Bitcoin Layer 2 Innovation and IBVM's Strategic Positioning: A New Era of Scalable, Sustainable Infrastructure

- IBVM's 250% oversubscribed presale validates Bitcoin Layer 2's shift toward scalable, sustainable infrastructure with 9,000+ TPS and 99% energy efficiency. - The project combines Bitcoin's security with enterprise-grade DeFi/DePIN capabilities through ZK-Rollups and UTXO partitioning, outpacing competitors like Bitcoin Hyper. - Institutional backing ($20M from Rollman/Quest) and 100k+ wallet downloads position IBVM as a key player in Bitcoin's $2.2T ecosystem expansion.

The evolution of Bitcoin from a store of value to a foundational platform for decentralized finance (DeFi), decentralized physical infrastructure networks (DePIN), and Web3 applications hinges on the development of robust Layer 2 solutions. In 2025, the Bitcoin ecosystem has witnessed a surge in innovation, with projects like Bitcoin Hyper, Stacks, and Rootstock addressing scalability, programmability, and transaction efficiency. Among these, the International Bitcoin Virtual Machine (IBVM) has emerged as a standout contender, with its technological advancements signaling a paradigm shift in how the market values scalable, sustainable infrastructure. This article examines IBVM's strategic positioning, its technological differentiation, and the implications for long-term investment in Bitcoin's next phase.

The Case for Bitcoin Layer 2: Beyond Store of Value

Bitcoin's original design prioritized security and decentralization, but its 7–10 transactions per second (TPS) and high fees have long constrained its utility for real-world applications. Layer 2 solutions have bridged this gap by enabling off-chain transaction processing, smart contracts, and cross-chain interoperability. Projects like the Lightning Network (handling up to 1 million TPS) and Rootstock (EVM-compatible smart contracts) have laid the groundwork. However, the 2025 wave of innovation—led by IBVM and Bitcoin Hyper—has introduced architectures that combine Bitcoin's security with enterprise-grade scalability and energy efficiency.

IBVM, for instance, leverages Zero Knowledge Rollups and UTXO partitioning to achieve 9,000+ TPS with 1-second finality, while reducing energy consumption by over 99%. This is a critical differentiator in an era where environmental sustainability is reshaping investor and regulatory priorities. By anchoring its security to Bitcoin's blockchain, IBVM avoids the risks of standalone Layer 1s, offering a “best of both worlds” approach.

Market Validation Signal for IBVM

There has been strong market demand for IBVM, with rapid token reservation far surpassing initial allocation. This level of demand is rare even in a bullish market and reflects several key factors:

1. Strategic Funding and Partnerships: Backed by significant institutional partners, IBVM has demonstrated credibility. Expert collaborations in NFTs and enterprise Web3 solutions add a layer of technical assurance.

2. Community Engagement: With strong wallet download and social media numbers, IBVM has cultivated a grassroots movement. This organic growth is a strong indicator of user trust and adoption potential.

3. First-Mover Advantage in Green Infrastructure: As regulators and investors prioritize ESG (Environmental, Social, Governance) criteria, IBVM's energy-efficient design positions it to capture market share from legacy solutions.

Comparatively, projects like Bitcoin Hyper have attracted speculative interest, but IBVM's focus on sustainability and enterprise-grade scalability aligns more closely with long-term institutional adoption. Market enthusiasm for IBVM validates its core thesis: that Bitcoin's future lies in Layer 2 solutions that balance innovation with environmental responsibility.

Technological Differentiation and Ecosystem Potential

IBVM's architecture is designed to unlock use cases beyond traditional DeFi. Its support for decentralized escrow, DePIN, and cross-chain token standards (e.g., BRC-20, Ethereum) positions it as a bridge between Bitcoin's security and the broader Web3 ecosystem. For example, DePIN projects—such as decentralized energy grids or IoT networks—require high-speed, low-cost transactions and smart contracts, which IBVM delivers without compromising Bitcoin's core principles.

In contrast, projects like Stacks and Rootstock focus narrowly on smart contracts, while the Lightning Network remains limited to micropayments. IBVM's versatility—enabling both financial and infrastructure applications—gives it a broader value proposition.

Investment Implications: Balancing Risk and Reward

For investors, strong early demand and strategic partnerships present a compelling case for IBVM. However, the project's success will depend on execution risks, such as:

- Adoption Rates: Will developers and enterprises migrate to IBVM's platform? Early engagement with partners and DePIN use cases suggests momentum.

- Regulatory Clarity: The U.S. Clarity Act and global ESG frameworks could accelerate or hinder adoption. IBVM's green credentials may insulate it from regulatory headwinds.

- Competition: Bitcoin Hyper and Merlin Chain are formidable rivals, but IBVM's energy efficiency and institutional backing give it a unique edge.

A prudent investment strategy would involve:

1. Early Participation: Engaging with Layer 2 opportunities early can provide access advantages.

2. Diversification: Pairing IBVM with complementary projects like Bitcoin Hyper or Rootstock to hedge against sector-specific risks.

