Ripple Partners with Mastercard: Is XRP Set for a Major Comeback?

The payments and crypto worlds have a new high-profile headline: Ripple has joined forces with Mastercard to enable $RLUSD credit-card settlements via the XRP Ledger (XRPL).

At first glance, this partnership looks like a game-changer: it fuses the scale of traditional finance with blockchain architecture — positioning XRP not just as a speculative asset, but as a settlement layer with real-world utility.

But to understand how meaningful this could be, we need to view it against the backdrop of XRP’s recent turbulence, macro risk, and how things might unfold from here.

XRP: Recent Trend & Headwinds

Historical Weakness & Macro Pressure

Recently, analysts asked: “Will XRP crash to $0 in November?” — the short answer was no , but the warning was clear: the next few weeks would test its resilience hard.

For example: trading around ~$2.19, XRP failed to hold its support zone near $2.30–$2.40, with lower highs and lower lows forming.

Macro-risks have weighed heavily: a prolonged U.S. government shutdown freezing economic data, stronger dollar as investors seek safety, risk-off sentiment hitting speculative tokens like XRP.

On the technical side, support levels near $2.20 and $2.00 have been flagged as danger zones – if broken, the path to lower levels like $1.50 was considered possible.

Why This Partnership Matters More Now

Given that backdrop of uncertainty, the Mastercard-deal could be the catalyst XRP needs. It introduces a tangible use-case and signals institutional/legacy financial engagement rather than just hype.

Ripple × Mastercard Partnership: What’s At Stake

Settlement Utility: By enabling $RLUSD (Ripple’s stablecoin) via Mastercard’s network on the XRPL, the infrastructure lines up for faster inter-bank or cross-border transactions, using XRPL’s ledger mechanics rather than legacy slower rails.

Institutional Validation: Mastercard’s involvement sends a signal to large institutions and payment providers that the XRPL ecosystem is capable of handling scale and compliance.

Liquidity & Visibility: More transaction volume and settlement flows through XRPL could increase demand for XRP (as a bridge currency) and raise XRPL’s profile.

Market Sentiment Shift: While macro pressures persist, a partnership like this can shift sentiment from “risk asset under pressure” to “utility token emerging” — which could attract a different class of investors.

Current Market Snapshot & Technical Implications

XRP trades near ~$2.27, showing modest upside but still under pressure.

Broad market: The macro environment (strong dollar, inflation/interest-rate uncertainty) remains a headwind, which has been reflected in recent altcoin corrections.

Key technical levels:

Immediate resistance: ~$2.50–$2.60 (a breakout zone)

Support: ~$2.20 and ~$2.00 — if these fail, risk of deeper pullback increases.

If XRP holds above ~$2.30 and momentum shifts (with the Mastercard news in motion), the next target zone could be ~$3.00+ — especially if the broader crypto market starts recovering.

Outlook: Risks & Opportunities

Opportunities

- If the partnership rollout is visible and adoption begins, XRP could attract new capital, bridging from traditional finance into crypto.

- A recovery in Bitcoin/market liquidity tends to lift altcoins — and XRP with a strong narrative may outperform.

- The narrative shift from “just an altcoin” to “settlement infrastructure” could appeal to longer-term institutional players, not just traders.

Risks

- Macro conditions remain fragile: The stronger-than-expected dollar / weaker risk appetite could derail altcoin rallies.

- Execution risk: Partnerships often take time to roll out meaningful volume; if rollout is delayed or adoption slow, market may be disappointed.

- Technical breakdown: If support levels break decisively (< ~$2.20), the recent bullish narrative could unravel and reinforce previous bearish signals.

- Saturation: Given XRP’s market cap and previous runs, much of the good news may already be priced in — limiting room for upside unless adoption becomes large-scale.

What to Watch

- Partnership cadence: Any announcements of pilot deployments, live settlement flows, or Mastercard network updates involving XRPL will accelerate the bullish case.

- Macro signals: Inflation data, Fed commentary, dollar strength — because even a fundamental utility story can struggle in a risk-off environment.

- Technical breakout: A daily close above ~$2.50 with volume would signal the trend reversal. Conversely, a daily close below ~$2.00 would amplify risk of further downside.

