News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.26)|SIGN, and JUP are set for large token unlocks this week; crypto market long liquidations reached $612 million; a Spark lending whale sold 11,190 ETH2Bitget UEX Daily | EU Suspends Tariffs on US; Gold Hits Record High Breaking $5000, Silver Breaks $100; Rieder Top Fed Contender (January 26, 2026)3a16z-backed Entropy shuts down, promises investors refunds

IonQ buys SkyWater for $1.8 billion to secure domestic chip manufacturing for quantum computers

Cointelegraph·2026/01/26 13:15

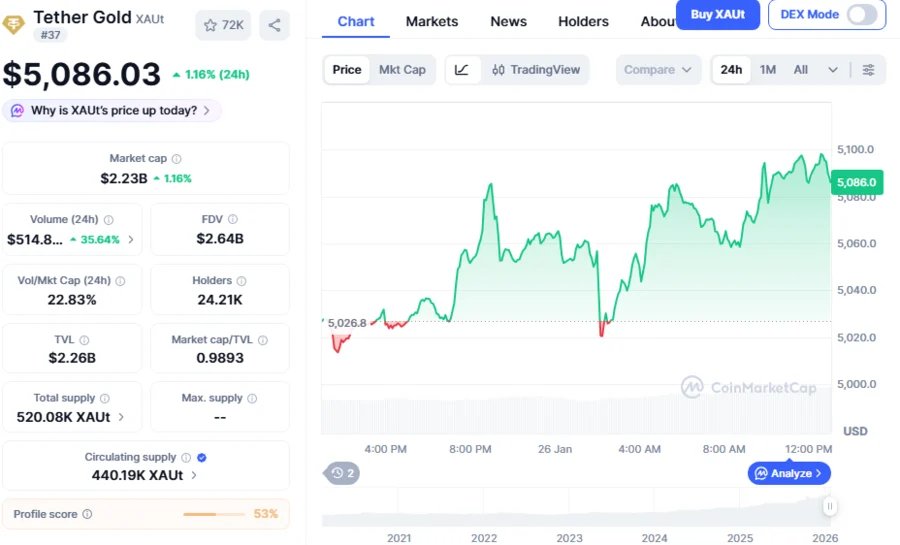

Whale Dumps ETH, Buys 7,546 XAUT Tokens Worth $36.04 Million Amid Craze for Digital Gold for Safe Haven

