News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Fed Hawkish Stance; Google Bond Oversubscribed; Robinhood Profit Decline (February 11, 2026)2'If individuals around the globe understood what I do': MicroStrategy's Michael Saylor shares a viral statement regarding MSTR shares and Bitcoin potentially reaching $10 million3Robinhood launches public testnet for blockchain built on Arbitrum

Bitcoin Price Prediction: BTC Open Interest Drops as Bears Hold Control

CoinEdition·2026/02/11 11:12

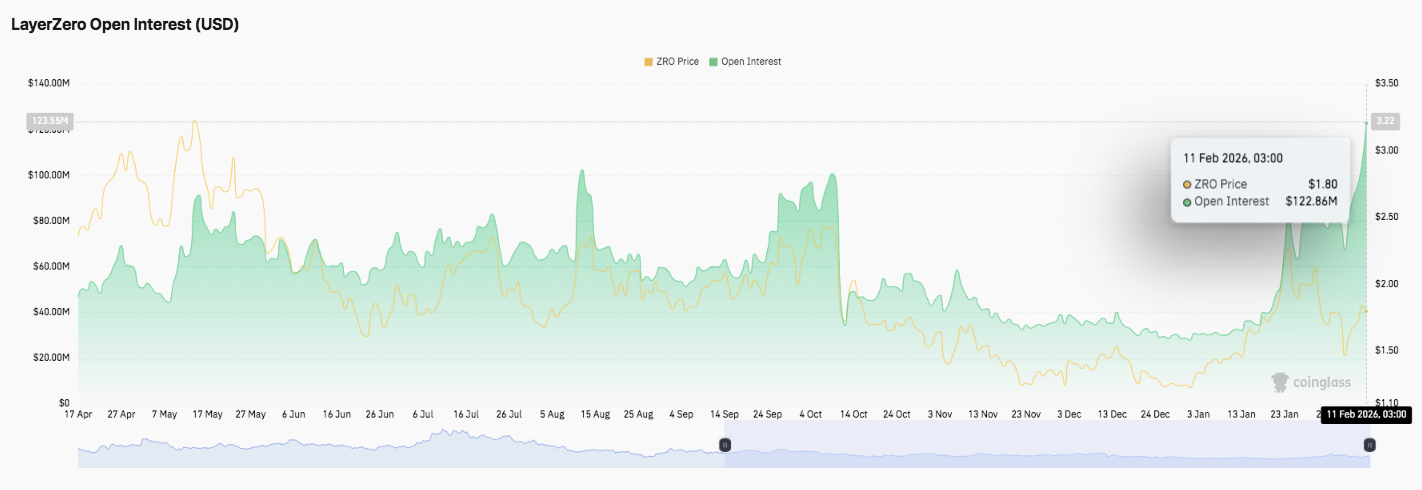

LayerZero (ZRO) Price Prediction: Can LayerZero Clear $2.46 and Extend Rally?

CoinEdition·2026/02/11 11:00

Zcash, BNB, and Sui Experience Biggest Declines Amid Crypto Market Downturn

101 finance·2026/02/11 10:54

BTC Bear Market Warning: Analyst Reveals Ominous Signs of Structural Downturn, Not Correction

