Bullish Experts Face Off Against Legal Challenges Amid DoorDash’s Growth

- Analysts upgrade DoorDash (DASH) with $272–$340 price targets, citing market leadership and strategic innovations like Wolt acquisition and drone delivery. - Short-seller claims about ITIN worker onboarding and profit model fragility spark regulatory risks, while a lawsuit alleges illicit THC deliveries. - DoorDash counters with CSR initiatives (e.g., free meals for SNAP recipients) and expanded partnerships with Kroger/Uber Eats to strengthen public perception. - Market uncertainty persists amid Fed rat

DoorDash (DASH) shares have regained strength as a series of analyst upgrades and increased price targets point to renewed optimism in the delivery leader. On October 27, 2025, Barclays resumed coverage with an Equal-Weight rating and set a $272 price target in a

The stock has hovered around $254.59, with analysts forecasting an average price target of $303.27—suggesting a 19.12% potential upside, according to the Barclays note. This positive outlook is driven by DoorDash’s global expansion through its 2022 acquisition of Wolt and its entry into drone delivery, as highlighted in the Barclays reinstatement. Goldman Sachs analysts emphasized the company’s favorable 3:1 risk/reward profile and strong financials, including a 50.04% gross margin and $11.895 billion in annual revenue, as detailed in

Yet, the optimistic outlook faces some challenges. Short-seller Culper Research recently accused

Despite these obstacles, DoorDash has shown resilience in the market. Shares climbed 4.8% after the short-seller report, and the company has increased its focus on corporate social responsibility to improve its public image. In November, DoorDash eliminated delivery fees for 300,000 SNAP recipients and pledged to provide one million free meals through its Project

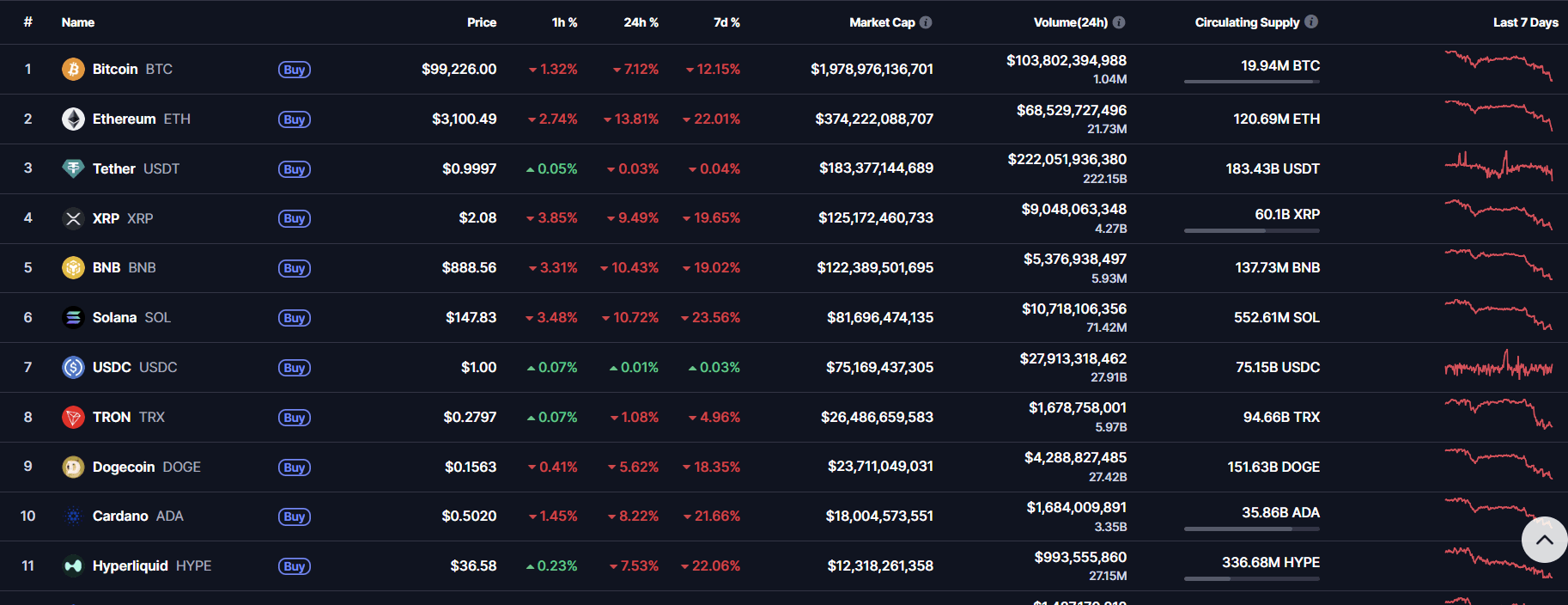

The overall market backdrop remains uncertain. The Federal Reserve’s reluctance to lower interest rates has kept volatility elevated, as shown in the

With shares trading near $264.30, investors are weighing the risks of regulatory challenges against the opportunities presented by DoorDash’s expanding reach. With 39 analysts setting an average target of $303.27, the possibility of reaching the high-end estimate of $360 remains, though not without significant challenges, as referenced in the earlier Barclays reinstatement.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Crash Deepens: Can the $3K Line Hold or Will It Break Next?

Bitcoin Updates: Swiss Crypto Lending Offers 14% Returns Alongside Bank-Backed Insurance

- Swiss crypto lender Fulcrum offers 14% APR on stablecoins with Lloyd's insurance and FINMA regulation. - Platform uses 50% LTV over-collateralization and institutional-grade security to mitigate market risks. - Targets inflation-hedging investors by bridging traditional finance gaps with insured crypto yields. - Competes with alternatives like Bitget's zero-interest loans but emphasizes regulatory compliance and capital preservation.

Bitcoin News Update: Analyst Highlights How MSTR's Convertible Bonds Prevent Forced Bitcoin Sales

- MSTR's convertible debt structure allows debt repayment via cash, stock, or both, avoiding Bitcoin sales during market downturns. - The company raised €350M through a 10% dividend-bearing euro-denominated preferred stock offering to fund Bitcoin purchases. - Q3 results showed $3.9B operating income from Bitcoin gains, driving a 7.6% stock surge to $273.68 post-earnings. - Risks persist if Bitcoin fails to rally in 2028, potentially forcing partial liquidation amid $1.01B 2027 debt obligations. - MSTR hol

Solana News Today: Solana ETFs Surpass Bitcoin as Staking Returns Attract Institutional Investments

- U.S. spot Solana ETFs (BSOL/GSOL) attracted $199M in 4 days, outperforming Bitcoin/Ethereum ETF outflows. - 7% staking yields drive institutional inflows as investors rotate capital from major crypto assets. - Despite ETF success, SOL price fell below key support levels, raising concerns about $120 price floor. - Strategic staking and treasury purchases boosted Solana's institutional appeal, with $397M in staked assets. - Market remains cautious as ETF competition intensifies, with Bitwise's BSOL outpaci