News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Tariff Threats Escalate; Gold and Silver Prices Hit New Highs; US Stock Futures Generally Decline (Jan 20, 2026)2 Bitcoin Market Sentiment Has Changed, Analyst Says: Why 2022 Is the Wrong Comparison3FG Nexus ETH Sale: Nasdaq Giant’s Strategic $8 Million Ethereum Move Reveals Cautious Crypto Stance

NZD/USD surges toward 0.5850 near four-month highs

101 finance·2026/01/20 07:15

The Latest: World Economic Forum begins in Davos for the first time without its founder

101 finance·2026/01/20 07:15

BitGo Set to Go Public: Can the Crypto Asset Custody Giant Replicate the IPO Success Story?

Bitget·2026/01/20 07:12

XRP slips below $2 after failed breakout triggers sharp reversal

101 finance·2026/01/20 07:09

Ethereum Network Activity Surge: Alarming Connection to Address Poisoning Attacks Revealed

Bitcoinworld·2026/01/20 07:06

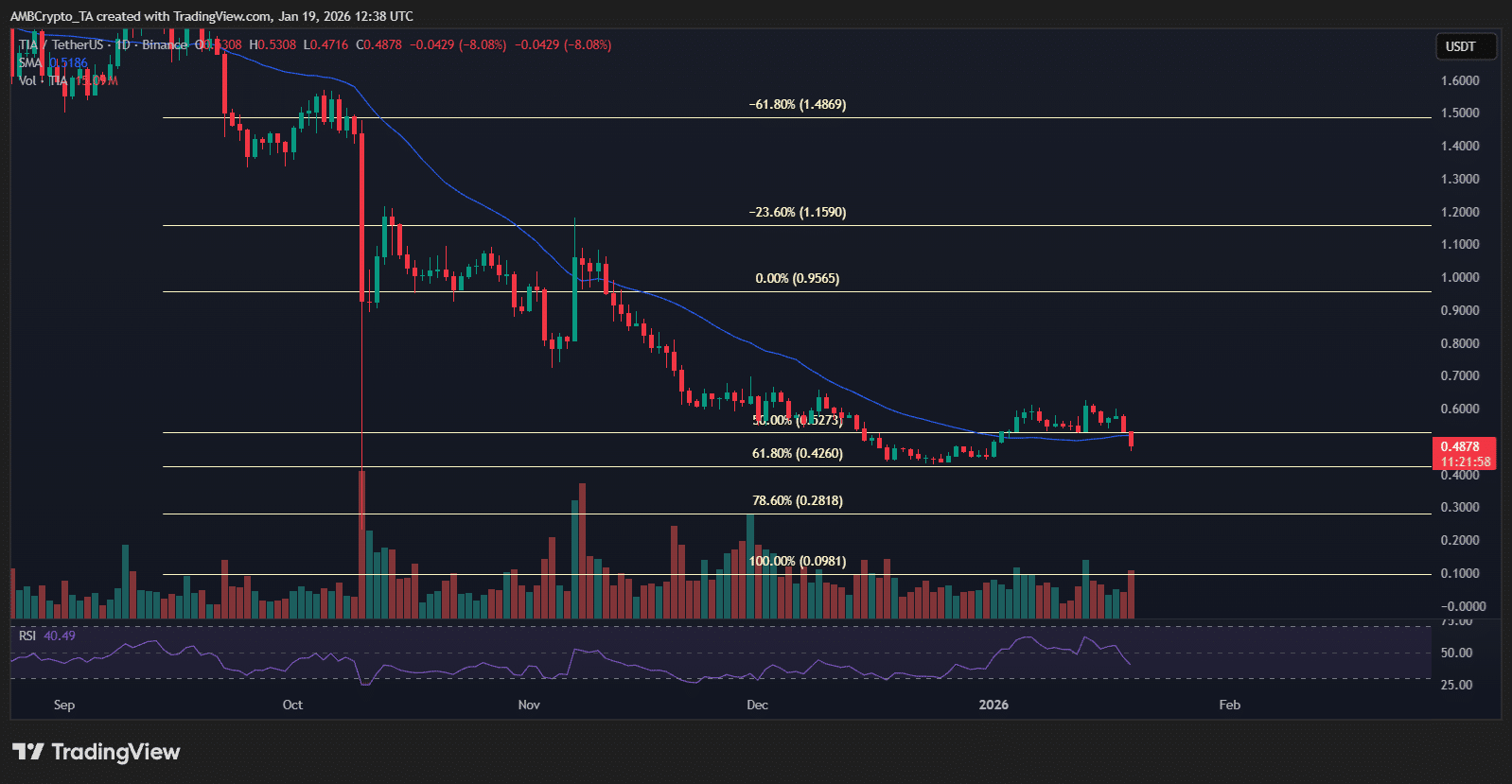

Celestia price analysis: Inside TIA’s 13% sell-off and what comes next

AMBCrypto·2026/01/20 07:03

DeFi Protocol MakinaFi Suffers Devastating $4.1M Ethereum Hack, Funds Drained

Bitcoinworld·2026/01/20 06:33

Pendle Governance Token Revolution: The Strategic Launch of sPENDLE Unlocks Liquid Staking

