News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Stocks, bonds, and cryptocurrencies support each other; gold and BTC jointly back US Treasury bonds as collateral, and stablecoins support the global adoption rate of the US dollar, making the losses from deleveraging more socialized.

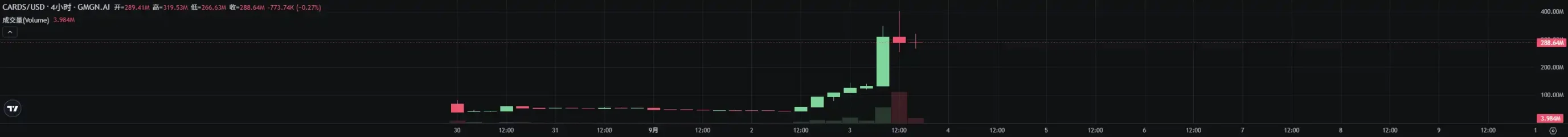

The demand is real, but it's not for the trading of Pokémon cards itself.

The U.S. August non-farm payroll report is expected to confirm that the labor market is "losing momentum" and to solidify the case for a Federal Reserve rate cut in September. However, even more striking is the upcoming revised report next week...

Is the U.S. labor market sounding a full "alarm"? The latest non-farm payroll data has once again fallen short of expectations, and most concerning is that the June employment data has been revised to show "negative growth"...

Real revenue flows to holders, and the next step is to conduct buybacks more intelligently while maintaining transparency.

The BRC2.0 led by Domo has launched. Can native Bitcoin assets become popular again?

- 16:04NEAR One CEO's X account hacked, users advised to be cautious of risksJinse Finance reported that the NEAR One CEO's X account was compromised by external parties. The account was used to post false information claiming to give away NEAR worth 1 million USD. Please do not interact with or share this fraudulent content, and remain vigilant.

- 15:51U.S. Treasury Secretary Yellen: The Federal Reserve must restore its credibility as an independent institutionJinse Finance reported that U.S. Treasury Secretary Bessent stated: In order to ensure the future and the stability of the U.S. economy, the Federal Reserve must reestablish its credibility as an independent institution. There must be an honest, independent, and nonpartisan review of the entire institution, including monetary policy, regulation, communication, staffing, and research. Looking ahead, the Federal Reserve must reduce the distortions it causes to the economy.

- 15:45A certain whale chased the rally and increased ETH holdings, resulting in a loss of approximately $10.67 million.According to Jinse Finance, on-chain analyst Yujin has monitored that a certain whale chased the rally and increased their ETH holdings at a price of $4,446 after the release of non-farm payroll data. However, as the price of ETH subsequently fell, this whale closed all 52,800 long ETH positions at a stop-loss price of approximately $4,265 about 15 minutes ago, incurring a loss of around $10.67 million. This address has maintained a long ETH strategy since the 25th of last month.