Short-Term Bitcoin Holders Face Massive Capitulation

Bitcoin reached a peak above 124,000 dollars… before collapsing below 115,000 in a few days. This brutal drop was not limited to the price. It triggered a massive capitulation of short-term investors, with billions liquidated at a loss. This rare on-chain shock reveals a deep psychological shift in the market. The bullish sentiment is wavering, and one question arises : is this a simple correction or the beginning of a lasting retreat?

In brief

- Bitcoin dropped below $115,000 a few days after reaching a historic peak above $124,000

- In 48 hours, short-term investors liquidated more than 50,000 BTC at a loss, totaling $5.69 billion

- This panic move marks the strongest wave of losses in over a month, according to CryptoQuant data

- The $110,000 threshold is now identified as a critical area to watch by analysts

A panic move among short-term investors

While suspicious movements are shaking Bitcoin , CryptoQuant analyst Maartunn points out that short-term holders transferred more than 50,000 BTC to exchanges at a loss in only 48 hours, a volume representing approximately $5.69 billion in realized losses.

This figure represents the strongest wave of loss-making sales recorded in over a month. Indeed, these capitulation flows reflect acute stress among recent Bitcoin holders, often more sensitive to sharp market fluctuations. The rapid loss of the $115,000 threshold acted as a psychological trigger, precipitating these sales amid high uncertainty.

The on-chain data published by CryptoQuant reveal the magnitude of the selling pressure, as well as the critical levels that investors are now closely monitoring :

- 50,026 BTC sold at a loss in 48 hours, for a total loss of $5.69 billion;

- This phenomenon occurs just a few days after a significant rejection below the $123,217 resistance level, tested multiple times;

- Analysts identify the $110,000 threshold as the next line of defense, as its breach could open the way to a deeper correction;

- Conversely, stabilization above $115,000–117,000 would be seen as a signal of potential technical recovery.

This context informs on how quickly the confidence of short-term investors can reverse in a market as volatile as Bitcoin’s.

A rebound in sight or a deeper alarm signal?

Beyond the numbers, the interpretation of this move divides analysts. Some see it as a classic “flush-out”, meaning a necessary purge of weak hands, often followed by an accumulation phase. Bullish investors hope that this correction will act as a healthy reset , allowing a return to a healthier dynamic, observes Maartunn.

This scenario assumes that long-term actors, less sensitive to volatility, will take advantage of this drop to strengthen their positions, thus providing a foundation for a potential rebound towards $120,000.

Such an optimistic reading is not shared by all. Other voices warn against a possible repetition of the pattern observed between February and last May, where successive waves of capitulation plunged the market into a prolonged consolidation phase.

In the end, this sequence reveals a growing tension between the short-term logic of speculators and the more structural vision of long-term investors. The crypto market, inherently unstable, relies on fragile equilibria. In the coming days, Bitcoin’s ability to stay above $113,000 will be decisive: either a technical rebound towards its recent highs, namely $124,000 , or a new retreat phase fueled by loss of confidence and declining liquidity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK FCA's New Fund Tokenization Policy: Blockchain-Driven Transformation in Asset Management

From Pound to Bitcoin: The UK Government’s ‘Trump-Style’ Ambition

With the Federal Reserve turning dovish, is Cardano (ADA) about to rebound?

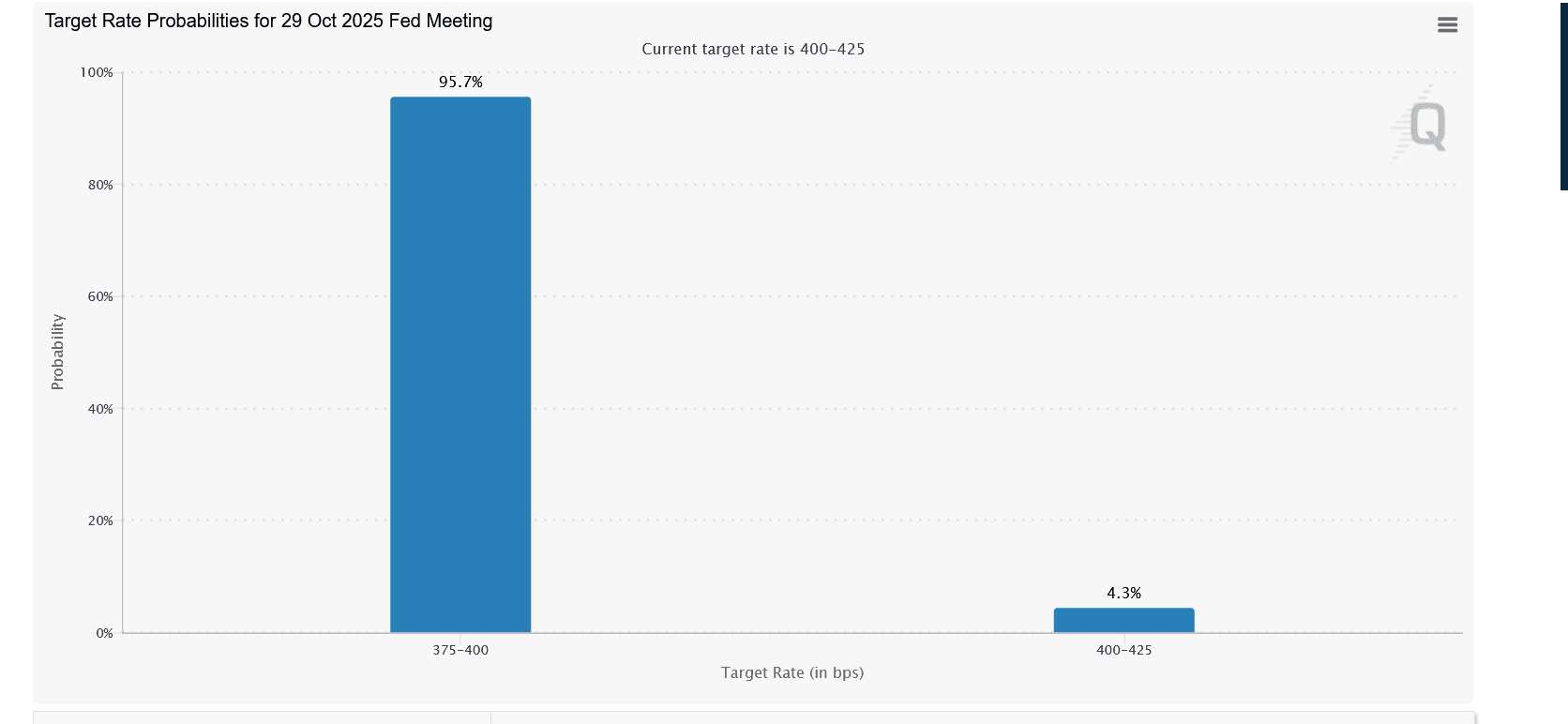

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Fidelity Clients Pour $154.6 Million into Ethereum as Interest Rises

Quick Take Summary is AI generated, newsroom reviewed. Fidelity clients invested $154.6 million in Ethereum, signaling strong institutional interest. The move boosts overall crypto market confidence and mainstream adoption. Ethereum institutional investment continues to grow due to staking rewards and network upgrades. Fidelity’s participation highlights the merging of traditional finance and blockchain innovation.References JUST IN: Fidelity clients buy $154.6 million worth of $ETH.