News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

This investment solidifies Grvt's position as a pioneer in the blueprint of global future finance and accelerates its mission to disrupt the current fragmented on-chain financial ecosystem by addressing long-standing industry challenges such as privacy vulnerabilities, security, scalability, and ease of use.

After settling on Sei, PYUSD0 will achieve sub-second finality, institutional-grade throughput, and composability in DeFi and capital markets.

The yield-bearing product offers institutional investors exposure to bitcoin with staking rewards under UK regulatory oversight

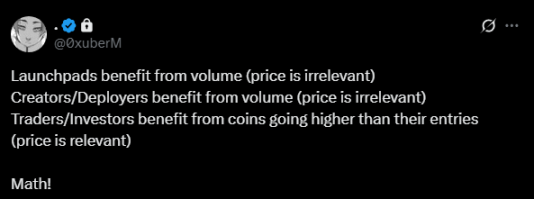

This game centered around "trading volume" and "short-term speculation" will continue to consume the chips of the "daredevil squads."

- 22:53Bloomberg Analyst: GDLC and Other New Crypto ETFs Show Strong First-Day Trading Performance, All Exceeding Market Average Trading VolumeAccording to Jinse Finance, data released by Bloomberg analyst Eric Balchunas shows that several newly approved cryptocurrency ETFs posted strong trading volumes on their first day of listing. Among them: the first basket spot crypto ETF $GDLC recorded a trading volume of $22 million; Dogecoin ETF $DOJE had a trading volume of $12 million; and Ripple ETF $XRPR reached $15 million. Analysts noted that although the first-day trading volumes of these three products were far below the record-breaking performance of previous bitcoin ETFs, they still significantly exceeded the average first-day trading volume of US ETF products, indicating a solid overall start. This performance reflects the ongoing market demand for diversified crypto asset ETF products, and issuers are expected to further expand their product matrices as a result.

- 22:08BitGo officially submits S-1 filing to the US SEC, initiates IPO processJinse Finance reported that cryptocurrency custody company BitGo has officially submitted an S-1 filing to the US SEC, initiating the IPO process. Founded in 2013, BitGo is one of the largest cryptocurrency custody companies in the United States, providing storage and protection of digital assets for its clients. BitGo intends to list on the New York Stock Exchange under the ticker symbol "BTGO." Goldman Sachs and Citigroup are the lead underwriters for this offering. According to the disclosed documents, for the years ended December 31, 2024, December 31, 2023, and December 31, 2022, BitGo's total revenues were $3.1 billions, $926.3 millions, and $2.5 billions, respectively, with net profits of $156.6 millions, $2.1 millions, and $4.6 billions, respectively. For the six months ended June 30, 2025, the company’s total revenue was $4.2 billions, with a net profit of $12.6 millions.

- 21:53Powell Damps Hopes for "Aggressive Rate Cuts," Ending U.S. Treasury’s Winning StreakBlockBeats news, on September 19, after Federal Reserve Chairman Powell dampened market expectations for a "more aggressive rate cut," U.S. Treasuries experienced their first weekly decline since mid-August. On Friday, yields on U.S. Treasuries across all maturities rose by 1 to 3 basis points, continuing the upward momentum that began after the Federal Reserve announced a 25 basis point rate cut on Wednesday. The benchmark 10-year U.S. Treasury yield edged up to 4.12%, reaching its highest level in two weeks. At the press conference following the policy decision, Powell stated that policymakers would decide future monetary policy on a "meeting-by-meeting" basis. This statement suppressed market expectations for a "rapid rate cut," although the interest rate swap market still tends to believe that the Federal Reserve will cut rates two more times this year. Amar Reganti, fixed income strategist at Hartford Funds, said: "Before this Federal Reserve meeting, the bond market was extremely optimistic, both in sentiment and positioning. The Fed did implement a rate cut, and there may be a few more in the future, but this clearly did not endorse the market's current expectations." Previously, despite inflation remaining above the Federal Reserve's target, signs of weakness in the labor market led the market to bet that policymakers would quickly lower borrowing costs, driving U.S. Treasury prices higher; however, the post-meeting sell-off ended this round of gains. (Golden Ten Data)