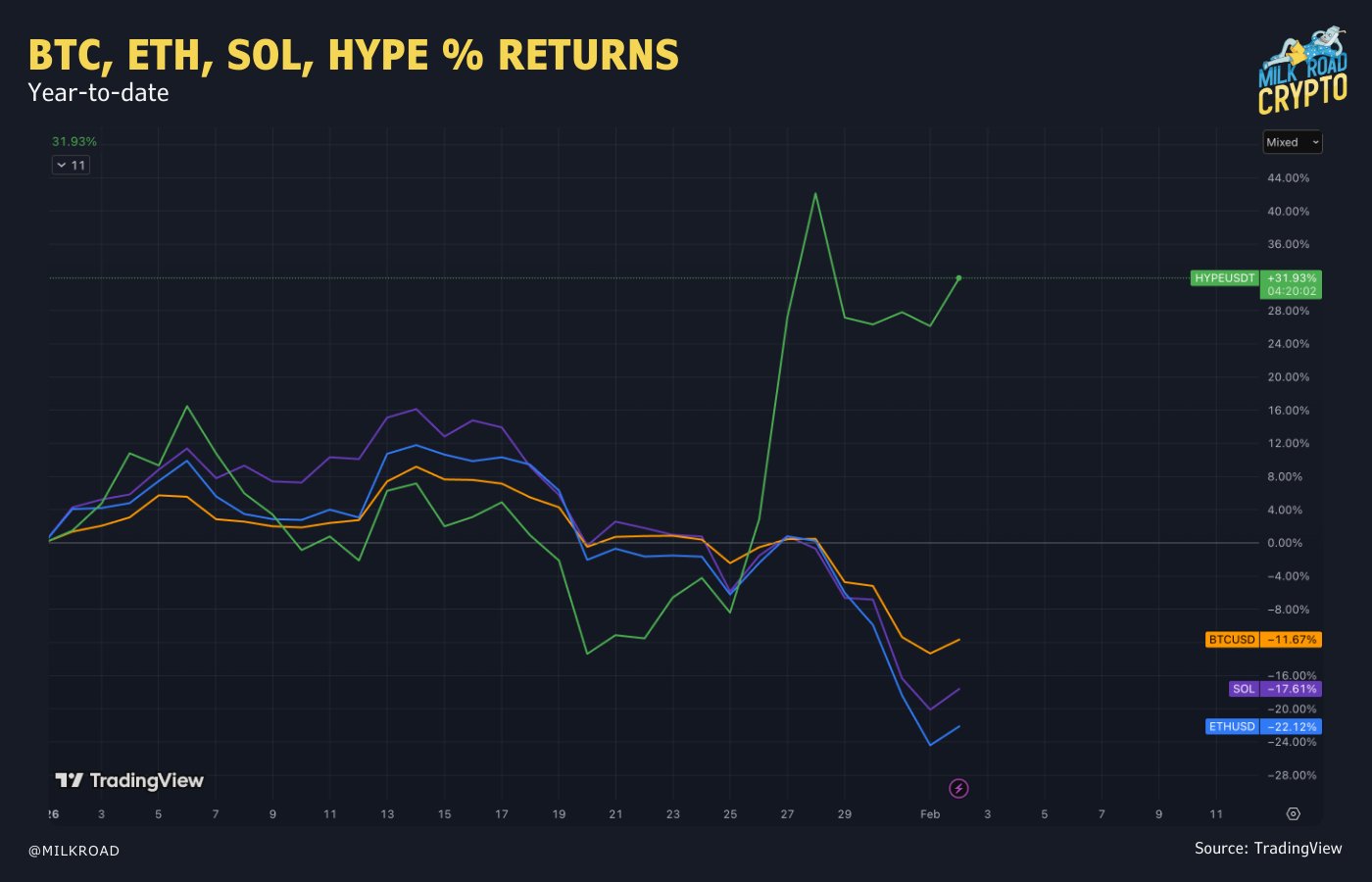

Hyperliquid: THIS is why HYPE is breaking out in a falling crypto market

AMBCrypto·2026/02/04 04:03

Bitcoin Faces Potential for Deeper Decline as Upward Momentum Fades Beneath Crucial Support Level

101 finance·2026/02/04 03:36

Flash

05:16

Ruisheng Asia reduces holdings of BlackRock Ethereum ETF worth $16.21 millionAccording to documents submitted by Pilgrim Partners Asia to the U.S. Securities and Exchange Commission (SEC), the company sold 620,000 shares of BlackRock's Ethereum exchange-traded fund, iShares Ethereum Trust ETF, in the previous quarter, valued at $16.21 million. Currently, Pilgrim Partners Asia still holds $25.49 million worth of BlackRock Bitcoin ETF and $10.64 million worth of Strategy shares.

05:16

US-listed Company Skysat Plans to Acquire 15,000 Bitcoins Through Equity-Linked TransactionsBlockBeats News, February 4th, according to Cointelegraph, Nasdaq-listed insurance brokerage firm Tranquilidade announced that the company has reached a strategic agreement where an undisclosed investor will contribute 15,000 bitcoins in exchange for equity in the company, currently valued at approximately $1.1 billion.

Tranquilidade also stated that the agreement includes a strategic collaboration focusing on artificial intelligence and the crypto field, planning to jointly establish an innovation lab to develop AI-driven trading and risk management tools, blockchain infrastructure, decentralized applications, and products covering Layer 2 networks, DeFi, and non-fungible tokens (NFTs).

According to Bitget data, Tranquilidade (TIRX) closed at $0.15, a 98.41% increase. With a market capitalization of about $7.479 million, it is far below the value implied by the proposed Bitcoin transaction. If the deal goes through, with Tranquilidade receiving 15,000 bitcoins, it would become the world's eighth-largest publicly traded Bitcoin treasury company.

05:15

Tether abandons $20 billion fundraising target after investor oppositionAccording to a report by Bijie Network: Tether CEO Paolo Ardoino downplayed the scale of its potential funding round, clarifying that the previously reported $15 billion to $20 billion target was a "misunderstanding" and was only the maximum valuation. The stablecoin issuer previously faced investor backlash over its $500 billion valuation target and may now only be able to raise $5 billion. Ardoino emphasized Tether's profitability, noting that the company's profit last year was about $10 billion, and defended its high valuation by comparing it to loss-making artificial intelligence companies. He pointed out that the company has attracted widespread attention from investors and highlighted the momentum brought by new U.S. stablecoin legislation and its compliant U.S. token issuance.

News