News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin’s post-quantum plan BIP-360 gains traction, but will it reverse market sell-off?2Bitcoin holders are being tested as inflation fades: Pompliano3 Bitcoin Price Bottom Not In Yet? Data Signals More Pain Ahead

Bitcoin Price Prediction: Can BTC Reclaim $72,000 This Week?

Coinpedia·2026/02/16 04:30

IMF warns stablecoins are just private dollar warehouses

Cryptopolitan·2026/02/16 04:21

BlueScope Targets US Expansion and Increases Returns for Shareholders

101 finance·2026/02/16 03:48

Bitcoin’s Short-Term Holders Signal Market Turning Point as SOPR Nears Key Threshold

Cointurk·2026/02/16 03:42

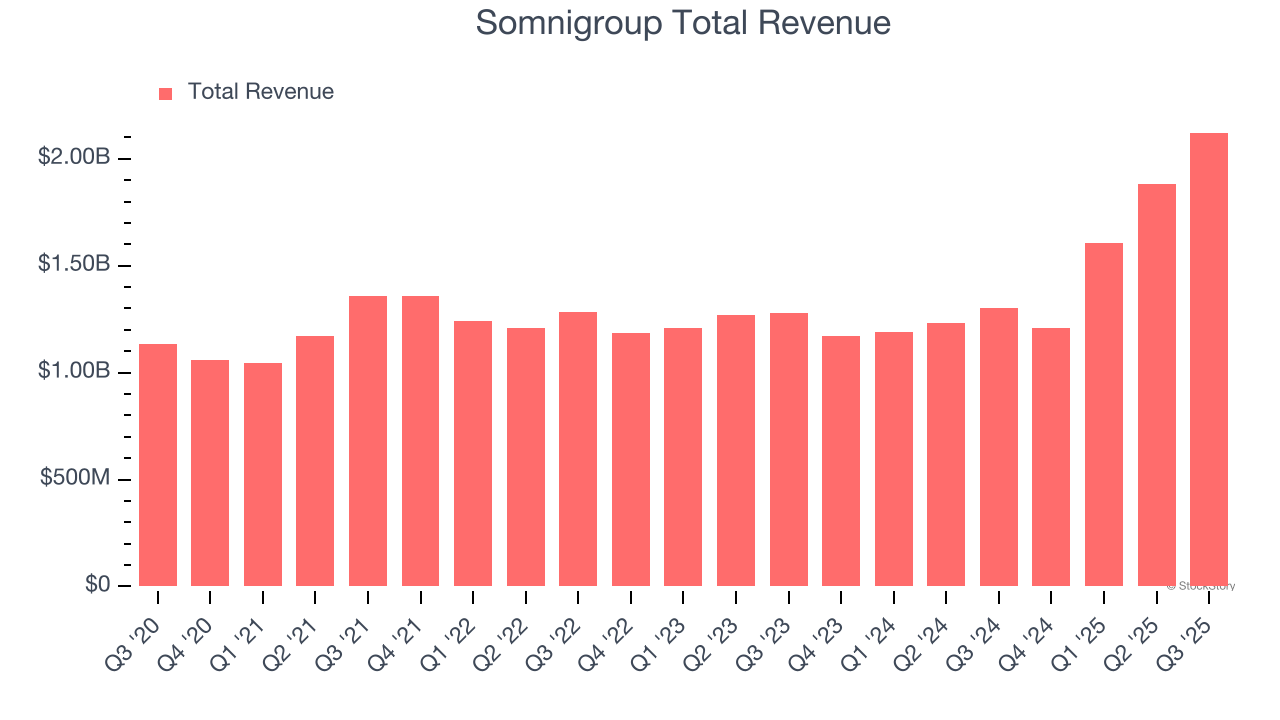

Somnigroup (SGI) Reports Q4: Everything You Need To Know Ahead Of Earnings

Finviz·2026/02/16 03:12

Leidos (LDOS) Q4 Earnings: What To Expect

Finviz·2026/02/16 03:06

Japan bear flips & now bets on yen strength vs dollar, sterling & franc (sees +8% vs. CHF)

101 finance·2026/02/16 03:06

Japan PM Takaichi to hold first meeting with BOJ chief Ueda since election win

101 finance·2026/02/16 03:06

Top Crypto Gainers Today – Pepe and Dogecoin Lead Memecoin Resurgence Amid Market Volatility

BlockchainReporter·2026/02/16 03:00

Flash

04:49

The market cap of AI token VVV on Base has surpassed $530 million, reaching a recent high, with a 24-hour trading volume of $26.6 million.BlockBeats News, on February 16, according to GMGN data, the AI token VVV on the Base chain surged over 34.2% in 24 hours, with its market cap surpassing $530 million to reach a recent high. The current market cap is $510 million, and the 24-hour trading volume is $26.6 million. BlockBeats reminds users that most Meme coins lack real use cases and have significant price volatility. Please invest cautiously.

04:26

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearishBlockBeats News, February 16, according to Coinglass data, Bitcoin continues to trade within a range. The current funding rates on major CEX and DEX platforms indicate a broadly bearish sentiment in the market, with specific funding rates shown in the attached chart. BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain balance between contract prices and the underlying asset prices, typically applied to perpetual contracts. It is a capital exchange mechanism between long and short traders; the trading platform does not collect this fee. It is used to adjust the cost or profit of holding contracts, ensuring that contract prices remain close to the underlying asset prices. When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates a generally bullish market sentiment. When the funding rate is less than 0.005%, it indicates a generally bearish market sentiment.

04:11

This Week's Unlock Schedule: ZRO, ARB, KAITO, and Others to Experience Large One-Time Token UnlockBlockBeats News, February 16th, according to Token Unlocks data, this week ZRO, ARB, KAITO, and others will experience a one-time large token unlock, including:

ZRO will unlock 25.71 million tokens on February 20th, worth approximately $44.99 million, accounting for 5.98% of the circulation;

YZY will unlock 62.5 million tokens on February 17th, worth approximately $20.33 million, accounting for 17.24% of the circulation;

ARB will unlock 92.65 million tokens on February 16th, worth approximately $11 million, accounting for 1.88% of the circulation;

KAITO will unlock 32.6 million tokens on February 20th, worth approximately $10.16 million, accounting for 10.64% of the circulation;

ZK will unlock 173 million tokens on February 16th, worth approximately $3.79 million, accounting for 3.06% of the circulation.

News