Bitcoin halving was 'not priced in' despite recent correction, analyst says

Significant bitcoin value expectations were not priced into the market prior to the halving event, despite the asset’s price dropping by over 7% in the past week, an analyst said.

U.S. inflation still rising

According to the U.S. Bureau of Economic Analysis , inflation rose to 2.7% on an annual basis in March from 2.5% in February, the U.S. Bureau of Economic Analysis reported. The hotter-than-expected inflation reading was released on Friday, exceeding the market expectation of 2.6%.

The core U.S. Personal Consumption Expenditures (PCE) Price Index, which excludes volatile food and energy prices, held steady at 2.8% on an annual basis, surpassing analysts' estimate of also 2.6%.

Barthere pointed out that the 250-day period following the halving has historically been the strongest period for bitcoin returns, compared with the 115 days prior to each event, and for non-having years.

Historically, the period between the halving and 250 days after the event results in higher bitcoin returns. Image: Nansen.

Bitfinex analysts point to on-chain movements by long-term holders distributing supply in the lead-up to the halving, suggesting that some price expectations were already factored into market conditions. However, they believe that current muted market conditions are expected as the market enters into the seasonally slower summer period.

According to Wintermute OTC Trader Jake Ostrovskis, the halving's effect on the price should be viewed from a longer-term perspective. "The halving itself is anticipated to have a longer-term impact rather than be a short-term driver. Heavy call demand at $100,000 in December 2024, and $200,000, in March 2025, suggests this view remains in play," Ostrovskis told The Block.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

POLY may become the biggest rug pull in crypto history

Arthur Hayes: How Do the US Dollar and Chinese Yuan Kill the Bitcoin Cycle?

EMC Labs September Report: Logical Analysis of BTCsh Cycle Initiation, Operation, and Conclusion

Since the start of this cycle, the structure of the crypto market has undergone dramatic changes, making it necessary to reconsider the operating logic and possible conclusion of BTC.

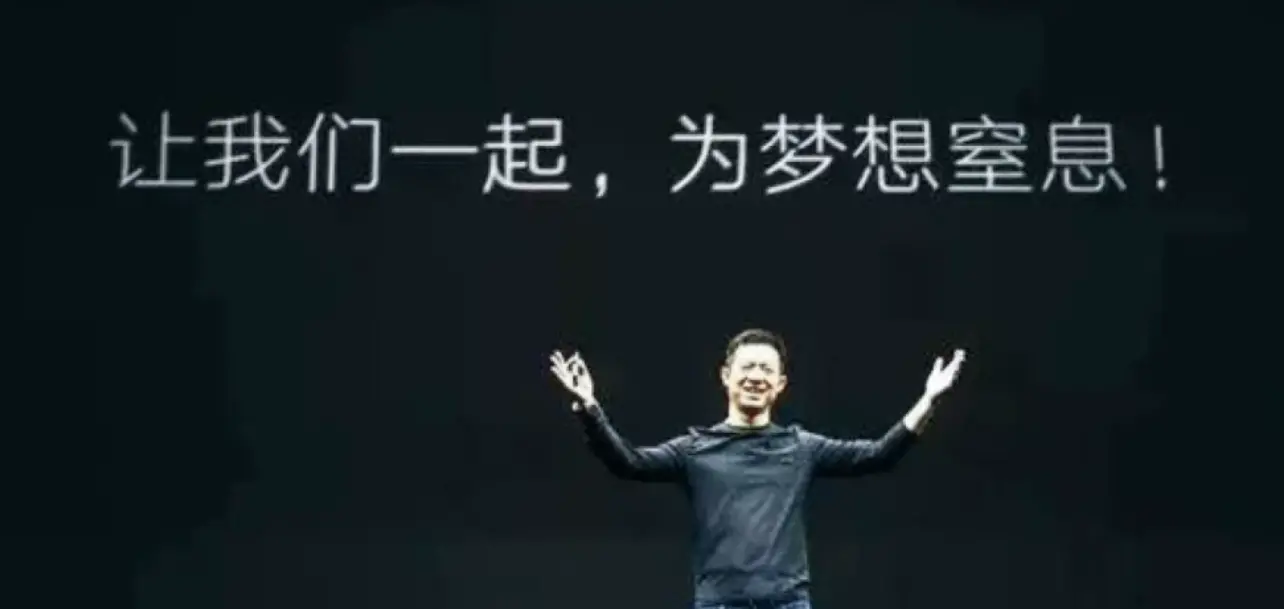

Veteran crypto figure Jia Yueting

The article provides a detailed account of Jia Yueting's business trajectory, from the "ecological integration" era at LeTV to his current "EAI + Crypto dual flywheel" strategy launched in the United States. Through a series of capital operations and his keen grasp of the crypto world, he is once again deeply aligning himself with Web3.