Bitcoin retreats slightly, XRP and Avalanche amplify the fall

The week started with a bang for the crypto market. Between spectacular crashes and regulatory uncertainties, investors watch every crumb of information, hoping to anticipate the trajectories of their favorite assets. A sense of suspense hangs over the blockchains: bitcoin holds the helm, but behind, some altcoins are seriously wobbling. Between caution, opportunity and technical signals, it is a pivotal moment playing out on the digital markets.

In brief

- Bitcoin maintains 57.8% dominance despite a 1.77% drop over 24 hours.

- XRP remains blocked by legal uncertainty and compressing technical signals.

- Avalanche falls 5.89% despite a very active DeFi ecosystem and institutional support.

- Technical data suggest possible reversals, but caution remains the order of the day among investors.

Bitcoin under pressure, but still captain of the crypto ship

Bitcoin, although trapped between accumulation by small hodlers and massive whale sales , retains its leadership status with 57.8% dominance, despite a slight 1.77% drop. Its price hovers around $110,051, but fundamental indicators, such as the hash rate and mining difficulty, remain stable. Signs that reassure the more patient, accustomed to latency phases between rallies.

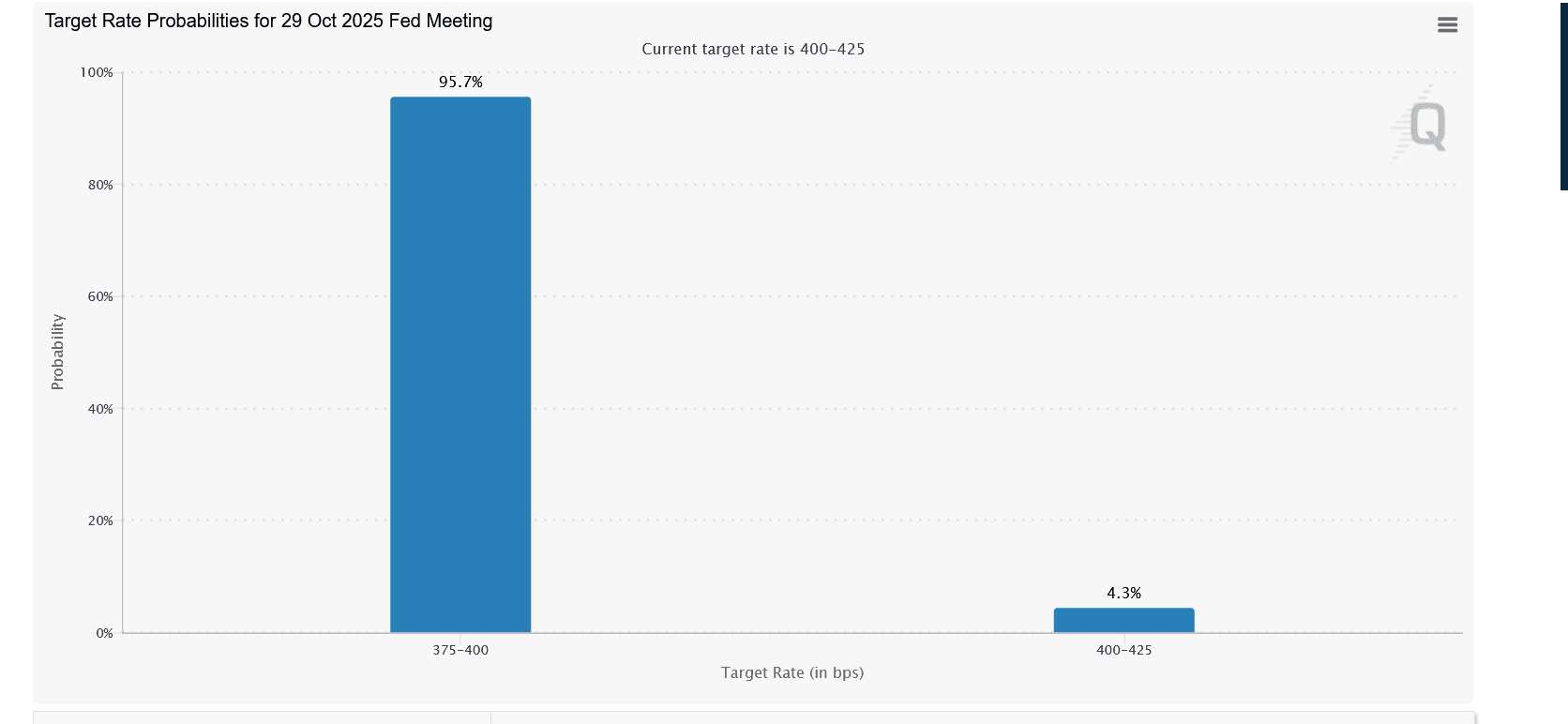

Macroeconomics also makes an appearance in the debate. In the United States, investors keep an eye on the Fed, shaken by tensions around Lisa Cook. Andrea Tueni, trading manager at Saxo Banque France, nuances in Bloomberg’s columns that although Fed’s independence raises questions:

Markets are really focused on a likely rate cut in September, more than on the Cook affair.

Bitcoin, far from being toppled, seems simply in tactical pause. Its current inertia could well be a strategic retreat. In the chaos, it remains the compass. And sometimes, a simple retreat hides an accumulation. Not a collapse: a breath.

XRP under tension, Avalanche descending: two altcoins, two moods

XRP drops 1.70%, but all eyes turn to its technical indicators, considered decisive in the short term. The RSI is neutral at 44, signaling the absence of a clear trend, while the Bollinger Bands tighten, hinting at a possible volatility explosion.

Buyer volume remains low, which hinders rebound attempts, and derivative markets are down, increasing caution around XRP.

Meanwhile, Avalanche takes a harsher hit: –5.89%, to $23.24. But behind this correction, a bubbling ecosystem. DeFi flourishes there, Visa and Toyota experiment, SkyBridge invests, and Grayscale wants to convert its AVAX Trust into a spot ETF, a first for this altcoin.

5 data points to watch closely:

- 57.8%: current market share of bitcoin;

- –1.77% / –1.70% / –5.89%: respective declines of BTC, XRP, AVAX;

- XRP: tight Bollinger Bands, RSI at 44 ;

- 81%: (unofficial) probability of an XRP ETF according to analysts;

- 81%: (unofficial) probability of an XRP ETF according to analysts.

On the memecoin side, nothing seems to be getting better. Dogecoin, Shiba Inu, and Pepe accumulate declines, illustrating growing weariness for these ultra-speculative assets. The crypto wave refocuses on fundamentals. Dogs bark, but for now, the bitcoin caravan passes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK FCA's New Fund Tokenization Policy: Blockchain-Driven Transformation in Asset Management

From Pound to Bitcoin: The UK Government’s ‘Trump-Style’ Ambition

With the Federal Reserve turning dovish, is Cardano (ADA) about to rebound?

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Fidelity Clients Pour $154.6 Million into Ethereum as Interest Rises

Quick Take Summary is AI generated, newsroom reviewed. Fidelity clients invested $154.6 million in Ethereum, signaling strong institutional interest. The move boosts overall crypto market confidence and mainstream adoption. Ethereum institutional investment continues to grow due to staking rewards and network upgrades. Fidelity’s participation highlights the merging of traditional finance and blockchain innovation.References JUST IN: Fidelity clients buy $154.6 million worth of $ETH.