News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump's Remarks Boost Gold Prices; S&P Hits Record High; Storage Stocks Shine in Earnings (January 28, 2026)2Crypto products on CME reached record activity at the end of 20253Bitcoin Achieves Remarkable Stability as a Macro Asset, New Analysis Reveals

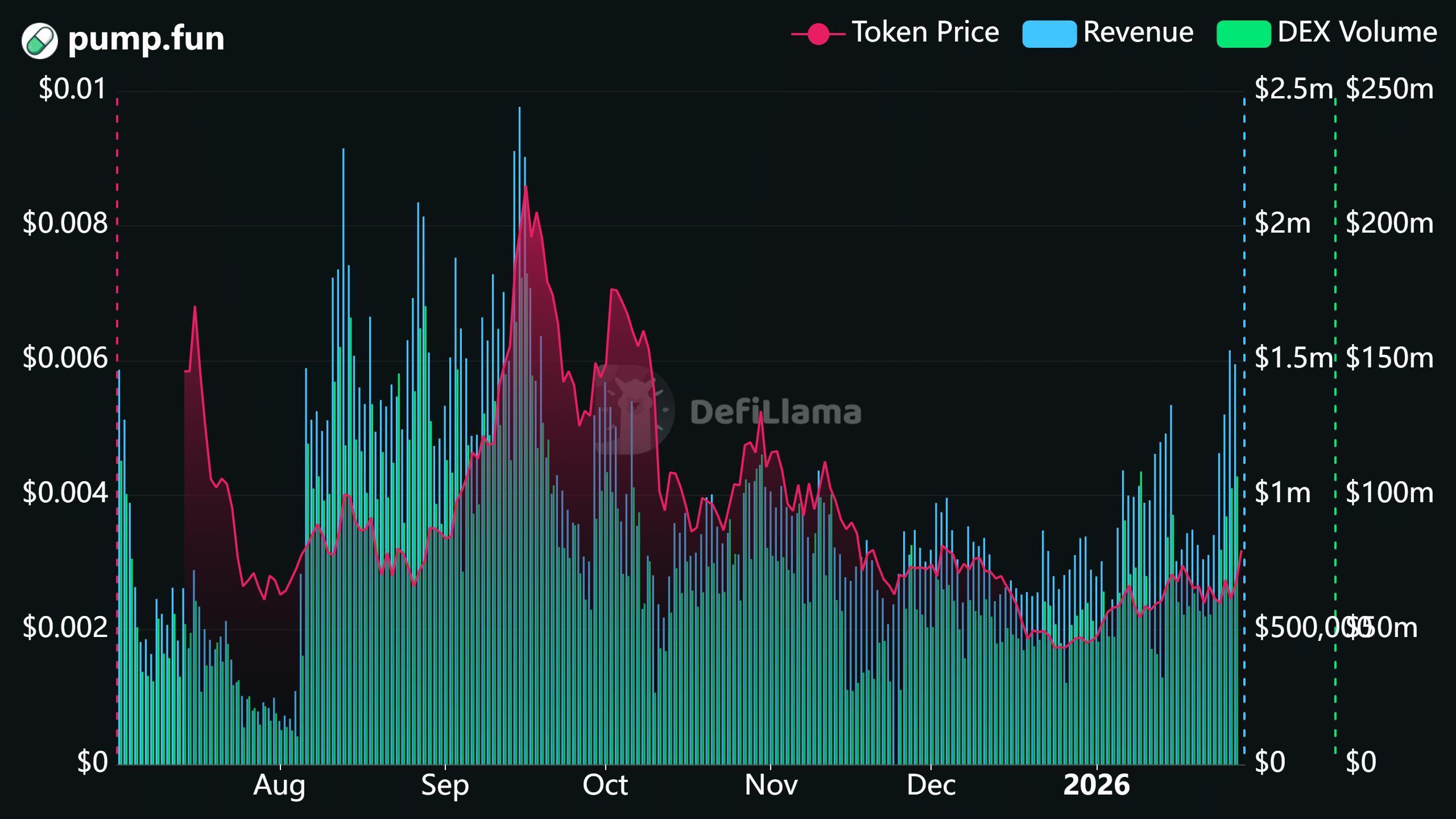

PUMP rallies as Pump.fun usage doubles: Can Solana ride the memecoin wave?

AMBCrypto·2026/01/28 09:03

The Five Most Important Analyst Inquiries from Ally Financial’s Fourth Quarter Earnings Call

101 finance·2026/01/28 09:03

CVB Financial’s Fourth Quarter Earnings Conference: The Five Key Analyst Questions

101 finance·2026/01/28 08:48

The Top 5 Analyst Questions That Stood Out During Fulton Financial’s Q4 Earnings Call

101 finance·2026/01/28 08:48

Dime Community Bancshares Q4 Earnings Call: The Five Most Important Analyst Questions

101 finance·2026/01/28 08:39

5 Essential Analyst Inquiries From BankUnited’s Fourth Quarter Earnings Call

101 finance·2026/01/28 08:39

5 Essential Analyst Inquiries from Pinnacle Financial Partners’ Q4 Earnings Conference Call

101 finance·2026/01/28 08:39

5 Insightful Analyst Inquiries From CACI’s Fourth Quarter Earnings Call

101 finance·2026/01/28 08:36

5 Thought-Provoking Analyst Inquiries During Live Oak Bancshares’s Fourth Quarter Earnings Call

101 finance·2026/01/28 08:36

5 Thought-Provoking Analyst Inquiries From Banner Bank’s Fourth Quarter Earnings Discussion

101 finance·2026/01/28 08:36

Flash

09:14

BNP Paribas: The Indian stock market is unlikely to receive a significant boost from the EU agreementGlonghui, January 28|William Bratton of BNP Paribas stated that the EU-India Free Trade Agreement is unlikely to have a significant impact on the sentiment of the Indian stock market. In a report, he wrote that while the agreement is a positive development, direct exports abroad are not a major driver of Indian corporate profits, thus the impact of the agreement is limited. For improvement to occur, the factors currently driving the market's underperformance need to be addressed. Bratton listed these factors as: a lack of investment themes, India's potential as an alternative to Chinese manufacturing is weakening, and sluggish macroeconomic momentum is dragging down profit expectations. Since July 2025, foreign investors have been net sellers of Indian stocks every month, and Bratton expects this trend to continue as the trade agreement with the United States remains unresolved and uncertainty persists.

09:14

Data: The market cap of the Solana-based meme coin PIPPIN has surpassed $500 million, up over 69% in 24 hours.ChainCatcher news, according to GMGN monitoring, the market capitalization of the Solana-based meme coin PIPPIN has surpassed 500 million USD, currently priced at approximately 0.512 USD, up over 69% in the past 24 hours, with a 24-hour trading volume reaching 50.5 million USD.

09:08

Stablecoin reserves in US Treasuries surpass those of many countriesCoinWorld News: According to CoinWorld, Wu Blockchain tweeted that Bitcoin OG Adam Back pointed out that stablecoin issuers have become important buyers of U.S. Treasury bonds, holding massive reserves of U.S. Treasuries, even surpassing some major countries. He believes that this convenient, low-friction "new business model" is driving a growing willingness in the market to issue more stablecoins.

News