Dogecoin News Today: Whales and Charts: The Secret Playbook Behind Dogecoin's 4% Surge

- Dogecoin (DOGE) rose ~4% overnight to $0.2185 amid technical signals and whale activity, despite no major news. - A TD Sequential "buy" signal and cup-and-handle pattern suggested bullish potential, while whale transfers to Binance triggered short-term volatility. - Market remains divided: declining retail engagement contrasts with whale accumulation, with price stability above $0.21 critical for further gains. - Future trajectory hinges on macroeconomic factors, whale buying continuity, and breakout abo

Dogecoin (DOGE) surged approximately 4% overnight between August 26 and August 27, 2025, reaching a price range of $0.2185, following a brief dip to $0.207. The price movement was attributed to a mix of technical indicators, whale activity, and broader market sentiment shifts. The cryptocurrency, which has historically been driven by speculative interest, showed signs of renewed buying pressure during the period, despite the absence of major news affecting its fundamentals.

Traders noted the emergence of a TD Sequential “buy” signal on DOGE’s 4-hour chart, which is often interpreted as a potential reversal point after a series of bearish candles. Additionally, a cup-and-handle pattern suggested longer-term bullish potential, with projected targets at $0.82 and $2.18. These technical signals, combined with the recent volatility, contributed to a cautious optimism among market participants, who are now closely watching for a confirmation of the pattern’s validity.

The surge followed a significant whale transfer of 900 million DOGE to Binance between August 24 and 25. While this activity initially caused a sharp drop in price, from $0.218 to $0.208, the broader on-chain data suggests that large holders are still accumulating the asset. Over 680 million DOGE were added to large wallets in August, countering some of the retail distribution seen during the decline. This dynamic underscores the dual nature of Dogecoin’s market: while whale movements can trigger significant volatility, they also serve as a key source of demand if accumulation continues.

Technical analysis further highlights the precarious position of DOGE in the short term. A key support level at $0.208 has been tested multiple times, and a breakdown below this threshold could lead to further declines toward $0.20 or even $0.19. On the other hand, if the price holds above $0.21 with sustained volume, the next resistance targets are expected to be at $0.281, $0.302, $0.315, and $0.339. Traders are also watching the RSI and MACD indicators, which suggest that momentum is stabilizing but remains volatile.

Looking ahead, the market remains split between bearish and bullish narratives. On one hand, declining open interest in DOGE futures and a reduction in daily active addresses—down to 58,000 from 674,500 in July—reflect a waning level of retail engagement. On the other hand, the ongoing accumulation by whales and the potential for a bullish breakout if key resistance levels are cleared have kept many traders in the market.

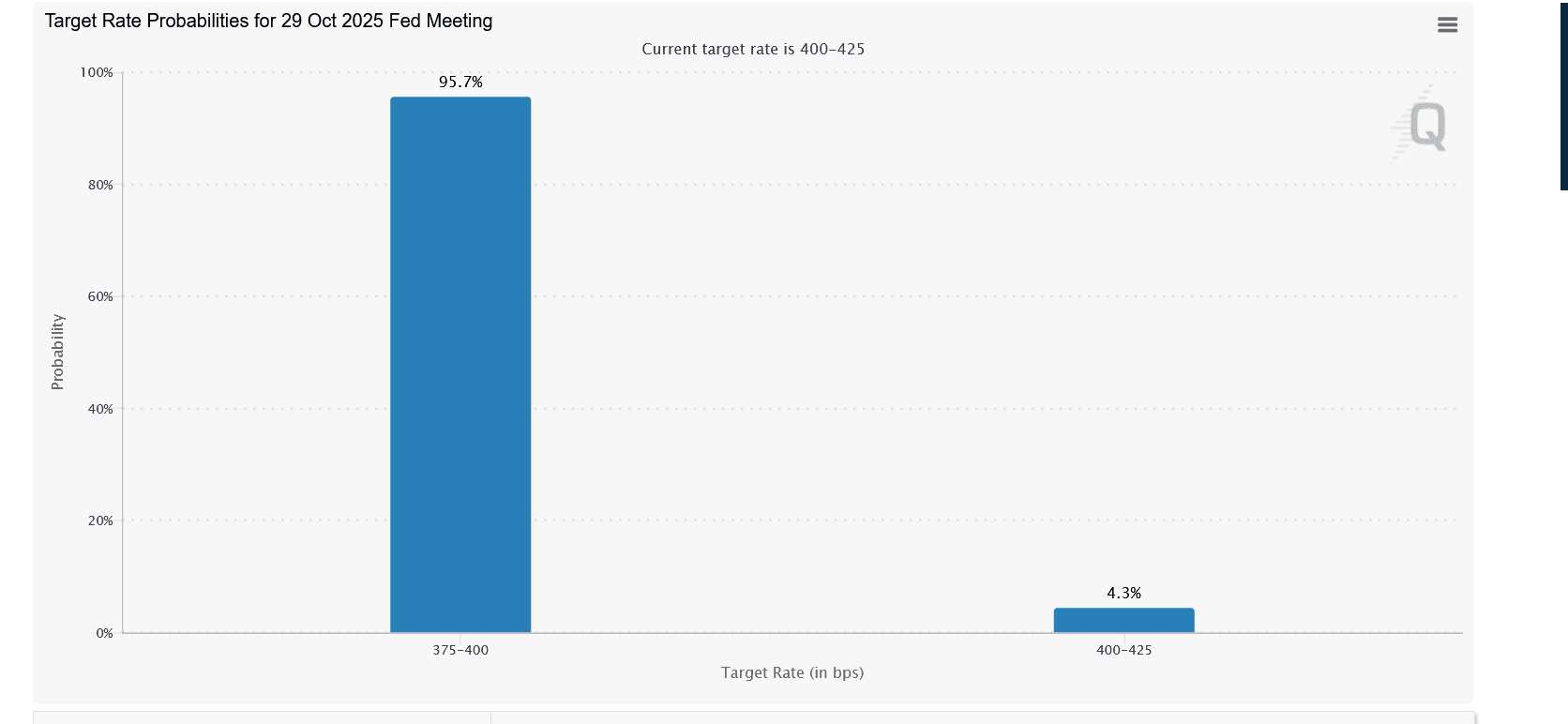

For now, Dogecoin’s trajectory will depend on several factors: the ability of bulls to maintain price above $0.21, the continuation of whale buying, and the broader crypto market’s reaction to macroeconomic signals, such as central bank policies and risk-on sentiment. While the 4% overnight spike is relatively modest in the grand scheme of DOGE’s history, it represents a critical test of the coin’s resilience amid ongoing volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK FCA's New Fund Tokenization Policy: Blockchain-Driven Transformation in Asset Management

From Pound to Bitcoin: The UK Government’s ‘Trump-Style’ Ambition

With the Federal Reserve turning dovish, is Cardano (ADA) about to rebound?

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Fidelity Clients Pour $154.6 Million into Ethereum as Interest Rises

Quick Take Summary is AI generated, newsroom reviewed. Fidelity clients invested $154.6 million in Ethereum, signaling strong institutional interest. The move boosts overall crypto market confidence and mainstream adoption. Ethereum institutional investment continues to grow due to staking rewards and network upgrades. Fidelity’s participation highlights the merging of traditional finance and blockchain innovation.References JUST IN: Fidelity clients buy $154.6 million worth of $ETH.