QCP Recommends Bitcoin Investment Amid Dollar Weakness

- Main event, QCP’s unchanged market signal amid dollar weakening.

- QCP advises buying Bitcoin dips for investors.

- Institutional interest and bullish market trends persist.

The recommendation to buy Bitcoin on dips remains firm due to the weakening US dollar. Support levels stand at $123,000, with resistance at $126,200, supported by persistent institutional inflows and the historical strength of BTC in October.

QCP Capital advises buying Bitcoin on market dips as the US dollar weakens. This recommendation comes amid shifting macroeconomic dynamics influencing cryptocurrency markets.

The unchanged signal from QCP Capital reflects ongoing confidence in Bitcoin, highlighting its potential strength as the dollar weakens. This is crucial for investors assessing market entry points.

QCP Capital remains consistent in its advice to buy Bitcoin during market downturns as the dollar weakens. The cryptocurrency trading firm cites broader macroeconomic factors, including institutional flows, supporting their stance.

“As was widely expected in Q4, a new all-time-high (ATH) was set for BTC, buoyed by the prospect of US stimulus, seeing prices rally 10% the past 9 days.” – Paul Howard, Wincent Director

Immediate market responses to QCP’s advice show increasing investor interest, aligning with a global trend of shifting investments. This reflects broader macroeconomic factors impacting current crypto trajectories. Expected continuation of institutional flows into Bitcoin suggests future price stability, amid macroeconomic changes. This trend highlights the currency’s potential as a hedge against dollar volatility.

Historical comparisons reveal similar price surges for Bitcoin during periods of dollar weakening. These events suggest potential market movements, supported by on-chain data and technical analysis. Bitcoin’s immediate support level is observed at $123,000 while long-term targets remain strong, allowing investors to strategize accordingly.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Arthur Hayes: How Do the US Dollar and Chinese Yuan Kill the Bitcoin Cycle?

EMC Labs September Report: Logical Analysis of BTCsh Cycle Initiation, Operation, and Conclusion

Since the start of this cycle, the structure of the crypto market has undergone dramatic changes, making it necessary to reconsider the operating logic and possible conclusion of BTC.

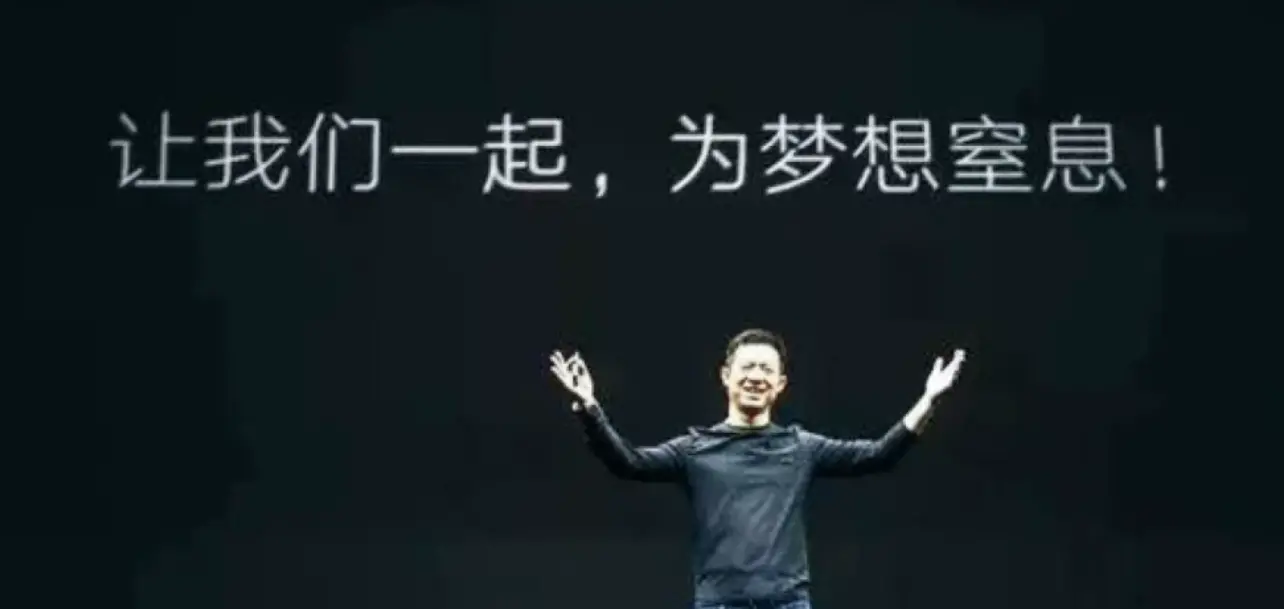

Veteran crypto figure Jia Yueting

The article provides a detailed account of Jia Yueting's business trajectory, from the "ecological integration" era at LeTV to his current "EAI + Crypto dual flywheel" strategy launched in the United States. Through a series of capital operations and his keen grasp of the crypto world, he is once again deeply aligning himself with Web3.

The Era of Staking for Crypto ETFs: Grayscale Takes the Lead by Leveraging Policy Differences, Government Shutdown May Delay Approval Process

The article provides a detailed explanation of how Grayscale, navigating compliance and regulatory structural differences, became the first to launch a spot crypto ETF with staking support in the US market, and discusses the impact of this move on the competitive landscape of the stablecoin market. Although Grayscale has gained a first-mover advantage, the capital inflow into its product has been relatively modest so far.