News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 16)|Fed rate cut probability reaches 95.9%;Spot Gold Price Surpasses $3,680/oz;South Korea lifts restrictions on virtual asset trading and brokerage services2XRP 4H Golden Cross Could Reflect ETF Optimism as Shiba Inu Netflows Crash and Dogecoin May Face Death Cross3Dogecoin Could Rally if It Breaks $0.29 Resistance, Analyst Says

SEC's Quantum Security Framework Signals

Cointribune·2025/09/17 00:57

Nakamoto Holdings Crashes 54% as Market Loses Faith in Its Bitcoin Model

Cointribune·2025/09/17 00:57

Memecoin news: Pump.fun flips Hyperliquid in revenue, DOGE ETF expected this week

Coinjournal·2025/09/17 00:57

Immutable (IMX) price rebounds sharply after deep correction: here’s why

Coinjournal·2025/09/17 00:57

US and UK to Announce New Crypto Cooperation Deal: A Turning Point for Digital Assets?

Cryptoticker·2025/09/17 00:45

Solana Sees 2.25 Billion USDC Minted In September

Quick Take Summary is AI generated, newsroom reviewed. Solana recorded $2.25 billion USDC Mint during September 2025 Institutions prefer Solana for speed, liquidity, and regulatory clarity GENIUS Act rules boost compliance trust for institutional stablecoin adoption Public companies increasingly use Solana treasuries for staking and yield Circle expands USDC Mint globally under MiCA and e-money frameworksReferences $2.25B $USDC Minted on Solana This Month

coinfomania·2025/09/16 23:03

Forward Industries to tokenize company stock and operate fully on Solana blockchain

Cryptobriefing·2025/09/16 22:18

Get Your Bitcoin and Ethereum via PayPal: P2P Payments Have Just Entered the Cryptocurrency Space

PayPal has launched peer-to-peer payments for Bitcoin and Ethereum, allowing users to send and receive cryptocurrencies directly through its platform more easily than before.

