News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 15)|EDCON 2025 Ethereum Developer Conference Set to Open Soon; Major Token Unlocks Scheduled This Week; Tether Launches New USD Stablecoin for US Market2Chainlink Could See Further Gains After SBI Partnership, Bitwise ETF Filing and Large Exchange Outflows3Ethereum Co-Founder Says AI-Led Governance Could Be Exploited, Urges Info-Finance Oversight

Symbiotic, Chainlink, and Lombard launch industry-first layer for cross-chain Bitcoin transfers

Cryptobriefing·2025/09/15 22:33

Brazil Explores Bitcoin Reserve with Parliamentary Hearing

Theccpress·2025/09/15 22:03

Brazil Considers National Bitcoin Reserve Proposal

Theccpress·2025/09/15 22:03

Bitcoin price drop to $113K might be the last big discount before new highs: Here’s why

Cointelegraph·2025/09/15 21:45

Trump Predicts a "Significant Rate Cut" by the Federal Reserve!

AICoin·2025/09/15 21:08

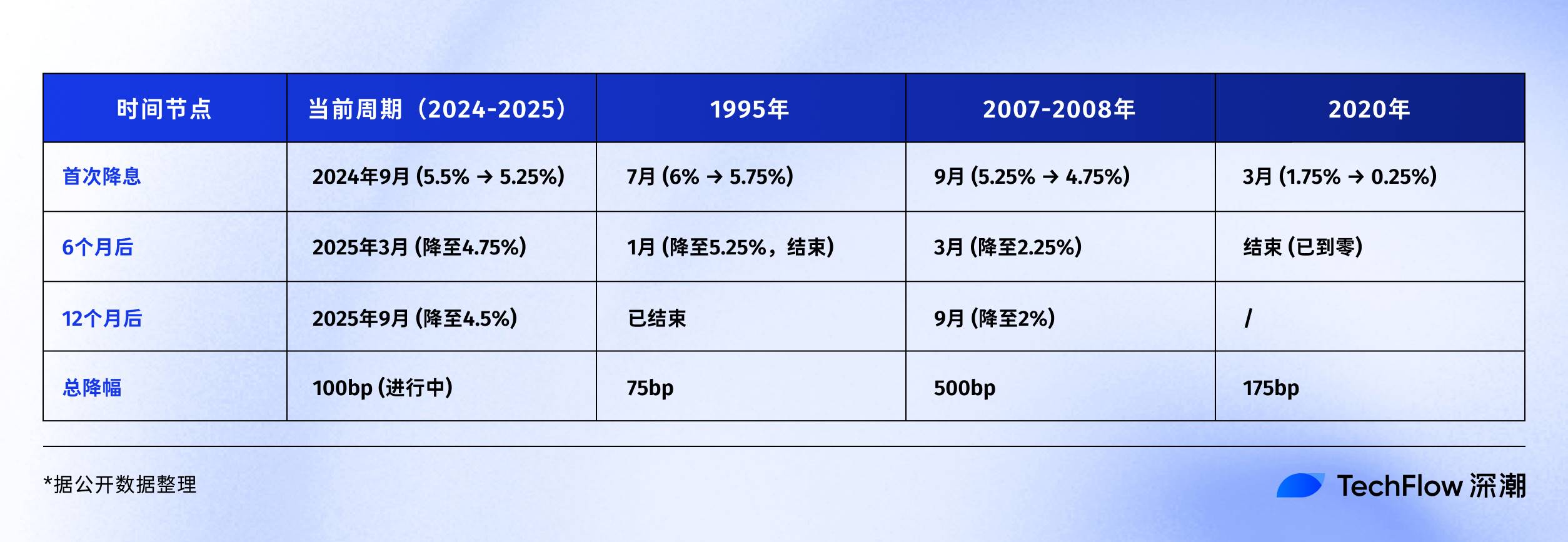

Reviewing the Fed's rate-cutting cycle: What’s next for Bitcoin, the stock market, and gold?

