Tech's investment in AI and geopolitical advantages drive up stocks and digital currencies

- Meta's $51.2B Q3 revenue beat estimates but EPS fell short, yet its AI/cloud investments bolster Wall Street optimism and 27% stock gains in 2025. - Intel's TSMC executive recruitment rumors and NVIDIA's $1B Nokia investment highlight AI talent/resource wars driving tech stock surges. - Trump-Xi trade talks and $36.2B Boeing deal boost Bitcoin 1.6% as investors anticipate eased tensions stabilizing crypto markets. - Magnificent Seven's 34% S&P 500 dominance reflects AI-driven tech consolidation, with hyp

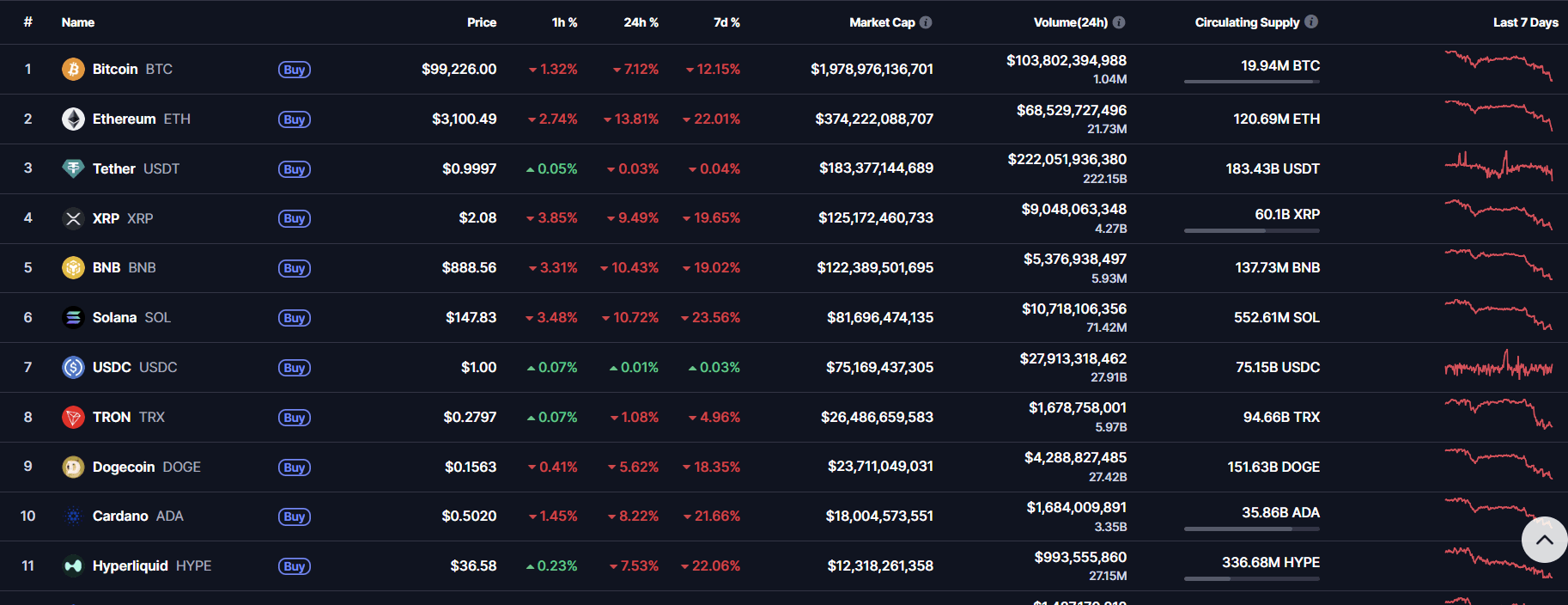

Meta’s third-quarter financial results, along with major moves by leading tech companies and international political events, have influenced global markets, resulting in gains for both stocks and cryptocurrencies. The social media giant posted

At the same time, news that Intel is attempting to hire

Nokia’s latest alliance with NVIDIA further highlights the surge in AI-focused markets. The Finnish company secured a $1 billion investment from NVIDIA, which acquired a 2.9% stake and agreed to work together on AI networking technologies. Following the announcement, Nokia’s stock jumped over 20%, reflecting strong investor interest in companies shifting toward AI and data center infrastructure. These partnerships are part of a larger trend, with major players like

International political events have also influenced market outlook.

The combination of corporate results, strategic alliances, and diplomatic negotiations highlights the deep connections within today’s global markets. As technology companies continue to invest heavily in AI and infrastructure, and as world leaders manage complex trade relationships, the performance of the Magnificent Seven is likely to remain a key indicator of broader economic and tech trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Crash Deepens: Can the $3K Line Hold or Will It Break Next?

Bitcoin Updates: Swiss Crypto Lending Offers 14% Returns Alongside Bank-Backed Insurance

- Swiss crypto lender Fulcrum offers 14% APR on stablecoins with Lloyd's insurance and FINMA regulation. - Platform uses 50% LTV over-collateralization and institutional-grade security to mitigate market risks. - Targets inflation-hedging investors by bridging traditional finance gaps with insured crypto yields. - Competes with alternatives like Bitget's zero-interest loans but emphasizes regulatory compliance and capital preservation.

Bitcoin News Update: Analyst Highlights How MSTR's Convertible Bonds Prevent Forced Bitcoin Sales

- MSTR's convertible debt structure allows debt repayment via cash, stock, or both, avoiding Bitcoin sales during market downturns. - The company raised €350M through a 10% dividend-bearing euro-denominated preferred stock offering to fund Bitcoin purchases. - Q3 results showed $3.9B operating income from Bitcoin gains, driving a 7.6% stock surge to $273.68 post-earnings. - Risks persist if Bitcoin fails to rally in 2028, potentially forcing partial liquidation amid $1.01B 2027 debt obligations. - MSTR hol

Solana News Today: Solana ETFs Surpass Bitcoin as Staking Returns Attract Institutional Investments

- U.S. spot Solana ETFs (BSOL/GSOL) attracted $199M in 4 days, outperforming Bitcoin/Ethereum ETF outflows. - 7% staking yields drive institutional inflows as investors rotate capital from major crypto assets. - Despite ETF success, SOL price fell below key support levels, raising concerns about $120 price floor. - Strategic staking and treasury purchases boosted Solana's institutional appeal, with $397M in staked assets. - Market remains cautious as ETF competition intensifies, with Bitwise's BSOL outpaci