News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | U.S. Shutdown Crisis Averted; Iran Tensions Boost Oil; Gold Rebounds Amid Microsoft Earnings Split (January 30, 2026)2Bitcoin Plunge Could Get Much Worse as Death Cross Gains Power3 Crypto Market Today Turns Red But LTH Data Signals Structural Stability

Cotton Ends Lower on Thursday

101 finance·2026/01/30 02:30

Majority of Saks OFF 5TH locations set to shut down following bankruptcy

101 finance·2026/01/30 02:18

How Ethos, supported by Sequoia, made it to the public market as competitors lagged behind

101 finance·2026/01/30 02:09

Sandisk forecasts profit surge, secures supply deal as AI fuels storage demand

101 finance·2026/01/30 01:54

How Ethos, supported by Sequoia, made it to the public market as competitors lagged behind

101 finance·2026/01/30 01:39

Altcoin Season Index Stagnates at 32, Revealing a Cautious Crypto Market

Bitcoinworld·2026/01/30 01:21

Dollar set for weekly decline amid escalating global tensions

101 finance·2026/01/30 01:15

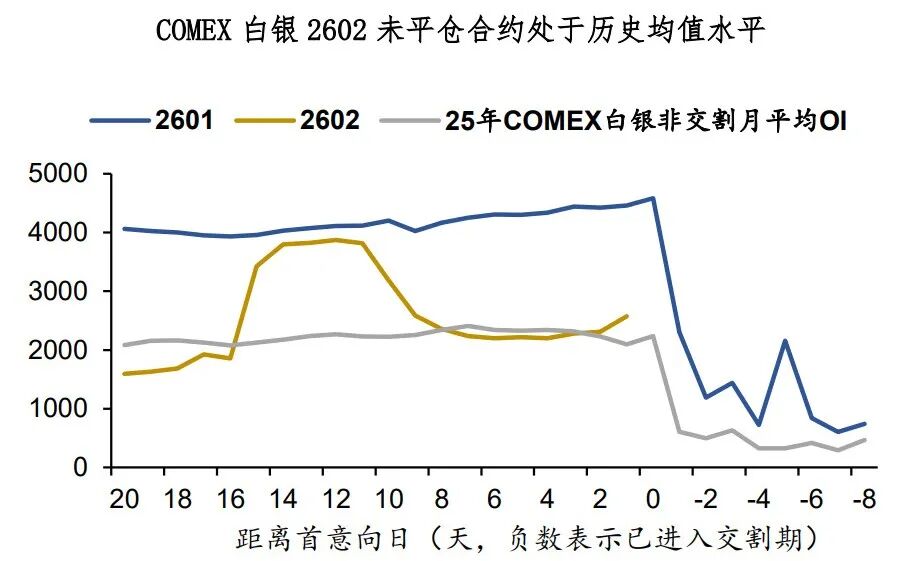

Silver: The Bull Market Needs a Breather

BFC汇谈·2026/01/30 01:02

Producer Price Indices, Australia, December 2025

101 finance·2026/01/30 00:33

Optimism votes to approve highly contested OP buyback program

Cointelegraph·2026/01/30 00:15

Flash

03:00

Eugene: Has re-entered the market and deployed positions, with a stop loss set below $80,000.BlockBeats News, January 30, trader Eugene Ng Ah Sio posted on his personal channel, stating, "This morning, I have redeployed a reasonably sized position. The market's recent consecutive blows seem to have washed out even the most steadfast bulls, and there is a clear sense of frustration and capitulation in sentiment (with many also calling for even lower prices). In my view, the risk-reward ratio for going long here is quite attractive, and the stop-loss level is also very clear, set below $80,000. I don't believe that crypto assets will underperform all risk assets in the long run; most likely, we are now at the tail end of this relatively weak phase. It's time to fire again."

03:00

Circle (CRCL): Why Did This Crypto Stock Drop 8% Today?According to CoinWorld, affected by the overall downturn in the cryptocurrency market, the stock price of a certain exchange fell by 8% on Thursday, bitcoin price dropped below $85,000, and spot trading volume also declined. Analysts pointed out that as large institutions such as JPMorgan and Fidelity plan to launch their own stablecoins, market competition is becoming increasingly fierce. Despite the decline in stock price, Wall Street's general rating for CRCL remains "Buy," with a 12-month average target price of $135-138, indicating a potential upside of more than 85%.

02:59

Messari says DePIN is making a strong comeback, entering a previously overlooked $10 billion sector.CoinWorld reported: According to CoinWorld, the DePIN sector has shifted from relying on subsidies to being driven by real income, with a market capitalization reaching $10 billion. Leading projects are trading at 10 to 25 times revenue valuations, and their revenue growth has shown greater resilience than DeFi and public chains during the bear market.

News