BlockchainReporter·2026/01/26 13:12

Crypto liquidations surge to $750 million as markets tumble over the weekend

101 finance·2026/01/26 13:12

Bitcoin Kicks Off the Week on Unstable Footing Amid Ongoing Uncertainty

101 finance·2026/01/26 12:54

Crypto Assets Hit Undervalued Levels: Here Are Top Coins to Consider

CoinEdition·2026/01/26 12:51

Moonn.Fun Taps LinkLayerAI to Advance Data-Led Agents for Meme Ecosystems

BlockchainReporter·2026/01/26 12:45

Ripple signs MOU with Riyad Bank’s innovation arm for blockchain solutions

Cointelegraph·2026/01/26 12:45

South Korea postpones digital asset law over stablecoin, exchange cap disputes

Cointelegraph·2026/01/26 12:36

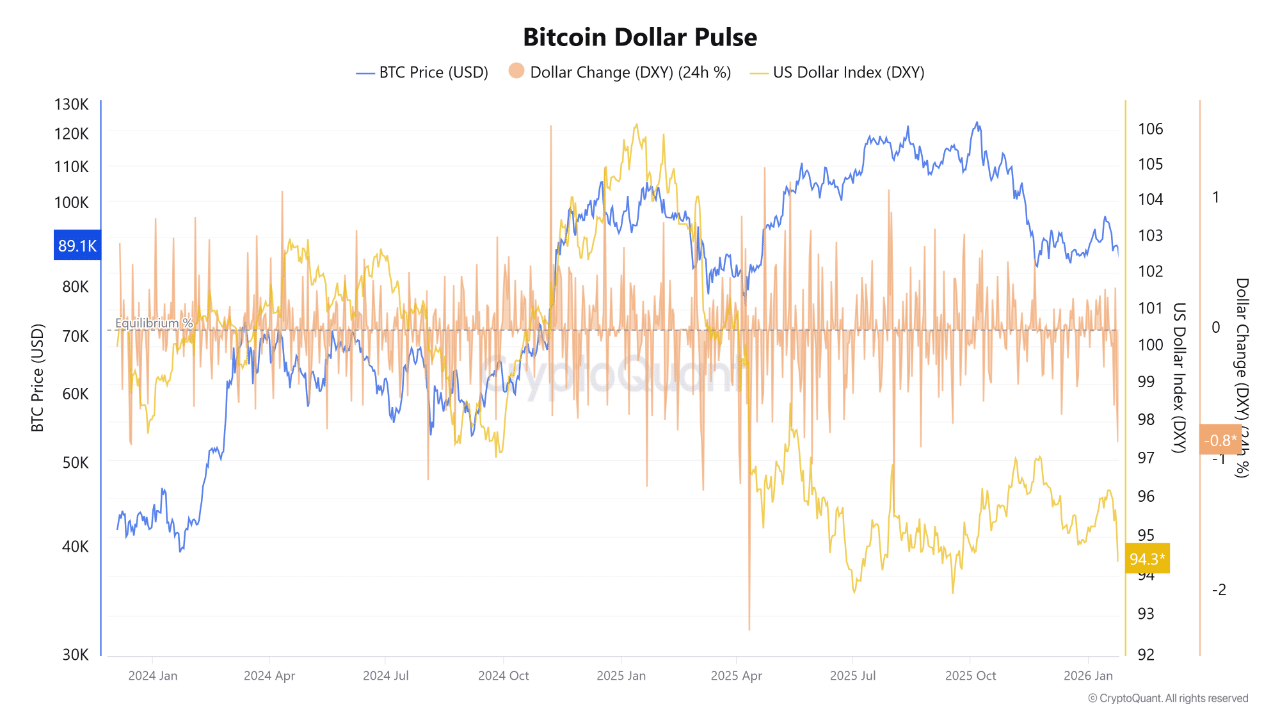

Dollar Is Weak, but Why Is Bitcoin Lagging?

Coinspeaker·2026/01/26 12:36

Gold price update for Monday, January 26: Gold surpasses $5,000 at market open for the first time

101 finance·2026/01/26 12:21

Flash

13:11

Nvidia and CoreWeave strengthen cooperation to accelerate AI factory constructionGlonghui, January 26|Nvidia and AI cloud computing company CoreWeave announced an expansion of their long-term complementary partnership to help CoreWeave accelerate the construction of AI factories with a total capacity of over 5 gigawatts by 2030, thereby promoting the large-scale application of artificial intelligence globally. In addition, Nvidia has invested $2 billion to purchase CoreWeave's Class A common stock at a price of $87.2 per share. This investment reflects Nvidia's confidence in CoreWeave as a cloud platform built on Nvidia infrastructure, as well as in its business, team, and growth strategy. Nvidia CEO Jensen Huang stated that artificial intelligence is entering the next frontier and is driving the largest infrastructure buildout in human history. CoreWeave's deep expertise in AI factories, platform software, and unparalleled execution speed have been recognized in the industry. We are working together to meet the huge market demand for Nvidia AI factories.

13:05

Strategy acquires another 2,932 bitcoins, bringing total holdings to 712,647 bitcoinsPANews reported on January 26 that Strategy recently increased its holdings by acquiring 2,932 BTC at an average price of approximately $90,061 per coin, with a total amount of about $264.1 million. As of January 25, 2026, Strategy holds a total of 712,647 BTC, with a cumulative purchase cost of approximately $54.19 billion and an average purchase price of $76,037.

13:02

Exchange report: The market may continue to fluctuate until a clear catalyst emergesJinse Finance reported that an Alpha report from a certain exchange indicated: Bitcoin's upward attempt was blocked, with the price failing to hold the resistance range of $95,000 to $98,000 and falling back to the established range. After reaching a high of $97,850 in mid-January, Bitcoin retreated by more than 10%, dropping below the year's opening price, with spot buying momentum weakening and ETF outflows intensifying. Derivatives positions have been adjusted in an orderly manner, and volatility responses remain limited to short-term contracts, indicating that market caution is event-driven rather than a broader shift in market mechanisms. In the absence of a recovery in spot and ETF demand, Bitcoin may continue to fluctuate within the range until a clearer demand catalyst emerges.

News