News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Tariff Threats Escalate; Gold and Silver Prices Hit New Highs; US Stock Futures Generally Decline (Jan 20, 2026)2BitGo IPO on the Brink: Can the Crypto Custody Giant Recreate Circle's Epic Surge?3FG Nexus ETH Sale: Nasdaq Giant’s Strategic $8 Million Ethereum Move Reveals Cautious Crypto Stance

Disney succession: A look inside the hunt for Bob Iger's successor as CEO

101 finance·2026/01/20 11:21

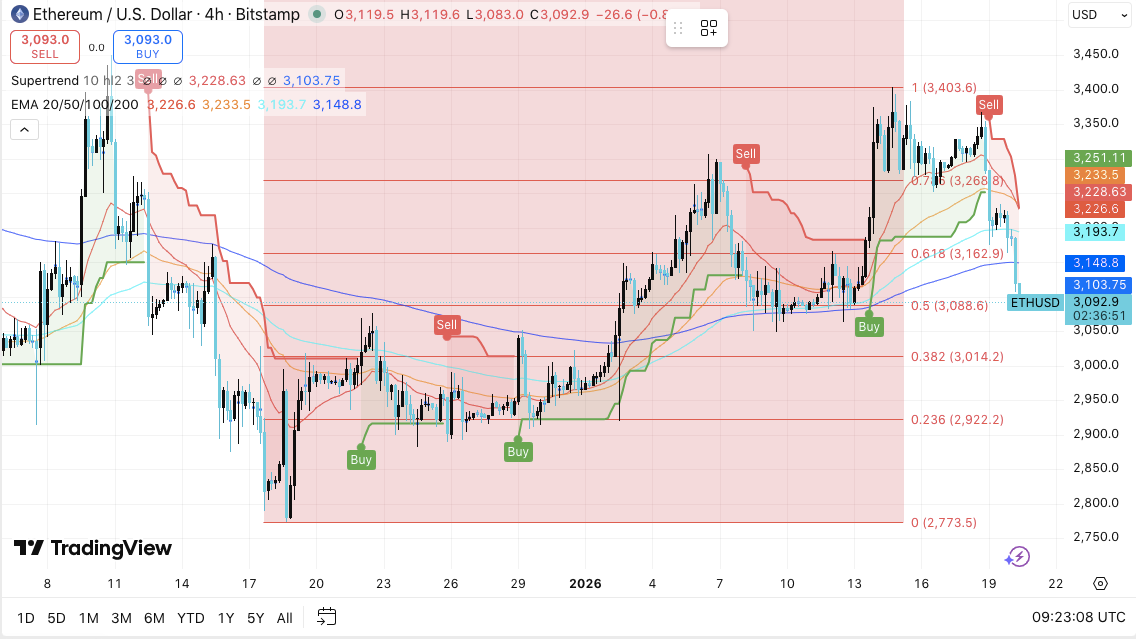

Ethereum Price Prediction: ETH Cooldown Continues as Leverage Eases to $40.3B

CoinEdition·2026/01/20 11:18

Ethiopia Plans State-Backed Bitcoin Mining Using Hydropower

Cryptotale·2026/01/20 11:15

Hong Kong Securities Group Opposes Stricter Crypto Licensing Rules for Asset Managers.

Coinspeaker·2026/01/20 11:15

Yield trading platform Pendle debuts new token to boost user capital efficiency

101 finance·2026/01/20 11:06

Cardano Sentiment Rallies After Hoskinson Comments on Ripple and Regulation

CoinEdition·2026/01/20 11:06

BofA Survey Reveals Investors Are Not Ready for a Market Downturn

101 finance·2026/01/20 10:57

Treasury yields climb to their highest levels in four months following a selloff in Japan

101 finance·2026/01/20 10:48

Euro boosted by strong foreign inflows – NOMURA

101 finance·2026/01/20 10:45

Bitcoin Institutional Demand Very Strong Despite Price Crash: CryptoQuant

Coinspeaker·2026/01/20 10:42

Flash

11:17

Portuguese regulators have ordered the prediction market Polymarket to cease operations in the country.PANews, January 20 — According to CoinDesk, the Portuguese gambling regulator SRIJ has ordered the blockchain-based prediction market Polymarket to cease operations in the country within 48 hours, after bets on the outcome of the January 18 presidential election on the platform exceeded 103 million euros (approximately $120 million). The regulator pointed out that Polymarket does not hold a Portuguese gambling license, and that the country's laws prohibit betting on the outcomes of real-world events such as politics, only allowing bets on sports, casino games, and horse racing. Currently, Polymarket remains accessible in Portugal, but the country's regulator may soon require internet service providers to block it.

11:15

U.S. Treasury yields reach highest level since September last yearMedium- and long-term US Treasury yields have risen as the Japanese bond market crash impacts global markets. The 30-year US Treasury yield increased by more than 0.09 percentage points to above 4.93%, while the 10-year US Treasury yield rose to 4.3%, both reaching their highest intraday levels since September 3 of last year.

11:15

Analysis: As the 10-year US Treasury yield rises to 4.27%, risk assets such as bitcoin and stocks come under pressurePANews reported on January 20, citing CoinDesk analysis, that the yield on the 10-year U.S. Treasury bond, the global benchmark for borrowing costs, has climbed to 4.27%, reaching a four-month high and putting pressure on risk assets such as bitcoin and stocks. The rising Treasury yields are increasing the cost of credit for mortgages, corporate loans, and more, thereby tightening financial conditions and potentially dampening investors' appetite for high-risk assets. The bitcoin price has dropped more than 1.5% since the start of the Asian session, to around $91,000, while Nasdaq index futures have fallen by more than 1.6%. Analysts believe that a potential catalyst for this yield increase is President Trump's threat to impose tariffs on Europe in response to efforts to acquire Greenland, which has sparked concerns in the market that Europe might sell off its $12.6 trillion in U.S. assets (including Treasuries). However, analysts point out that such retaliatory selling would be difficult to implement, as most of these assets are held by private investors rather than government funds.

News