News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 15)|EDCON 2025 Ethereum Developer Conference Set to Open Soon; Major Token Unlocks Scheduled This Week; Tether Launches New USD Stablecoin for US Market2Chainlink Could See Further Gains After SBI Partnership, Bitwise ETF Filing and Large Exchange Outflows3Ethereum Co-Founder Says AI-Led Governance Could Be Exploited, Urges Info-Finance Oversight

“Bitcoin Is Topping Out Ahead of Fed Rate Cut”, Says Peter Schiff

CryptoNewsNet·2025/09/15 10:09

PUMP Price Prediction 2025: Can Pump.fun’s Buyback Push It Past 1 Cent?

CryptoNewsNet·2025/09/15 10:09

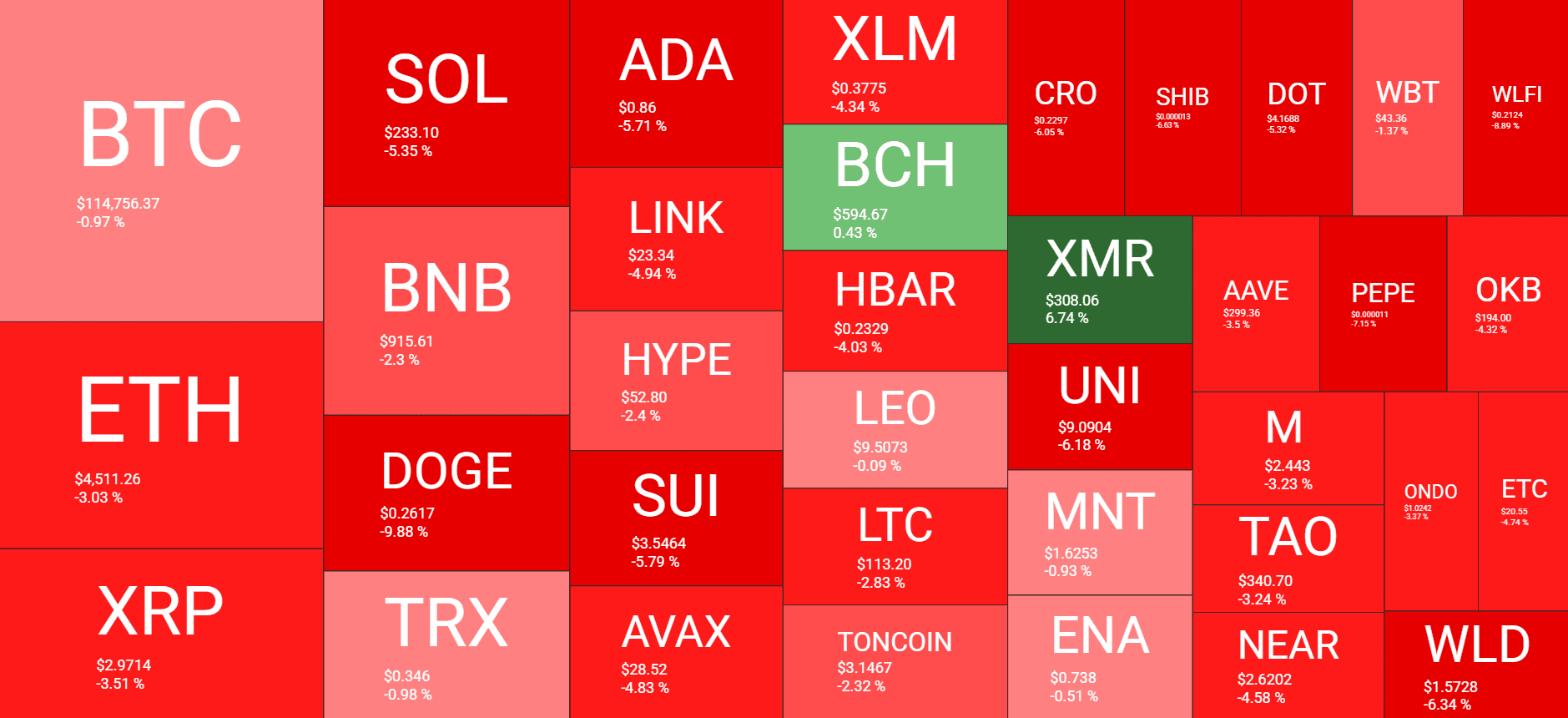

DOGE Plunges by Double Digits Daily as BTC Price Slides Below $115K: Market Watch

CryptoNewsNet·2025/09/15 10:09

Here's What History Says Will Happen a Month and Year After the Fed's Rate Cut

CryptoNewsNet·2025/09/15 10:09

Bitcoin Cohorts Return to Net Selling as Market Continues to Consolidate

CryptoNewsNet·2025/09/15 10:09

STRK price soars 7% as Starknet officially starts Bitcoin staking integration

Coinjournal·2025/09/15 10:06

$17.5B In Cat Bonds At risk After ESMA Warning

Cointribune·2025/09/15 10:03

PUMP reaches a historic record with over 1 billion volume in 24h

Cointribune·2025/09/15 10:03

Crypto : Shibarium Bridge victim of a 2.4 million $ flash loan attack

Cointribune·2025/09/15 10:03

Flash

- 09:54QCP: BTC ETF sees large inflows for five consecutive days, altcoin market cap hits 90-day highChainCatcher News, QCP released a market report stating that the cryptocurrency market has returned to normal after the volatility triggered by last week's CPI data. Although the data showed that tariffs caused some inflationary pressure, there were no major surprises, providing a green light for risk assets. Institutional capital inflows have significantly strengthened: BTC spot ETFs have recorded large inflows for five consecutive days, and after the SEC postponed its decision on the ETH staking ETF, ETH saw its largest single-day inflow in two weeks on Friday. Despite the postponement of ETF decisions, both XRP and SOL rose, with the market viewing the delay as inevitable rather than a rejection. As BTC consolidates within its range, the altcoin market has performed impressively: CMC's Altcoin Season Index has reached 72, and the total market capitalization of altcoins has reached $1.73 trillion, both the highest levels in 90 days. BTC has recovered from the September low of 107k, but is still fluctuating within a range. Market participants believe that with digital asset supporter Paul Atkins serving as SEC Chairman, traders seem to be accumulating high-beta cryptocurrencies in anticipation of what they see as the inevitable approval.

- 09:54Societe Generale and Standard Chartered predict the Federal Reserve will cut interest rates by 50 basis pointsAccording to ChainCatcher, citing Golden Ten Data, analysts at Société Générale believe that the Federal Reserve's moderately restrictive stance has been maintained for too long, resulting in an "over-tightening" situation. Therefore, a more substantial policy adjustment is necessary, specifically a 50 basis point rate cut. Standard Chartered is also the only institution predicting that the Federal Reserve will cut rates by 50 basis points this week. Currently, the market generally expects a 25 basis point rate cut, and traders believe the probability of a 50 basis point cut is only about 4%.

- 09:44pump.fun's market share among Solana-based token launch platforms rises to 90.6%BlockBeats News, on September 15, according to Jupiter data panel, in the ranking of Solana token issuance platform market share over the past 24 hours, pump.fun ranked first with 90.6%, Letsbonk ranked second with 5.18%, and Believe ranked third with 1.66%.