News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Tariff Threats Escalate; Gold and Silver Prices Hit New Highs; US Stock Futures Generally Decline (Jan 20, 2026)2BitGo IPO on the Brink: Can the Crypto Custody Giant Recreate Circle's Epic Surge?3FG Nexus ETH Sale: Nasdaq Giant’s Strategic $8 Million Ethereum Move Reveals Cautious Crypto Stance

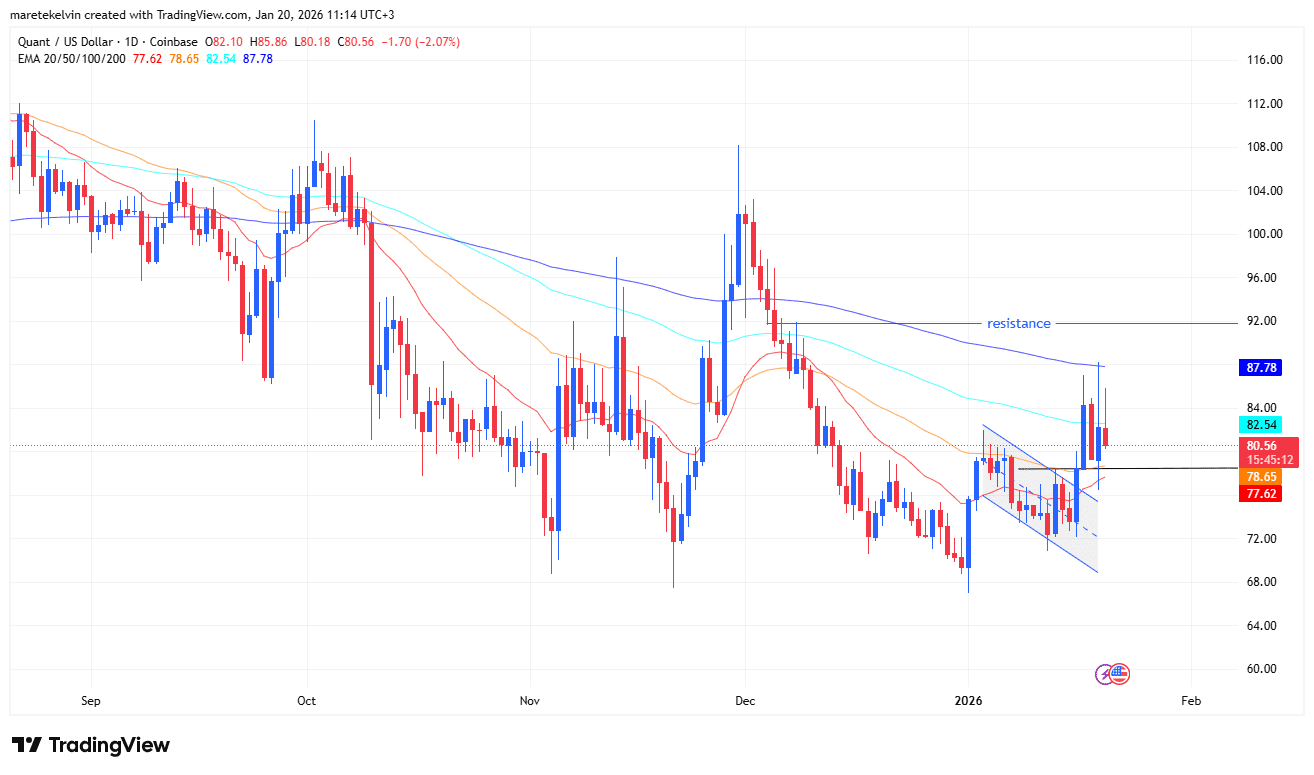

Quant: Are long-term holders positioning for a larger move? Assessing…

AMBCrypto·2026/01/20 11:33

Cardano’s market sentiment turns bearish after Hoskinson’s CLARITY Act intervention