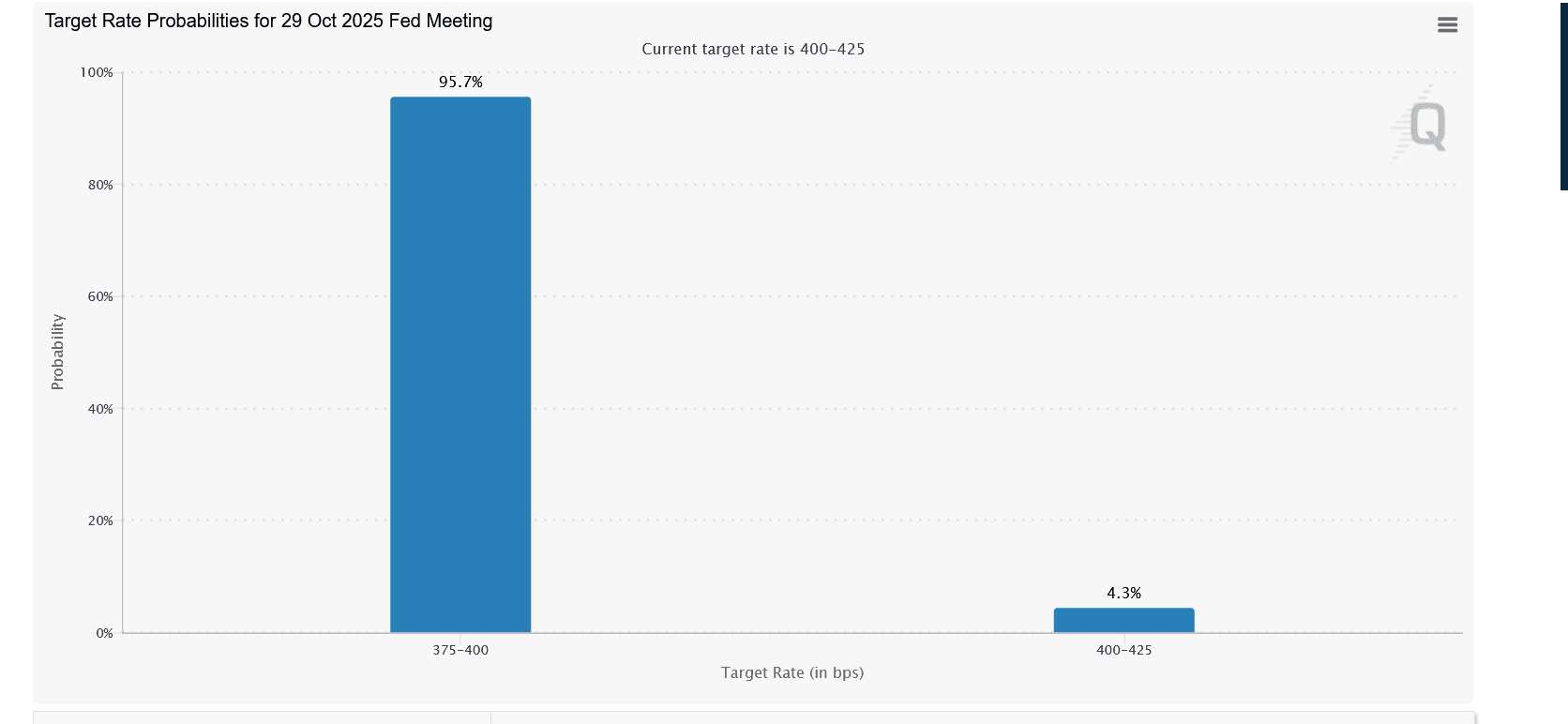

3. Long-Term Horizon: Given Bitcoin's $2.2 trillion market cap and the Federal Reserve's rate-cut cycle, Layer 2 infrastructure is poised to benefit from sustained capital inflows.

Conclusion: A New Infrastructure Paradigm

The Bitcoin Layer 2 landscape in 2025 is no longer about incremental improvements—it's about redefining the blockchain's role in global finance and infrastructure. Enthusiasm for IBVM is not just a funding milestone; it's a vote of confidence in a future where Bitcoin's security is paired with scalable, sustainable solutions. For investors, this represents an opportunity to align with a project that addresses both technical and environmental challenges, positioning itself at the intersection of innovation and institutional demand.

As the September 2025 rate cut looms and regulatory frameworks crystallize, the winners in the Bitcoin Layer 2 race will be those who prioritize adaptability, sustainability, and real-world utility. IBVM's strategic positioning makes it a strong candidate for long-term value creation in this evolving ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

UK FCA's New Fund Tokenization Policy: Blockchain-Driven Transformation in Asset Management

From Pound to Bitcoin: The UK Government’s ‘Trump-Style’ Ambition

With the Federal Reserve turning dovish, is Cardano (ADA) about to rebound?

Jerome Powell's latest remarks suggest that the Federal Reserve may cut interest rates again this month.

Fidelity Clients Pour $154.6 Million into Ethereum as Interest Rises

Quick Take Summary is AI generated, newsroom reviewed. Fidelity clients invested $154.6 million in Ethereum, signaling strong institutional interest. The move boosts overall crypto market confidence and mainstream adoption. Ethereum institutional investment continues to grow due to staking rewards and network upgrades. Fidelity’s participation highlights the merging of traditional finance and blockchain innovation.References JUST IN: Fidelity clients buy $154.6 million worth of $ETH.