Key Notes

- Bit Digital's $150 million financing round attracted Kraken Financial, Jump Trading Credit, and Jane Street Capital.

- Short traders faced $21 million in liquidations as Ethereum rebounded above $4,500 following a brief correction to $4,432.

- The company's mNAV stands at $3.84 per share with conversion price at 8.2% premium reflecting investor confidence.

Bit Digital, a publicly traded firm focused on Ethereum ETH $4 521 24h volatility: 1.3% Market cap: $545.74 B Vol. 24h: $39.65 B treasury and staking, has announced another major purchase, while derivatives short-traders were caught off guard with $21 million in short contracts liquidated as Ethereum price rebounded above $4,500 on October 8.

According to Bit Digital’s announcement on October 8, the company has purchased approximately 31,057 ETH, funded by proceeds of its recently completed $150 million convertible notes offering.

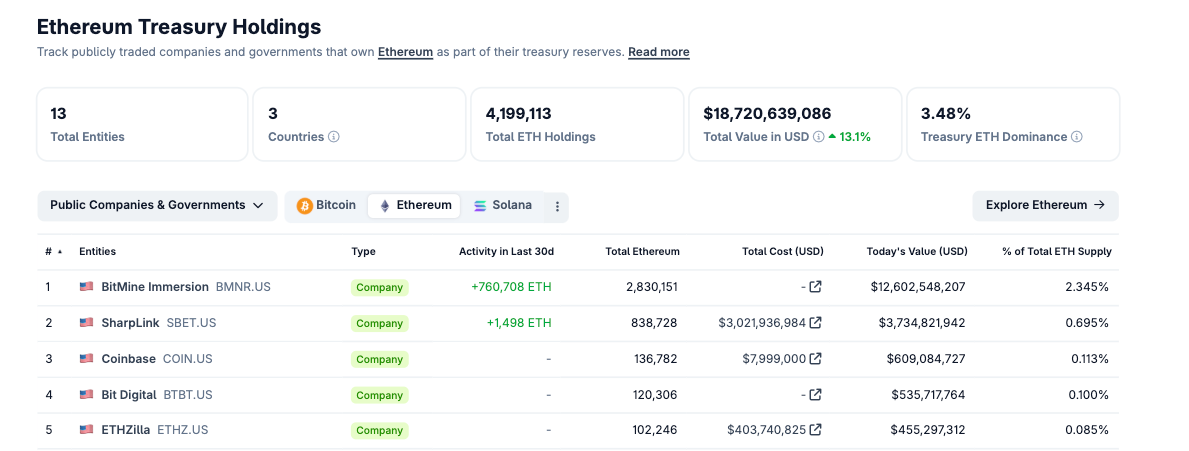

Ethereum Treasury Holdings as of October 8, 2025 | Source: Coingecko

Bit Digital Expands Ethereum Treasury to 150,244 ETH

Following the latest transaction, Bit Digital now holds 150,244 ETH, and is set to leapfrog Coinbase into third position among the largest Ethereum treasuries, according to Coingecko data .

Kraken Financial, Jump Trading Credit, and Jane Street Capital all participated in Bit Digital’s latest financing round, with CEO Sam Tabar reaffirming long-term commitment to the ETH treasury strategy.

“This purchase demonstrates our commitment to building shareholder value by financing ETH accumulation on terms that are accretive to NAV per share. The structure of our convertible notes allowed us to raise capital at a premium to mNAV, and we have deployed those proceeds directly into ETH. We view ETH as foundational to digital financial infrastructure and believe current levels provide a compelling long-term entry point,” said Sam Tabar, CEO of Bit Digital.

According to the company’s estimates as of September 29, 2025, Bit Digital’s mNAV was approximately $3.84 per share, calculated from $512.7 million in ETH holdings and $723.1 million in WYFI shares, totaling $1.236 billion in combined asset value.

The $4.16 per share conversion price marks an 8.2% premium over that mNAV, reflecting investor confidence in Bit Digital’s Ethereum-focused treasury model.

Short Traders Shed $28M in 1HR as Markets Brace for Early Rebound

Ethereum price rose to a multi-month peak above $4,700 earlier this week, tracking Bitcoin BTC $123 595 24h volatility: 2.3% Market cap: $2.46 T Vol. 24h: $66.44 B new all-time high of $126,200 on October 7. However, as Bitcoin began retracing, Ethereum followed suit, declining 5% to $4,432 amid profit-taking pressure.

That brief correction triggered a spike in leveraged short positions, as speculators anticipated deeper losses. But steady corporate demand amid the US government shutdown has seen bulls regain control as ETH price rebounded above $4,500 on October 8, sparking early signals of a potential short squeeze.

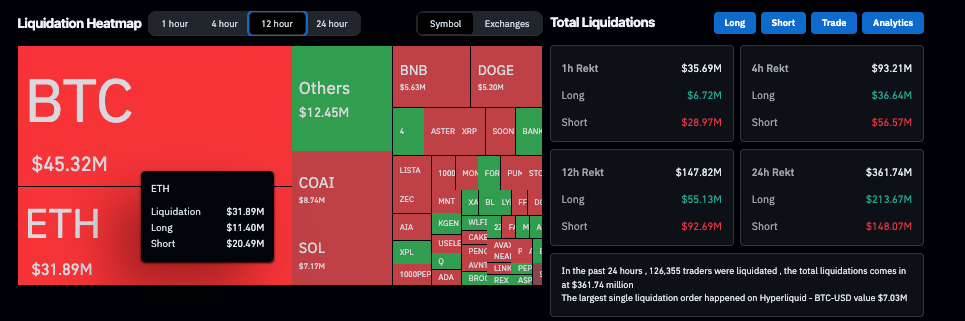

Crypto market liquidations as of October 8 | Source: Coinglass

Following a highly volatile 24-hour period where total crypto market liquidations hit $361.7 million, bull traders initially bore the brunt of the sell-off, accounting for $213.6 million of the wipeout. This placed the bull’s loss incidence at approximately 59% on the 24-hour time frame.

However, recent derivatives data reading after Ethereum retook $4,500 suggests an early rebound underway. Within just the past hour, total liquidations of $35.7 million were dominated by $28.9 million in shorts versus only $6.7 million in longs. This short squeeze has dramatically reduced the bull loss incidence to just 19%, indicating that bears are being aggressively forced out of the market.

Ethereum is leading the charge, with $20.5 million in short positions liquidated over the last 12 hours alone.

As this early rebound gains traction, and with institutional confidence reinforced by Bit Digital’s $673 million Ethereum treasury, the sharp short-liquidations could potentially set the stage for a new breakout toward $5,000 as the US government shutdown fuels corporate risk-on sentiment.

最佳钱包产品接近1600万美元,伴随以太坊突破4500美元

随着以太坊反弹突破4500美元,机构资金持续流入,类似Bit Digital这类公司不断扩大持仓,投资者正关注早期项目如最佳钱包(BEST)。

最佳钱包热度持续提升

最佳钱包(BEST)是一款新一代多链数字资产管理平台,提供智能保险库、多重签名集成与收益优化工具,面向零售与机构用户。