Bitcoinworld·2026/02/11 10:51

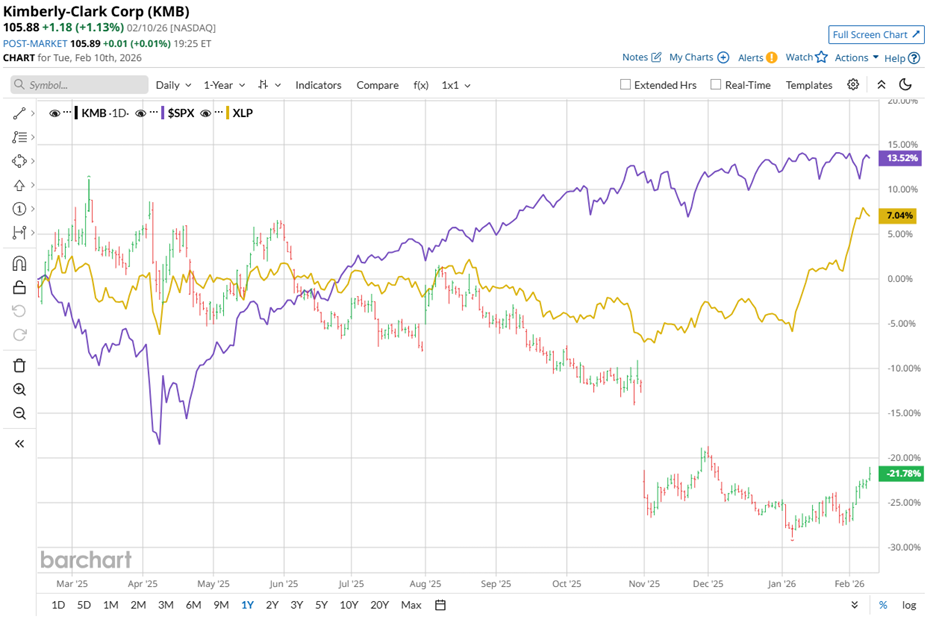

What Price Target Have Wall Street Analysts Set for Kimberly-Clark Shares?

101 finance·2026/02/11 10:48

TotalEnergies Reduces Share Repurchase to Minimum Range Due to Sluggish Oil Prices

101 finance·2026/02/11 10:21

Wall Street powerhouse sets its sights on the London Stock Exchange

101 finance·2026/02/11 10:21

Zand Partners with Ripple to Boost UAE’s Digital Economy with Stablecoins

Cointurk·2026/02/11 10:09

Anthropic executive subtly criticizes OpenAI's spending and advertising strategy

新浪财经·2026/02/11 10:09

Flash

11:12

“Cry if you must, this doesn't even qualify as a masterpiece”: X Million-Word Champion Accused of Rugging in Crypto Circle Stays UnfazedBlockBeats News, February 11th, Bubblemaps released analysis stating that X-Longform Contest million-dollar winner Beaverd had previously used a public address to issue over a dozen Meme tokens and made over $600,000 in profits. Among them, a token named SIAS plummeted to zero shortly after its issuance, and the official SIAS account was subsequently deactivated. Previously, its market value briefly soared to around $6 million, causing significant losses to users. SIAS was not the first Meme token that Beaverd pumped and dumped, as he had issued over a dozen tokens before that also went to zero.

In response to Bubblemaps' tweet, Beaverd replied, "Cry all you want, this can't even be considered one of my top five masterpieces."

Earlier on February 4th, the X platform officially announced the results of the Long-Form Content Creation Contest, with the million-dollar grand prize going to Beaverd (@beaverd). His winning entry was titled "Deloitte, a $740 Billion Cancer, Has Spread Across America," discussing the role of a major government consulting firm in federal and state IT systems. The article garnered 44.71 million views, 29,000 likes, and 7,700 retweets.

11:07

The transaction price structure shows that QXO Inc will pay $2 billion in cash and issue 13.2 million common shares to the seller.It is worth noting that QXO Inc has reserved a special right in the agreement to repurchase these shares at a price of $40 per share. This clause provides the listed company with flexibility in its future equity structure, while also reflecting a high level of consensus between both parties regarding the valuation of the target asset. By adopting a payment method that combines cash and equity, the acquirer not only alleviates immediate funding pressure but also effectively controls the risk of equity dilution through the share repurchase mechanism. The repurchase price of $40 per share represents a significant premium over the current market price, demonstrating management’s confidence in the company’s long-term value.

11:06

Humana recently released its performance outlook, projecting that its individual Medicare Advantage membership will see significant expansion in fiscal year 2026, growing by approximately 25% compared to fiscal year 2025.This growth expectation highlights the company's continued momentum in the U.S. government Medicare Advantage program sector.

Trending news

MoreHumana recently released its performance outlook, projecting that its individual Medicare Advantage membership will see significant expansion in fiscal year 2026, growing by approximately 25% compared to fiscal year 2025.

Fed to hold rates through May, but Warsh may be too loose with policy, economists say: Reuters Poll

News