News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

SEC Opens Public Consultation on Crypto Trading Rules

Cryptotale·2025/12/18 07:45

Is the DA war coming to an end? Deconstructing PeerDAS: How can it help Ethereum reclaim "data sovereignty"?

Odaily星球日报·2025/12/18 07:14

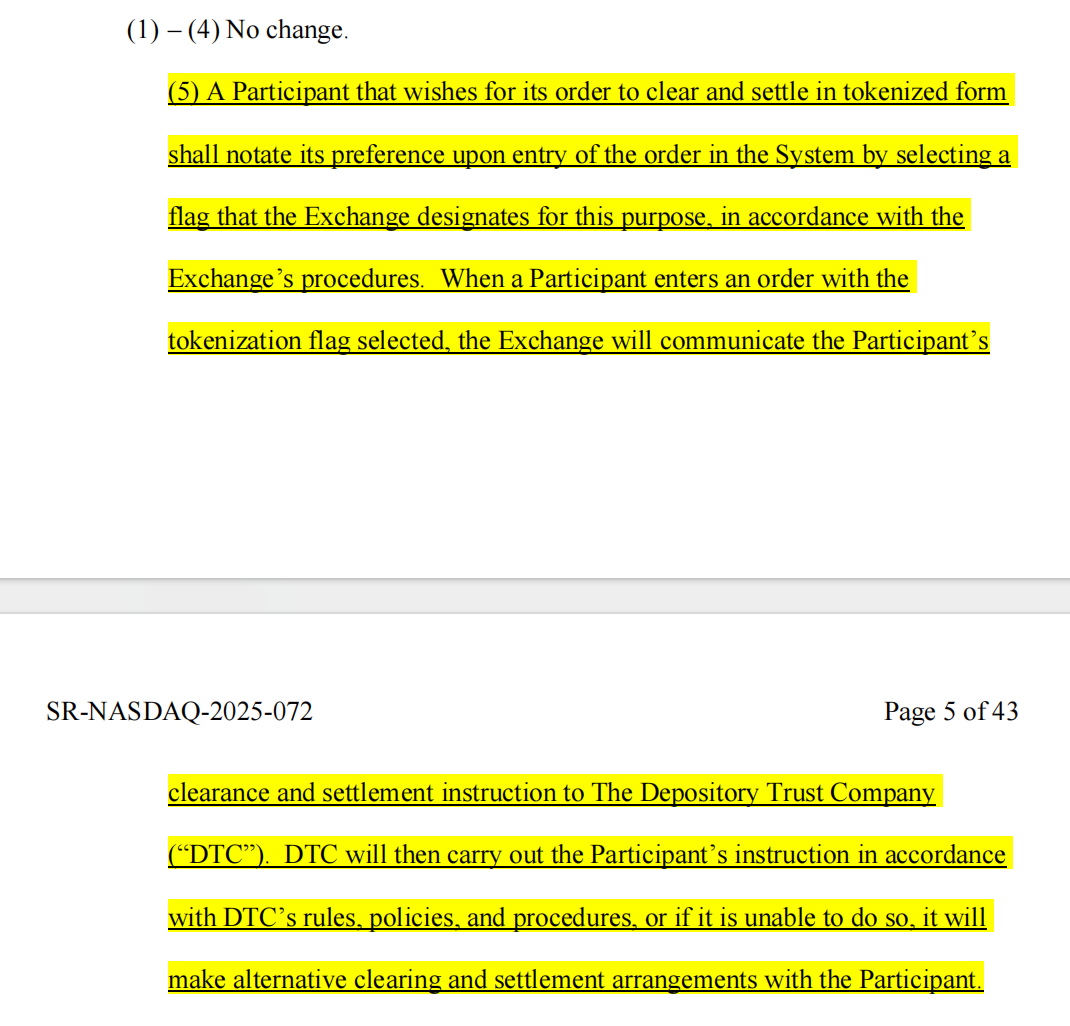

Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

Odaily星球日报·2025/12/18 07:14

Why did the "Insider King" fall into his own trap on October 11?