- On-chain/volume data: Increase in XRPL transaction volumes, RLUSD issuance, institutional wallet activity, and so on would confirm utility activation rather than just narrative.

Conclusion

The Mastercard–Ripple deal could mark the turning point for XRP’s next chapter. After a period of structural weakness, macro headwinds, and technical stress, this kind of infrastructure move injects real substance into XRP’s narrative.

If the partnership is executed, adoption begins, and market sentiment shifts, the scenario for XRP could pivot from “waiting to see” to “momentum underway.” But that’s a conditional outcome — execution and macro remain key.

In short: Yes, XRP could very well be set for a major comeback — provided the building blocks align. If not, the old risks remain alive.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Microsoft Strikes $9.7B Deal With IREN as AI Demand Surges

XRP ETF: Nate Geraci predicts a launch within two weeks

Sequans Sells 970 Bitcoins, Unsettling the Markets

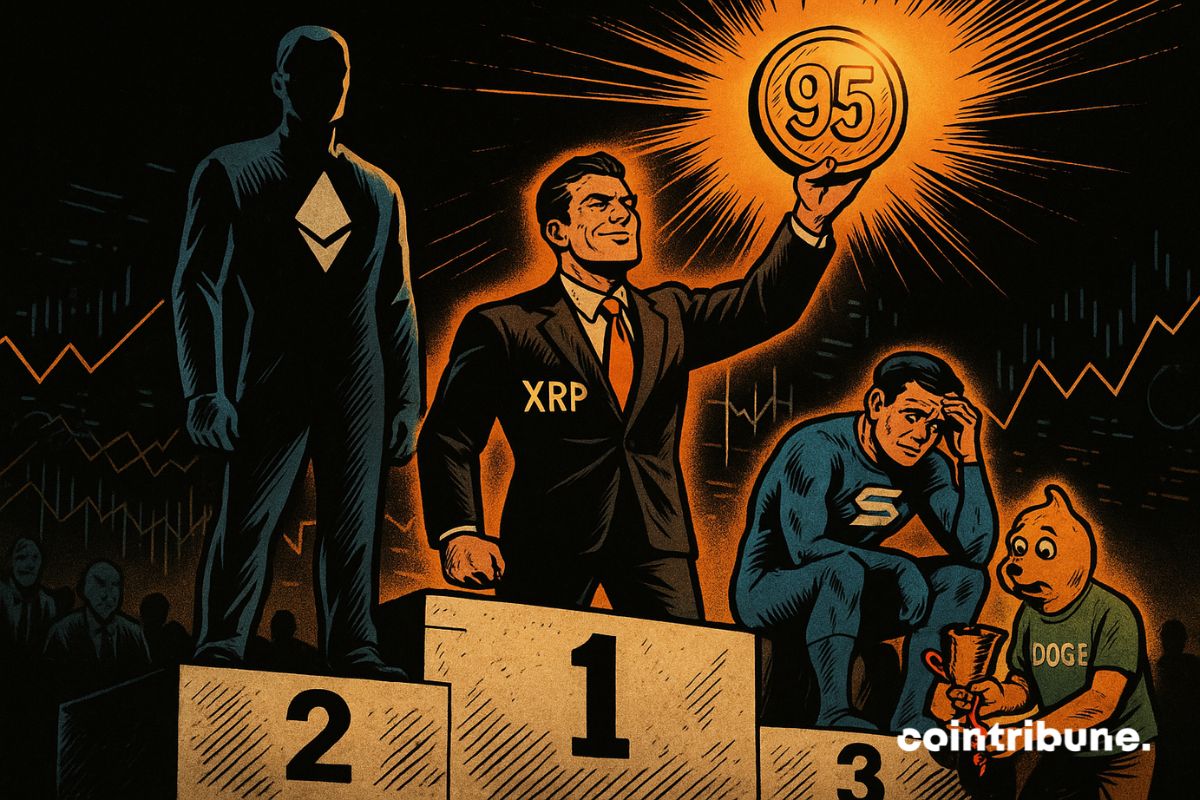

Crypto: Kaiko ranks XRP above Solana and Dogecoin in 2025