News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 15)|EDCON 2025 Ethereum Developer Conference Set to Open Soon; Major Token Unlocks Scheduled This Week; Tether Launches New USD Stablecoin for US Market2Chainlink Could See Further Gains After SBI Partnership, Bitwise ETF Filing and Large Exchange Outflows3Ethereum Co-Founder Says AI-Led Governance Could Be Exploited, Urges Info-Finance Oversight

Tether plans stablecoin for the US market (USAT)

CryptoValleyJournal·2025/09/15 22:57

Polymarket is booming: An overview of 10 ecosystem projects

A range of third-party ecosystems has emerged around Polymarket, including data/dashboards, social experiences, front-end/terminal, insurance, and AI agents.

链捕手·2025/09/15 22:53

Symbiotic, Chainlink, and Lombard launch industry-first layer for cross-chain Bitcoin transfers

Cryptobriefing·2025/09/15 22:33

Brazil Explores Bitcoin Reserve with Parliamentary Hearing

Theccpress·2025/09/15 22:03

Brazil Considers National Bitcoin Reserve Proposal

Theccpress·2025/09/15 22:03

Bitcoin price drop to $113K might be the last big discount before new highs: Here’s why

Cointelegraph·2025/09/15 21:45

Trump Predicts a "Significant Rate Cut" by the Federal Reserve!

AICoin·2025/09/15 21:08

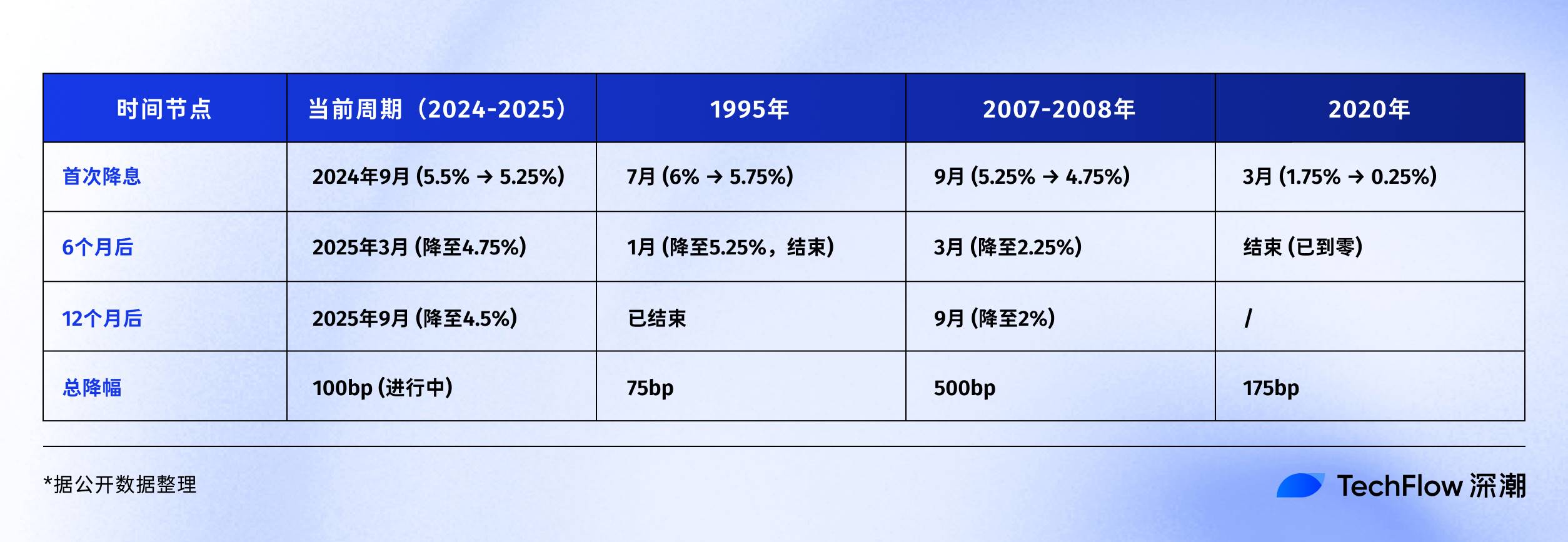

Reviewing the Fed's rate-cutting cycle: What’s next for Bitcoin, the stock market, and gold?

If history rhymes, the next 6-12 months could be a critical window.

深潮·2025/09/15 20:59

Will Tesla and xAI merge? Hedge fund tycoon: It feels inevitable

Positive remarks from SkyBridge Capital founder Anthony Scaramucci have further fueled expectations of a possible merger between Tesla and xAI.

ForesightNews·2025/09/15 20:43

Capital B Expands Bitcoin Holdings to 2,249 BTC, Yield Hits 1,536%

coinfomania·2025/09/15 20:12

Flash

- 00:26US-listed company Next Technology Holding plans to issue up to $500 million in common stock, with the proceeds including the purchase of bitcoin.According to ChainCatcher, as shown in an announcement by the US SEC, the US-listed company Next Technology Holding Inc. (NXTT) has submitted an S-3 registration statement to the US Securities and Exchange Commission, proposing to issue up to $500 million in common stock through a shelf registration process. The company plans to use the raised funds for general corporate purposes, including working capital, research and development expenses, potential mergers and acquisitions, and the purchase of bitcoin, among other uses, which have not yet been finalized.

- 00:26Milan secures enough votes to be confirmed as a Federal Reserve governorChainCatcher news, according to Golden Ten Data, Milan has secured enough votes in the US Senate confirmation vote and has been officially confirmed as a member of the Federal Reserve Board of Governors.

- 00:25US CFTC orders former Voyager CEO of crypto lending company to pay $750,000 to defrauded customersChainCatcher news, according to Bloomberg, the U.S. Commodity Futures Trading Commission (CFTC) issued a statement on Monday stating that Stephen Ehrlich, co-founder and former head of the bankrupt crypto lending platform Voyager Digital Ltd., must pay $750,000 to defrauded customers. According to a consent order from the federal court in New York, Ehrlich neither admitted nor denied the allegations and is banned from commodity trading for three years, in addition to other restrictions. CFTC Acting Director Charles Marvine stated that this settlement highlights the agency’s important role in the digital asset sector, with compensating victims and restricting the defendant’s ability to cause future harm as its core mission. In October 2023, the CFTC sued Ehrlich and Voyager, accusing them of fraudulently operating a digital asset platform, misleading customers by claiming it was a “safe haven,” and attracting clients with promises of high returns while lending billions of dollars in customer assets to high-risk third parties. Ehrlich at the time said he was “angry and disappointed” by the allegations. Previously, Ehrlich had reached a settlement with the Federal Trade Commission (FTC) regarding related false statement charges.