News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Quick Take Summary is AI generated, newsroom reviewed. Solana recorded $2.25 billion USDC Mint during September 2025 Institutions prefer Solana for speed, liquidity, and regulatory clarity GENIUS Act rules boost compliance trust for institutional stablecoin adoption Public companies increasingly use Solana treasuries for staking and yield Circle expands USDC Mint globally under MiCA and e-money frameworksReferences $2.25B $USDC Minted on Solana This Month

PayPal has launched peer-to-peer payments for Bitcoin and Ethereum, allowing users to send and receive cryptocurrencies directly through its platform more easily than before.

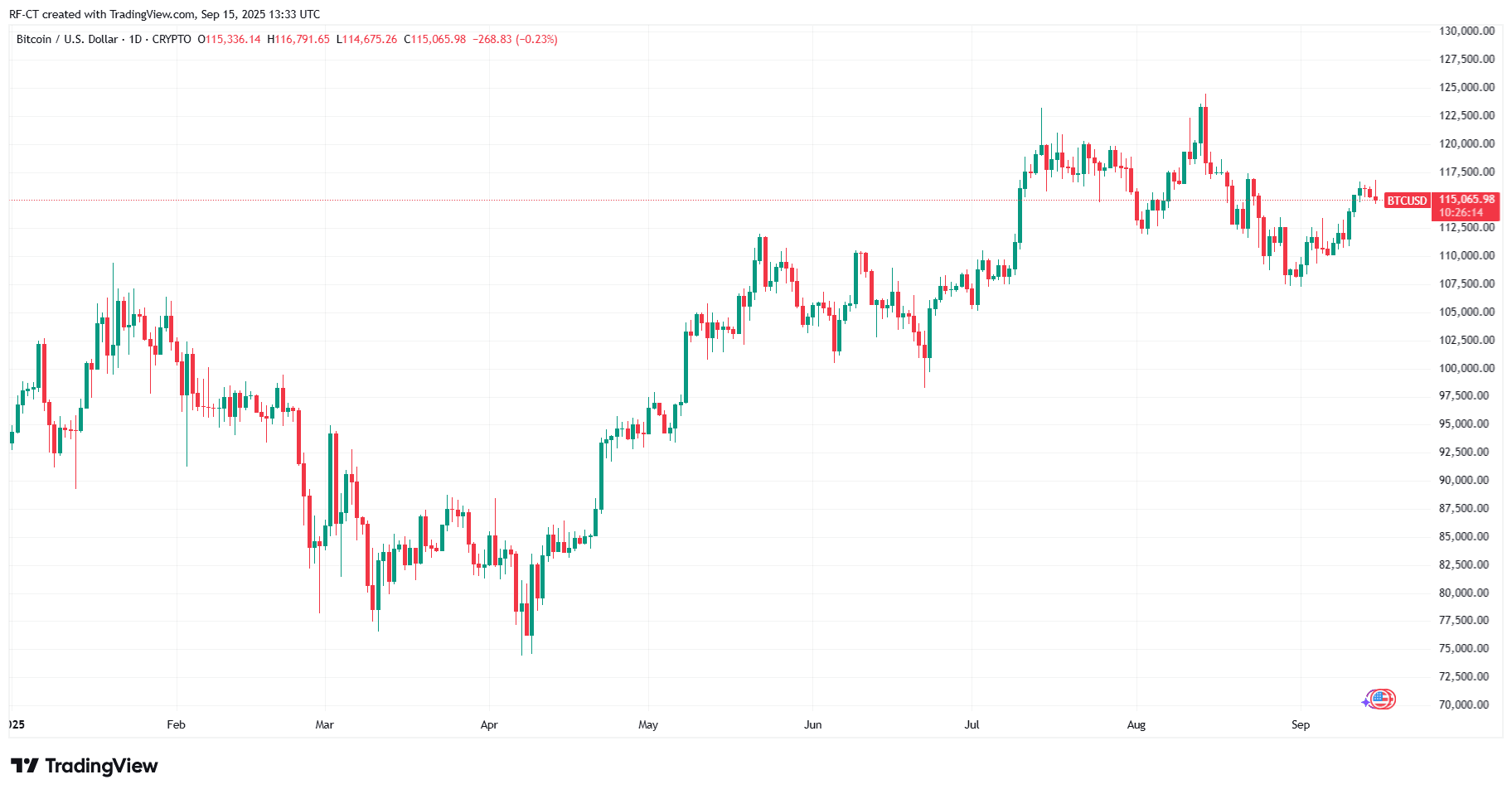

Key indicators (Hong Kong time, 16:00 on September 8 to 16:00 on September 15): BTC/USD rose by 3.8% (111,3...

If history rhymes, the next 6-12 months could be a critical window.

Sol Strategies is now responsible for packaging on-chain funds into investment products and integrating them into Nasdaq.

- 00:00Santander Bank's digital bank Openbank has now launched POL token trading services in Germany.Jinse Finance reported that Polygon announced on its social media platform that Openbank, a 100% digital bank under Grupo Santander, has launched trading services for Polygon's native token (POL) in Germany. Customers can now directly buy, sell, or hold Polygon's native token POL on the platform without the need to transfer funds to any other platform.

- 2025/09/16 23:55An address containing 1,000 BTC has been activated after 11.7 years of dormancyChainCatcher news, according to Whale Alert monitoring, about 3 hours ago, an address dormant for 11.7 years was activated, containing 1,000 BTC (approximately $117 millions).

- 2025/09/16 23:02Grayscale: US dollar credibility challenged by debt and inflation pressures, crypto assets may become alternative stores of valueJinse Finance reported that Grayscale's latest macro research report points out that the US government's commitment to maintaining low inflation is facing a credibility crisis due to high debt levels, rising interest rates, and continued deficit spending. If investors begin to doubt the stability of the US dollar as a store of value, they may turn to alternative assets such as cryptocurrencies. The report states that bitcoin and ethereum, as the core currency assets of the crypto market, have limited and transparent supply mechanisms, giving them the potential to hedge against fiat currency depreciation in the macro environment. Similar to gold, their value comes from "not being passively expanded due to government debt needs." Grayscale emphasizes that the current unsustainable growth of public debt is driving global demand for crypto assets, but if governments around the world strengthen fiscal discipline and reaffirm central bank independence in the future, it may weaken the demand for cryptocurrencies.