News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.26)|SIGN, and JUP are set for large token unlocks this week; crypto market long liquidations reached $612 million; a Spark lending whale sold 11,190 ETH2Bitget UEX Daily | EU Suspends Tariffs on US; Gold Hits Record High Breaking $5000, Silver Breaks $100; Rieder Top Fed Contender (January 26, 2026)3a16z-backed Entropy shuts down, promises investors refunds

Crane (NYSE:CR) Reports Q4 CY2025 Sales Surpassing Expectations

101 finance·2026/01/26 22:15

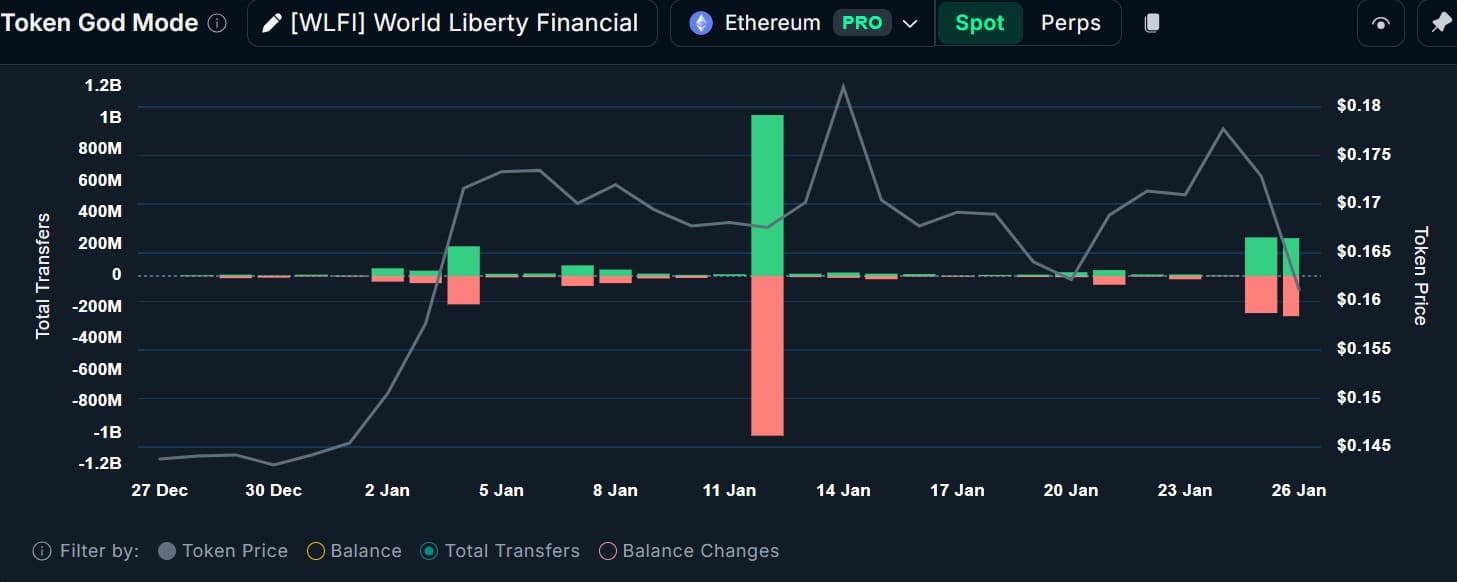

Assessing World Liberty Financial after 235mln WLFI exchange transfer

AMBCrypto·2026/01/26 22:03

Canton Network Welcomes YZi Labs as Super Validator to Scale Institutional Web3 Infrastructure

BlockchainReporter·2026/01/26 22:00

Park National: Fourth Quarter Earnings Overview

101 finance·2026/01/26 21:54

Sanmina (NASDAQ:SANM) Reports Higher Than Expected Q4 CY2025 Revenue, Yet Shares Decline

101 finance·2026/01/26 21:48

NBT: Fourth Quarter Financial Highlights

101 finance·2026/01/26 21:36

Alexandria Real Estate Equities: Fourth Quarter Earnings Overview

101 finance·2026/01/26 21:36

Bitcoin Risk-Off Asset: CryptoQuant CEO Reveals Critical Market Misunderstanding in 2025 Analysis

Bitcoinworld·2026/01/26 21:36

Polymarket Scores Game-Changing Exclusive Licensing Deal with Major League Soccer

Bitcoinworld·2026/01/26 21:36

First Merchants (NASDAQ:FRME) Falls Short of Q4 CY2025 Revenue Projections

101 finance·2026/01/26 21:33

Flash

22:16

Ethereum network transaction fees drop to their lowest level since May 2017Ethereum network transaction fees have recently dropped to their lowest levels since May 2017, indicating a significant decrease in transaction costs. Although specific data was not provided, this change reflects a low-cost state of network activity. The market is currently in a historical low-fee phase. (glassnode)

22:13

The probability that the Federal Reserve will keep interest rates unchanged this week is 97.2%.According to Jinse Finance, CME "FedWatch" shows that the probability of the Federal Reserve cutting interest rates by 25 basis points in January is 2.8%, while the probability of keeping rates unchanged is 97.2%. By March, the cumulative probability of a 25 basis point rate cut is 15.5%, the probability of keeping rates unchanged is 84.1%, and the cumulative probability of a 50 basis point rate cut is 0.4%.

21:48

Hyperliquid HIP-3 DEX open interest reaches all-time high, surpassing $790 millionJinse Finance reported that Hyperliquid stated that a "surge in commodity trading" is driving the open interest of decentralized exchanges deployed based on HIP-3 to surpass $790 million, reaching a record high. Hyperliquid CEO Jeff Yan said that the platform has become the world's "most liquid venue for cryptocurrency price discovery."

News