Cryptoticker·2025/09/16 21:59

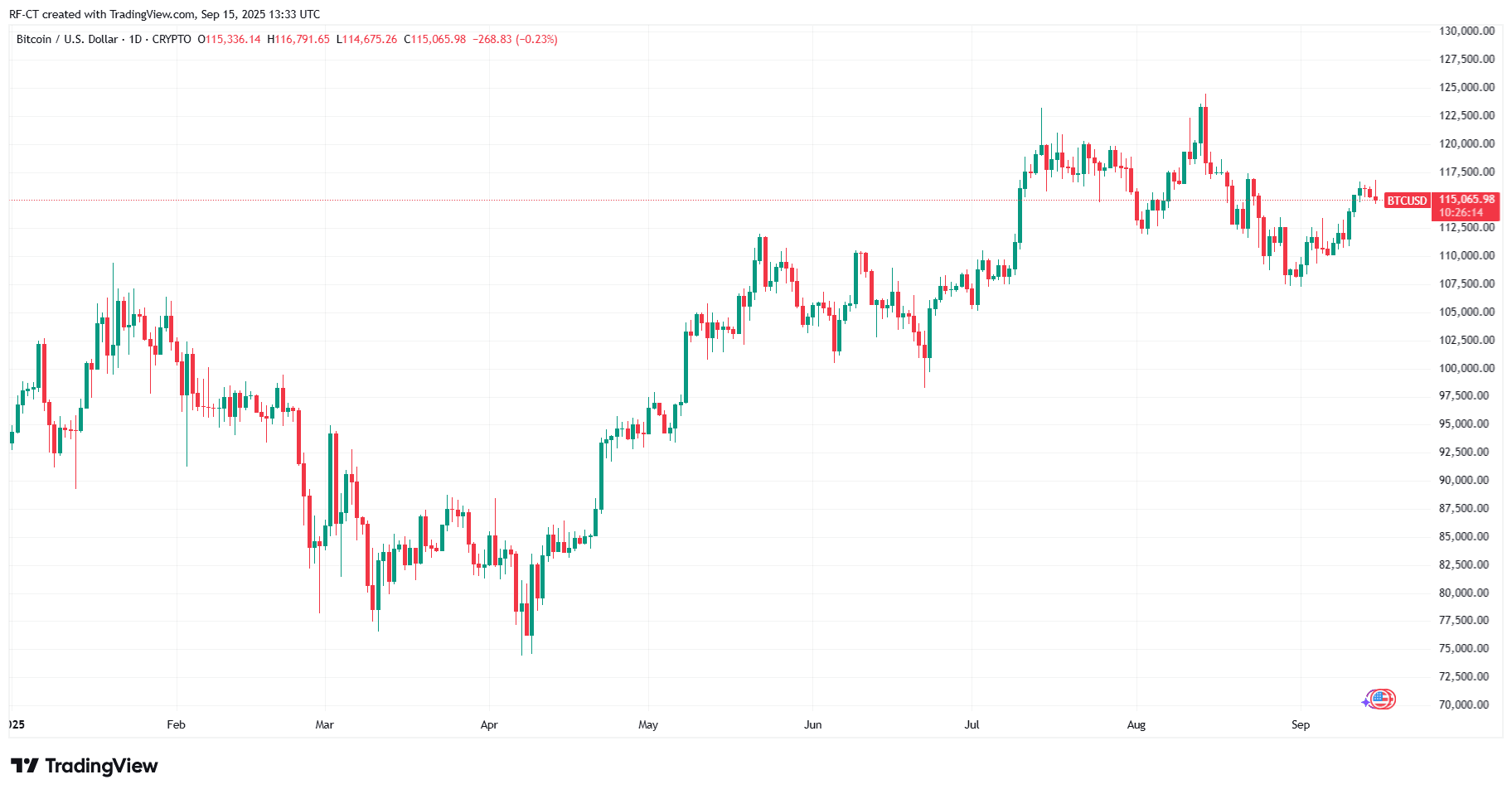

Bitcoin eyes long liquidations as gold passes $3.7K for first time

Cointelegraph·2025/09/16 21:39

Bitcoin analyst predicts 35% rally after 9th bullish RSI signal fires

Cointelegraph·2025/09/16 21:39

Flash

- 01:00Yala announces it will destroy illegally minted YU tokens on September 23On September 17, Yala released a follow-up analysis report on the September 14 attack incident. The attacker exploited a temporary deployment key used during the authorized cross-chain bridge deployment to establish an unauthorized cross-chain bridge and extract funds. The YU token once depegged to $0.2, later stabilizing at $0.94. The official statement clarified that the attack did not exploit any protocol vulnerabilities and that Bitcoin reserves were unaffected. The hacker has returned 22,287,000 YU tokens, while the remaining 7,713,000 YU have been converted into 1,635.572 ETH, of which 151.5 ETH were mixed through Tornado Cash, and 1,474.6 ETH are distributed across 146 hacker-controlled wallets. Yala announced that the illegally minted YU tokens will be destroyed on September 23, restoring the 1:1 USDC redemption ratio. Additionally, users who suffered liquidation losses due to the depegging will be compensated, and Yala has already cooperated with law enforcement agencies to track down the hacker.

- 01:00Traders increase bets: Expecting the Federal Reserve to launch a significant 50 basis point rate cut by the end of the yearJinse Finance reported that bond traders are ramping up options bets, expecting the Federal Reserve to implement at least one 50 basis point rate cut during the remaining three policy meetings this year. The market predicts that officials will make the first rate cut of 2025 on Wednesday, with a 25 basis point cut seen as the most likely outcome. However, despite persistent inflation, a cooling labor market is prompting some traders to hedge against the risk of a deteriorating economic outlook leading to more aggressive rate cuts in the coming months. This week, trading flows related to the Secured Overnight Financing Rate (SOFR) show rising demand for December options contracts—these contracts expire two days after the Fed's policy statement on December 10. SOFR is highly sensitive to Fed policy expectations. These positions will profit if the Fed implements two 50 basis point cuts or three 25 basis point cuts cumulatively at the September, October, and December meetings. These trades reflect a more dovish path than what is currently priced in by swap contracts—swap contracts are pricing in a cumulative rate cut of about 70 basis points by the December meeting.

- 00:59President of the European Commission: The Commission will soon propose the 19th round of sanctions against Russia, targeting cryptocurrencies and others.ChainCatcher News, according to market sources, European Commission President Ursula von der Leyen stated that the Commission will soon propose the 19th round of sanctions against Russia, targeting cryptocurrency, banking, and energy.