AIcoin·2025/12/18 07:07

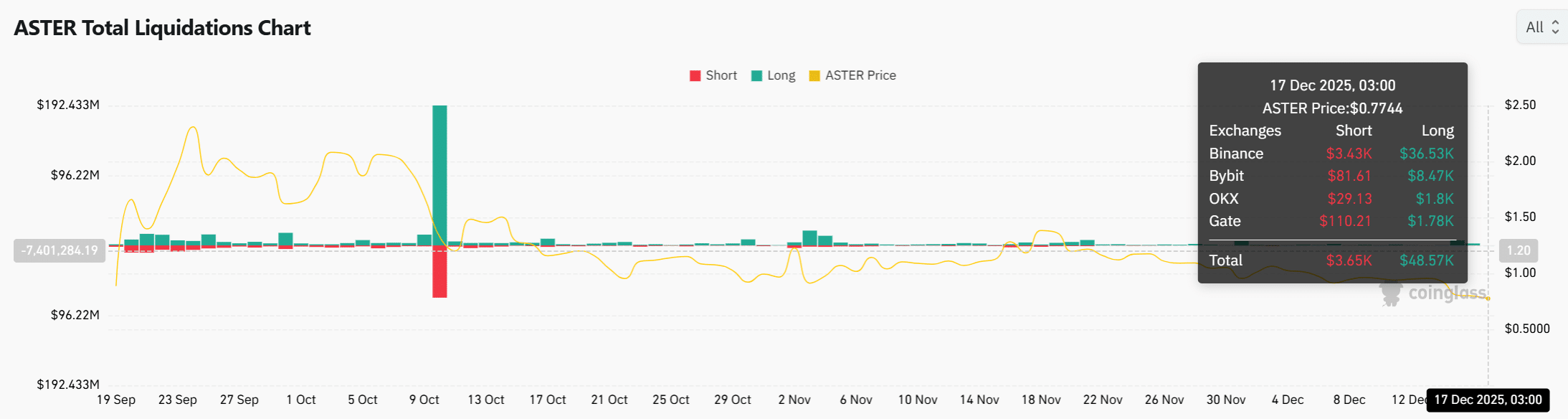

ASTER price sinks as whale losses deepen – Is $0.6 next?

AMBCrypto·2025/12/18 07:03

Dark Defender: Narrative Will Continue to Shift In Favor of XRP. Here’s why

TimesTabloid·2025/12/18 07:03

Revealing the Edge: Longs Hold Slight 50.57% Lead in BTC Perpetual Futures

Bitcoinworld·2025/12/18 06:42

MSCI Crypto Delisting: The Alarming $15 Billion Threat to Bitcoin Markets

Bitcoinworld·2025/12/18 06:27

Bitcoin's Price Ceiling Tightens as Loss-Holders Sell

Decrypt·2025/12/18 06:09

Caroline Ellison Shifted to Community Custody Before 2026

Cryptotale·2025/12/18 06:06

Flash

07:49

CryptoQuant Analyst: Bitcoin Price Has Fallen Below the Short-Term Holder Cost BasisBlockBeats News, December 18, CryptoQuant analyst @AxelAdlerJr posted that the bitcoin price has fallen below the average purchase price of short-term holders (i.e., the STH-SOPR (30D) shown in the chart has dropped to 0.98). Two on-chain indicators show that the selling pressure from new market participants is increasing. The SOPR 30D indicator measures the average token sales of short-term holders: a value above 1 indicates profitable sales, while a value below 1 indicates sales at a loss. The chart shows that the 30-day SOPR moving average has dropped to the 0.98 area, which means that, on average, short-term holders are selling tokens at a loss. A further decline in this indicator will intensify selling pressure and lead to new local lows. Currently, there is a strong risk-averse sentiment in the market for short-term positions. Key reversal confirmation signals: price rebounds above the STH realized price and SOPR rises above 1.

07:48

SlowMist Cosine: Two trading platforms found to have serious vulnerabilities SlowMist's Cosine posted that the SlowMist team discovered serious vulnerabilities in two trading platforms (directly affecting fund security), could not contact anyone, and received no response from public contacts. One of these trading platforms has a 24-hour trading volume of 3.7 billion USD, and the other 240 million USD.

07:43

T. Rowe Price: The Bank of Japan may raise interest rates more aggressively than the market expectsAccording to TechFlow, on December 18, as reported by Golden Ten Data, Vincent Chung, multi-portfolio manager at T. Rowe Price, stated that the Bank of Japan may raise interest rates more aggressively than the market expects. Japan's economic performance is slightly better than generally anticipated, although some slowdown is evident. Importantly, inflation remains persistent, and we continue to see upward pressure on wages. Recently, the market shifted its expectation for the Bank of Japan's next rate hike from January to this month. Current market pricing suggests that only one rate hike is expected in 2026. T. Rowe Price believes there may be two rate hikes next year.

News