Cointelegraph·2026/01/20 11:30

US IT hardware stocks fall as Morgan Stanley turns cautious on sector

101 finance·2026/01/20 11:30

USD: US-EU trade disputes spark risk aversion in markets – BBH

101 finance·2026/01/20 11:27

US Dollar weakens amid Greenland tariff uncertainty – MUFG

101 finance·2026/01/20 11:27

Disney succession: A look inside the hunt for Bob Iger's successor as CEO

101 finance·2026/01/20 11:21

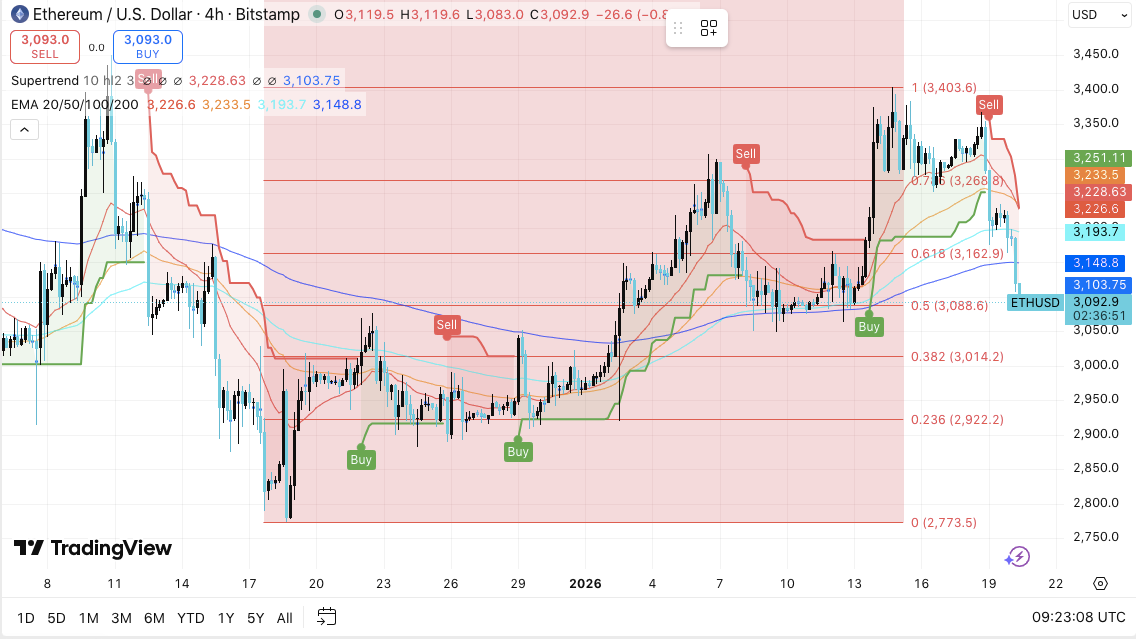

Ethereum Price Prediction: ETH Cooldown Continues as Leverage Eases to $40.3B

CoinEdition·2026/01/20 11:18

Ethiopia Plans State-Backed Bitcoin Mining Using Hydropower

Cryptotale·2026/01/20 11:15

Hong Kong Securities Group Opposes Stricter Crypto Licensing Rules for Asset Managers.

Coinspeaker·2026/01/20 11:15

Yield trading platform Pendle debuts new token to boost user capital efficiency

101 finance·2026/01/20 11:06

Flash

11:42

BlackRock's PFF ETF now holds $380 million worth of Strategy preferred sharesAccording to Odaily, Stretch (STRC), a perpetual preferred stock under the bitcoin treasury company Strategy, has become the fourth largest holding of the BlackRock iShares Preferred and Income Securities ETF (PPF ETF), with an allocation of $210 million. The ETF also holds several other Strategy preferred stocks, with a total value of approximately $380 million, including: 1. An allocation of $97.5 million and a weight of 0.69% in Strife (STRF); 2. An allocation of $90 million and a weight of 0.64% in MSTR common stock; 3. An allocation of $73 million and a weight of 0.51% in Stride (STRD). (CoinDesk)

11:28

Analysis: Multiple indicators turn bullish simultaneously, $90,000 becomes the dividing line between bulls and bears for BitcoinAccording to Odaily, Bitcoin has been oscillating above $90,000, with multiple on-chain and market sentiment indicators warming up in sync, releasing potential "buy" signals. The market's focus is on whether this key support level can remain effective. On the on-chain side, the Hash Ribbons indicator shows that the miner capitulation phase is gradually coming to an end and is beginning to transition into a hash rate recovery zone. This indicator is based on the 30-day and 60-day moving averages of the network's total hash rate. Historically, it has often sent positive signals after miner selling pressure has been released and before a new price rally begins. Capriole Investments pointed out that the current price range is more suitable for long-term allocation. On-Chain Mind also stated that this is one of the strongest Hash Ribbons signals on record, which usually means forced selling is decreasing. In terms of sentiment indicators, the Fear and Greed Index has shown structural improvement. CryptoQuant data shows that its 30-day moving average has crossed above the 90-day moving average, forming a classic "golden cross." This pattern often appears after the market has experienced a prolonged period of stagnation and price compression, and historically has been followed by a rebound in the subsequent weeks. From a technical perspective, $90,000 is seen as the core battleground between bulls and bears. BTC is currently trading in the $90,000 to $92,000 range, which coincides with the 4-hour 200 moving average and a key weekly support level. Analysts believe that as long as this level is maintained, the bullish structure remains intact; if the weekly close falls below $90,000, the price may retrace to the $80,000 to $85,000 range, with further support around $74,500 and the 200-week moving average. Overall, the simultaneous improvement in on-chain data, sentiment signals, and technical patterns makes $90,000 a critical threshold for determining Bitcoin's short- and medium-term trend.

11:28

Analysis: Tariff news triggers $850 million in long liquidations in the crypto market on Monday, but considered a healthy correctionPANews, January 20 – According to Wintermute market analysis, bitcoin recently broke through the $95,000 resistance level and briefly touched $98,000, driven by strong ETF inflows and moderate inflation data. However, on Monday, news of Trump imposing tariffs on Europe triggered $850 million in long liquidations, causing the price to quickly fall back to around $92,000. This rally was mainly driven by three factors: significant ETF capital inflows (with a single-day net inflow of $760 million last Tuesday and $1.4 billion for the whole week), supportive inflation data (core CPI rose 2.6% year-on-year, the lowest since March 2021), and bitcoin’s catch-up trade against hard assets such as gold. However, on Monday, Trump’s announcement of tariffs on eight European countries put pressure on risk assets across the board, leading to a rapid correction in the crypto market. The report believes that although the liquidations were intense, leverage was quickly cleared without triggering a market spiral, making it a healthy adjustment. Looking ahead to this week, the market’s focus will be on the Davos Forum, the EU emergency summit, and the core PCE data to be released on Friday. If bitcoin can hold above $90,000 and ETF inflows remain positive, the breakout trend will remain valid; if it falls below this level, it may return to the consolidation range seen since last November. The report believes that current buying interest remains solid, with the key being whether the tariff threat will turn into actual policy. At present, the market tends to view it as “political noise.”

News