If history rhymes, the next 6-12 months could be a critical window.

深潮·2025/09/15 20:59

Will Tesla and xAI merge? Hedge fund tycoon: It feels inevitable

Positive remarks from SkyBridge Capital founder Anthony Scaramucci have further fueled expectations of a possible merger between Tesla and xAI.

ForesightNews·2025/09/15 20:43

Capital B Expands Bitcoin Holdings to 2,249 BTC, Yield Hits 1,536%

coinfomania·2025/09/15 20:12

Bitcoin Inflows Hit $625B in 1.5 Years, Surpassing Prior 15 Years

coinfomania·2025/09/15 20:12

Starknet BTC Staking Brings Bitcoin Into DeFi Innovation

coinfomania·2025/09/15 20:12

Flash

- 22:44Michigan officials: No evidence that Federal Reserve Governor Cook violated primary residence disclosure regulationsJinse Finance reported, citing foreign media, that the property tax authority in Ann Arbor, Michigan, stated that Federal Reserve Governor Lisa Cook did not violate regulations when applying for a property tax exemption for her primary residence. This finding may strengthen Cook’s defense against the Trump administration’s efforts to remove her from the Federal Reserve Board. Jerry Markey, the assessor for Ann Arbor, said there is “no reason to believe” that Cook violated property tax rules. Cook does occasionally reside elsewhere, and municipal records show she has applied to Ann Arbor authorities for permission to rent out her Michigan residence on a short-term basis. The official stated that temporarily leaving the residence or renting it out short-term does not disqualify Cook from the Ann Arbor property tax exemption. Markey said, “Temporarily residing elsewhere does not necessarily cause a homeowner to lose eligibility for the primary residence exemption.”

- 22:30Deutsche Bank: Investors Are Reducing Dollar Exposure at a Record PaceJinse Finance reported that Deutsche Bank's analysis of ETFs shows that overseas investors are significantly reducing their US dollar exposure at an "unprecedented pace" when purchasing US stocks and bonds with currency hedging. George Saravelos, the bank's Global Head of FX Research, cited data from over 500 funds, noting that for the first time in a decade, the capital inflows into US dollar-hedged ETFs for US assets have surpassed those into non-hedged funds. According to Saravelos, this hedging behavior explains why the US dollar has remained weak even as international investors have returned to US assets after Trump's tariff policies disrupted markets earlier this year. At that time, the market speculated that trade war risks might dampen investor interest in US stocks, bonds, and the US dollar itself. Saravelos wrote: "The implication at the FX level is clear: foreign investors may have returned to the US asset market (albeit at a slower pace), but they do not want to take on the accompanying US dollar exposure. For every purchase of an asset hedged against US dollar risk, an equivalent amount of currency is sold to eliminate FX risk."

- 22:14US lawmakers and crypto executives including Michael Saylor push for establishing a US strategic Bitcoin reserveJinse Finance reported that more than ten crypto industry leaders, including Strategy co-founder Michael Saylor and Marathon Digital Holdings CEO Fred Thiel, will hold a roundtable meeting with Senator Cynthia Lummis and Congressman Nick Begich on Capitol Hill in Washington to promote the "Strategic Bitcoin Reserve" legislation. This proposal, reintroduced by Lummis in March this year as the "BITCOIN Act," plans to acquire 1 million bitcoins over five years through a "budget-neutral strategy" and establish it as a U.S. strategic reserve asset. The bill is an expansion of an executive order by President Trump, which required the government to permanently hold bitcoin, prohibited its sale, and mandated that confiscated crypto assets be deposited into an independent reserve. Currently, the bill has been submitted to the House Financial Services Committee and the Senate Banking Committee, but a hearing has not yet been scheduled. This move follows Congress's passage of the first stablecoin regulatory bill and marks a shift by lawmakers toward broader crypto industry regulation. Industry organizations such as DPN (Digital Power Network) have stated they will ensure that the strategic bitcoin reserve becomes a priority in Washington.