News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Applies Brakes to Trade War, US Stocks Rebound; Storage Stocks Continue to Rise to New Highs; Musk Pushes for SpaceX Listing in July (January 22, 2026)2Stablecoins Are Quietly Taking Off with Credit Cards3BitGo IPO on the Brink: Can the Crypto Custody Giant Recreate Circle's Epic Surge?

Abbott Laboratories (NYSE:ABT) Falls Short of Q4 CY2025 Revenue Projections, Shares Decline

101 finance·2026/01/22 12:54

After a Record-Breaking Auction, Are U.S. Treasuries Backing Gold or Undermining It?

汇通财经·2026/01/22 12:53

A Shared Sense of Relief

101 finance·2026/01/22 12:48

AI Crypto Coins: DeepSnitch AI Attracts Mass of Traders Looking for a High Upside Amid Short-Term Volatility, TAO and ICP Start Correcting

BlockchainReporter·2026/01/22 12:42

Cadence: Q4 Financial Highlights

101 finance·2026/01/22 12:27

After Trump's U-turn on Greenland, gold price holds above $4,800

汇通财经·2026/01/22 12:26

Revolutionary: Brevis Builds Attention-Based Prediction Market on Monad with Zero-Knowledge Verification

Bitcoinworld·2026/01/22 12:18

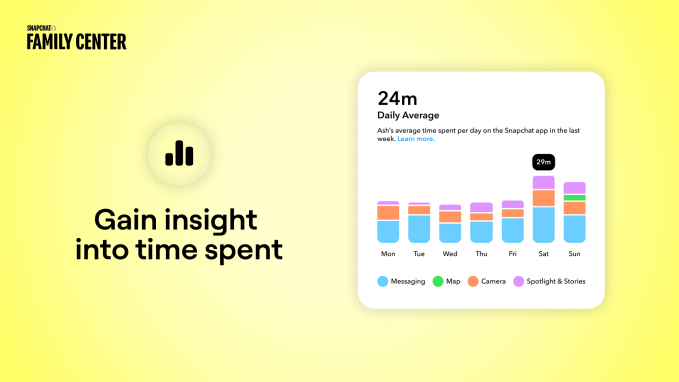

Snapchat gives parents new insights into teens’ screen time and friends

101 finance·2026/01/22 12:15

India's Cyient posts quarterly profit fall on one-off labour code charges

101 finance·2026/01/22 12:12

Flash

12:45

Analysis: Strategy's credit risk has eased as its preferred shares are now worth more than its convertible bondsPANews, January 22 – According to an exchange report, the credit risk of bitcoin treasury company Strategy has eased, as the notional value of its perpetual preferred shares has reached $8.36 billion, exceeding its $8.2 billion in convertible debt. This shift in capital structure towards permanent capital reduces refinancing risk and balance sheet volatility. Convertible bonds introduce refinancing risk at maturity and volatility linked to the share price, whereas perpetual preferred shares do not require principal repayment and pay a fixed dividend, ranking between common equity and debt in priority. The company's preferred share portfolio consists of four instruments, with a total annual dividend of approximately $876 million. In addition, Strategy holds $2.25 billion in reserves to improve dividend coverage and reduce short-term financing risk. The number of outstanding common shares has increased from 76 million in 2020 to over 310 million, which may alleviate future dilution pressure from bond conversions.

12:42

Analysis: Bitcoin has fallen below the 0.75 supply cost baseline quantile and has failed to recover, with selling pressure on the riseAccording to ChainCatcher, market sources indicate that bitcoin has fallen below the 0.75 supply cost-basis quantile and has failed to reclaim this level. The current spot price is now below the cost basis for 75% of the supply, suggesting that selling pressure is increasing. Risk has risen significantly, and unless the price recovers above this level, the downward trend will remain dominant.

12:39

The spot price of Bitcoin is below the cost basis of 75% of its supplyBitcoin has failed to reclaim the 0.75 supply cost basis. Currently, the spot price is below the cost basis for 75% of the supply, indicating increased distribution pressure. Risk levels have risen, and the downward trend is dominant unless this level is reclaimed. (glassnode)

News