News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Macro headwinds test Bitcoin price as $70K crumbles amid US market volatility2Trump filling Democratic seats at SEC, CFTC could advance crypto bill talks, TD Cowen says3Bitcoin price ignores $168M Strategy buy, and falls as Iran tensions escalate

Dollar bearishness clouds Bitcoin inverse bet

Grafa·2026/02/19 01:54

Bausch Health (BHC) Q4 Earnings Lag Estimates

Finviz·2026/02/19 01:24

Tenaris (TS) Reports Q4 Earnings: What Key Metrics Have to Say

Finviz·2026/02/19 01:03

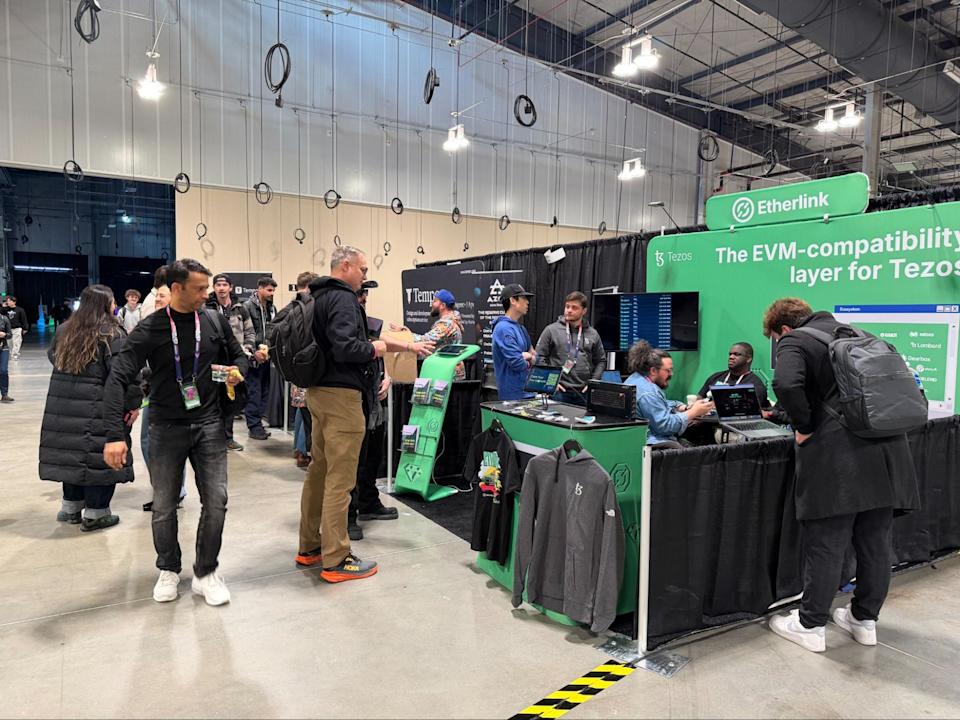

ETH Denver 2026 Opens With Builder Energy Despite Crypto Slump

101 finance·2026/02/19 00:48

Mahindra Selects Mobileye's (MBLY) EyeQ6 ADAS for Future Vehicle Lineup

Finviz·2026/02/19 00:45

TD Cowen Cautious on Amicus Therapeutics (FOLD) Despite Positive 2025 Revenue Projections

Finviz·2026/02/19 00:42

Analysts Bullish on Vera Therapeutics (VERA) Amid New Commercial Chief Appointment

Finviz·2026/02/19 00:42

Kadant (KAI) Surpasses Q4 Earnings and Revenue Estimates

Finviz·2026/02/19 00:27

Flash

02:31

An address sold 886.31 WBTC worth $58.53 million.According to Odaily, on-chain analyst Ai Yi has monitored that a new address (0x44f...8C91A) sold 886.31 WBTC on-chain in the past 5 hours, worth 58.53 millions USD, with an average selling price of 66,044.99 USD. The related funds were bridged via Defiway six months ago and were consolidated from dozens of addresses and sold six hours ago.

02:21

Institution: The average annual salary of Samsung Electronics employees increased by nearly 20% last year, reaching 15.5 million KRW.Gelonghui, February 19th|A survey report released on Thursday shows that, driven by the artificial intelligence boom, the average annual salary of Samsung Electronics employees will increase by nearly 20% in 2025, while the total number of employees will slightly decrease. According to a report released by the Korea CXO Research Institute, the average annual salary of Samsung Electronics employees (excluding formal executives) is about 15.5 million Korean won (approximately $106,000), a 19.2% increase from 13 million Korean won in 2024. The survey results are based on an analysis of the company's employee expenditure and the number of employees participating in the national pension plan.

02:21

Fed Minutes Signal First Interest Rate Hike Soon, Significant Division Within Committee on Rate PathBlockBeats News, on February 19, Wednesday, the minutes of the meeting held on January 27-28 revealed that the Federal Open Market Committee (FOMC) decided last month to maintain the benchmark interest rate in the 3.50%-3.75% range, a decision that received support from "almost all" policymakers. However, the subsequent views expressed by various parties presented a two-sided picture: some officials were optimistic about the surge in productivity brought about by artificial intelligence and the decrease in inflation, while others expressed concerns that AI investment is bringing financial risks based on rising asset valuations and participation from the "opaque private market."

The minutes noted: "Some participants...anticipated that the acceleration in productivity growth associated with technological or regulatory developments would exert downward pressure on overall inflation. However, most participants cautioned that the push toward the Committee's 2% inflation goal might be slower and more uneven than widely anticipated, and they judged that the risks of inflation persisting above the Committee's target were important."

The minutes stated that given that AI is seen as having both huge potential, risks, and uncertainties, the Fed's decision last month to pause monetary easing was appropriate to assess the current state of the economy after cutting rates by 75 basis points last year.

Only a "few" policymakers supported further action at the meeting. Fed Governors Christopher Waller and Stephen Miran both dissented, advocating for rate cuts, citing concerns about potential weakness in the labor market. In addition, the opinions of the other 17 officials were also divided. For example, for the first time recently mentioned in the minutes, if inflation continues to exceed the Fed's 2% target, a rate hike may be considered. Current inflation levels are about 1 percentage point above that target.

After the minutes were released, investors insisted on betting that the Fed would keep the policy rate unchanged until the meeting on June 16-17—a meeting expected to be Wash's first after taking office, with market expectations for rate cuts of 25 basis points at this meeting and the September meeting. In contrast, market pricing shows that there is no possibility of a rate hike in the foreseeable future. (Wall Street CN)

News