News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

A quick overview of new project investment opportunities such as MegaETH, Momentum, and zkPass.

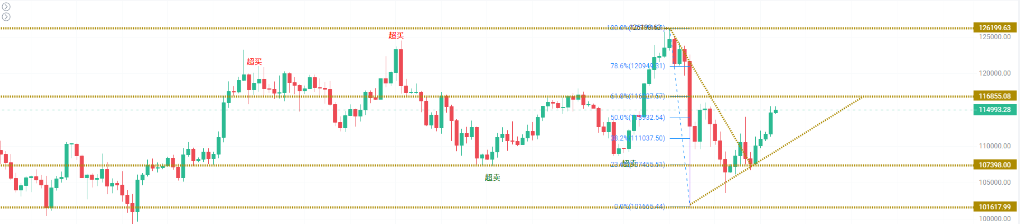

This article analyzes the reasons behind the recent significant surge in the crypto market, mainly attributing it to progress in tariff negotiations between China and the United States, as well as positive signals released by macroeconomic data.

Quick Take Summary is AI generated, newsroom reviewed. A top trader with a 100% win rate expanded his $360M crypto leveraged long. His holdings include 1,683 BTC and 40,305 ETH, showing bullish conviction. Unrealized profit currently stands at $16.9 million and rising. The move reflects renewed market optimism and potential for near-term rallies.References 💰TRADER WITH 100% WIN RATE ADDS MORE LONGS! He's now playing a $360M leveraged LONG with 1,683 $BTC ($194M) at 13x and 40,305 $ETH ($168M) at 5x. His u

- 20:38ETHZilla has sold approximately $40 million worth of ETH for stock buybacksAccording to a report by Jinse Finance, a certain exchange company (Nasdaq: ETHZ) announced that it has sold approximately $40 million worth of Ethereum (ETH) for stock buybacks. Since the sale was executed on October 24, the company has repurchased about 600,000 shares of common stock for approximately $12 million and plans to continue using the remaining funds for further stock buybacks. The company still holds about $400 million in ETH for future strategic planning.

- 20:30Analysis: If the US SEC does not intervene temporarily, Bitwise Solana Staking ETF, as well as LTC and HBAR ETFs, will be listed at the opening tonight (GMT+8).According to Jinse Finance, Bloomberg ETF analyst Eric Balchunas stated in a post that "the New York Stock Exchange (NYSE Arca) has issued an announcement that the Bitwise Solana Staking ETF, Canary Litecoin, and Canary HBAR ETF will begin trading on October 28 (after the US stock market opens in the evening of the 28th, East 8th District time), while Grayscale Solana will undergo a share conversion the following day. Unless there is temporary intervention by the US SEC, the above trades are expected to proceed as scheduled."

- 20:18All three major U.S. stock indexes hit record highs, with Apple's market value approaching $4 trillion.ChainCatcher news, according to Golden Ten Data, U.S. stocks closed higher on Monday, with the Dow Jones up 0.7%, the S&P 500 up 1.2%, and the Nasdaq up 1.86%. All three major indexes reached record highs. Apple (AAPL.O) rose 2.2%, with its market capitalization approaching 4 trillions USD. Tesla (TSLA.O) rose 4%, Qualcomm (QCOM.O) rose 11%. The Nasdaq Golden Dragon China Index closed up 1.58%, XPeng Motors (XPEV.N) rose over 6%, and Baidu (BIDU.O) rose nearly 5%.