News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Cardano Founder Reveals Midnight Launch Plan, Teases New Goodies Every 3 Months

CryptoNewsNet·2025/12/08 15:15

Michael Saylor Bitcoin Outreach Reaches Middle East Funds

CryptoNewsNet·2025/12/08 15:15

Tom Lee's BitMine Immersion Ramps Up Ether Acquisition, Adding $435M of ETH to Treasury

CryptoNewsNet·2025/12/08 15:15

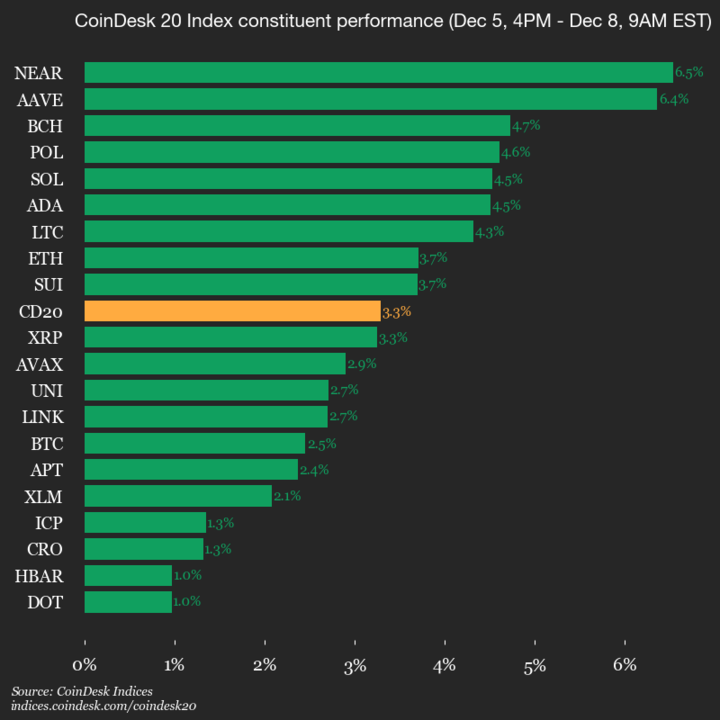

CoinDesk 20 Performance Update: Index Gains 3.3% as All Constituents Trade Higher

CryptoNewsNet·2025/12/08 15:15

HYPE Token Experiences Rapid Growth: Temporary Craze or the Beginning of a Fresh Cryptocurrency Movement?

- Hyperliquid's HYPE token surged 15.50% in 7 days, capturing 72.7% of top DEX perpetual trading volume in 2025. - The HIP-3 upgrade enabled permissionless futures markets via HYPE staking, boosting platform utility and liquidity. - Social media-driven speculation and technical indicators fueled volatility, with price swings between $32.40 and $38.50. - Critics highlight risks of sentiment-driven demand, noting HYPE's FDV of BTC469M relies on sustained DeFi growth and innovation. - Investors face a high-ri

Bitget-RWA·2025/12/08 15:08

White House economic advisor Hassett: Interest rates should continue to be lowered.

Cointime·2025/12/08 14:54

Trump: A single rule executive order on artificial intelligence will be issued this week.

Cointime·2025/12/08 14:54

Hassett: Trump will release a lot of positive economic news.

Cointime·2025/12/08 14:54

Soluna completes $32 million rights issue, pricing in accordance with Nasdaq rules.

Cointime·2025/12/08 14:54

Flash

- 12:00Vitalik Buterin: Ethereum can handle temporary loss of finalityChainCatcher reported that Ethereum co-founder Vitalik Buterin stated on the X platform that occasionally losing finality is not a big deal, as finality is intended to ensure that blocks are not rolled back. If, due to a significant client error, finality is occasionally delayed by several hours, as long as erroneous blocks are not ultimately finalized, this situation is acceptable, and the chain will continue to operate during this period. Computer science PhD Fabrizio Romano Genovese agreed with Vitalik Buterin's view, noting that when finality is lost, Ethereum becomes more like Bitcoin. He explained that Ethereum's finality mechanism works such that when a block receives more than 66% of validator votes, it is "justified," and after two more epochs (64 blocks), the block is "finalized." A spokesperson for Polygon stated that the lack of finality would affect infrastructure that relies on it, such as certain cross-chain or Layer2 bridges, but Polygon will continue to operate normally. However, transfers from Ethereum to sidechains may be delayed, waiting for finality to be restored. AggLayer will also delay transactions from Ethereum to L2 until finality is achieved again.

- 12:00An Ethereum address dormant for 10 years has been activated, containing 850 ETHAccording to ChainCatcher, monitored by Whale Alert, an Ethereum pre-mined address that had been dormant for 10.4 years was just activated. The address contains 850 ETH, currently valued at approximately $2.81 million. These tokens were worth only $263 in 2015, representing a value increase of over 10,000 times.

- 11:44Michael Saylor Speech: Bitcoin Will Reshape the Global Financial System, Countries Should Seize the Opportunity of the Digital Capital RevolutionChainCatcher news, Michael Saylor delivered a keynote speech titled "Digital Capital, Credit, Currency, and Banking" at the Bitcoin MENA conference, focusing on the transformative potential of bitcoin in global finance. Saylor pointed out that U.S. political figures, including Donald Trump, have recently recognized bitcoin as a treasury reserve asset and presented data on the growth of bitcoin treasuries since 2020. He described bitcoin as the "world's digital value carrier," emphasizing its characteristics such as no time limit, no counterparty risk, no event risk, no confiscation risk, no holding fees, high portability, and final settlement within minutes. Through DuPont analysis, Saylor demonstrated bitcoin's superior capital efficiency compared to traditional finance. In his speech, he compared the performance of different asset classes: fiat currency depreciation rate at -1.4%, inflation rate at 7.5%, stock return rate at 12.1%, while bitcoin's annual compound growth rate reached 34.2%. Saylor warned of risks in the traditional system, such as currency depreciation, and positioned bitcoin as a tool to hedge volatility. He firmly stated: "Our purchasing power will exceed that of all sellers in the market, and we will not experience buyer fatigue." He went further: "Our goal is to acquire every bitcoin available on the market." He concluded by calling on countries, especially those in the Middle East and North Africa, to adopt bitcoin as digital capital, credit, and currency, predicting that the process of bitcoinization will accelerate and usher in an era of digital abundance.