Bitcoinworld·2026/01/20 06:33

Katana Blockchain Achieves Remarkable $2.8M Revenue Milestone Six Months After Mainnet Launch

Bitcoinworld·2026/01/20 06:33

Flash

07:27

Hong Kong's new crypto asset management regulations face industry resistance, association warns "all-or-nothing" licensing requirements may stifle innovationBlockBeats News, January 20 — Hong Kong securities industry groups have raised objections to the city’s proposed regulatory framework for digital asset management, warning that the related reforms could hinder traditional asset management institutions from entering the cryptocurrency sector. The Hong Kong Securities and Futures Professionals Association, in a submission to regulators on Tuesday, opposed a proposed regulatory adjustment that would remove the existing “minimum exemption threshold” for Type 9 asset managers. According to a report by local law firm JunHe, under the current framework, institutions holding a Type 9 license (covering discretionary portfolio and asset management business) that allocate less than 10% of their fund’s total assets to crypto assets only need to report to regulators and do not need to apply for an additional license upgrade. The Hong Kong Securities and Futures Professionals Association pointed out that the proposed reform would eliminate this threshold, meaning that even a 1% bitcoin exposure would require obtaining a full virtual asset management license. The industry group stated that this “all-or-nothing” regulatory approach lacks the principle of proportionality, arguing that imposing significant compliance costs even when risk exposure is limited could deter traditional management institutions from exploring the crypto asset class. This industry backlash targets a regulatory framework that is already moving at full speed. In December last year, after launching a public consultation in June, Hong Kong authorities released a consultation summary report on the proposed reforms. The Financial Services and the Treasury Bureau and the Securities and Futures Commission of Hong Kong have launched further consultations on introducing a supplementary licensing regime for crypto asset trading, advisory, and management services.

07:26

USD1 Trading Competition Reaches Midway Point: Veteran Meme "EGL1" Surges to the Top, New Coins "BIG DON" and "An" Temporarily Follow BehindBlockBeats News, January 20, according to GMGN monitoring, the BNB Chain 10-day "USD1 Trading Competition" has now reached its fifth day. As the community generally believes that the winning projects are likely to get listed on top exchanges, this event has quickly spawned several new Meme coins using USD1 as a liquidity pool (such as "安", "BIG DON"), whose market caps have soared, while also injecting a new round of market expectations into some older projects (such as EGL1, CDL). The recently popular Meme coin "1" may have also seen its market cap rise due to having a USD1 liquidity pool. The current top three tokens by market cap are as follows: EGL1: Market cap is temporarily reported at $29.7 million, currently priced at approximately $0.0297; BIG DON: Market cap is temporarily reported at $29.5 million, currently priced at approximately $0.0295; 安: Market cap is temporarily reported at $2,700, currently priced at approximately $0.027. It is reported that the top three in this trading competition will receive multiple incentive supports. There are no restrictions on the token creation time for participation. Eligible USD1 trading pairs mainly include: projects created on Four meme using USD1 as the base token, or other Four meme projects with active USD1 liquidity pools. There are currently many Meme coins with the same name in the market. The tokens with the highest liquidity at present are: EGL1: 0xf4b385849f2e817e92bffbfb9aeb48f950ff4444 BIG DON: 0x71429f2e1e243b451b939a2af2b69fa646064444 “安”: 0x126976da699d5ad0815eb134286fc6ca53e04444 BlockBeats reminds users that Meme coin trading is highly volatile, mostly relying on market sentiment and hype, and has no actual value or use case. Investors should be aware of the risks.

07:26

Hong Kong Cryptocurrency Asset Management New Regulation Faces Industry Resistance, Association Warns 'Not Global, Then Local' License Requirement Could Stifle InnovationBlockBeats News, January 20th - The Hong Kong securities industry group has raised concerns about the city's proposed digital asset management regulatory framework, warning that the related reforms could hinder traditional asset management institutions from entering the cryptocurrency space.

The Hong Kong Securities and Futures Professional Association expressed opposition in a submission to regulators on Tuesday to a proposed regulatory adjustment that would eliminate the existing "minimum exemption threshold" for Type 9 asset managers. Under the current framework, institutions holding a Type 9 license (covering discretionary investment portfolio and asset management businesses) that allocate less than 10% of the total fund assets to crypto assets only need to report to the regulator without having to apply for an additional license upgrade, according to a report by the local law firm King & Wood Mallesons.

The Hong Kong Securities and Futures Professional Association pointed out that the proposed reform would remove this threshold, meaning that even allocating just 1% to Bitcoin exposure would require obtaining a full virtual asset management license. The industry group stated that this "all or nothing" regulatory approach lacks a proportionality principle, believing that even in cases of limited risk exposure, it would still incur substantial compliance costs, potentially hindering traditional management institutions from exploring the cryptocurrency asset class.

The industry backlash this time is aimed at a regulatory framework that is already fast-tracked. In December of last year, after launching a public consultation in June, the Hong Kong authorities released a consultation summary report on the proposed reforms. The Hong Kong Financial Services and the Treasury Bureau and the Securities and Futures Commission have further consulted on the introduction of a supplementary licensing regime for cryptocurrency trading, advisory, and management services.

Trending news

MoreNews