News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 16)|Crypto market sees $508 million in long liquidations over 24 hours; Hassett faces opposition from Trump-aligned senior figures in Fed chair contest2Bitget US Stock Morning Report | US Stocks Fluctuate and Retreat, Tesla Hits New High for the Year, Fed Shows Strong Economic Confidence, Non-farm Payrolls to be Released Tonight, Commodity Prices Fluctuate Violently3Bitcoin sees ‘pure manipulation’ as US sell-off liquidates $200M in an hour

ZKP Crypto’s First Proof Pod Delivery Sparks Interest in Its $300/Day Model While DOGE and DOT Flatten Out

BlockchainReporter·2025/12/16 12:01

Massive BlackRock ETH Deposit: A $140 Million Vote of Confidence in Ethereum’s Future

Bitcoinworld·2025/12/16 12:00

Solana Weathers Massive 6 Tbps DDoS Attack With Zero Downtime, Co-Founder Says

Coinspeaker·2025/12/16 11:39

Analyst: XRP Is Repeating a Pattern I’ve Only Seen Once Before

·2025/12/16 11:33

Stunning Prediction: Bitcoin All-Time High Inevitable for 2025 as 4-Year Cycle Shatters

Bitcoinworld·2025/12/16 11:27

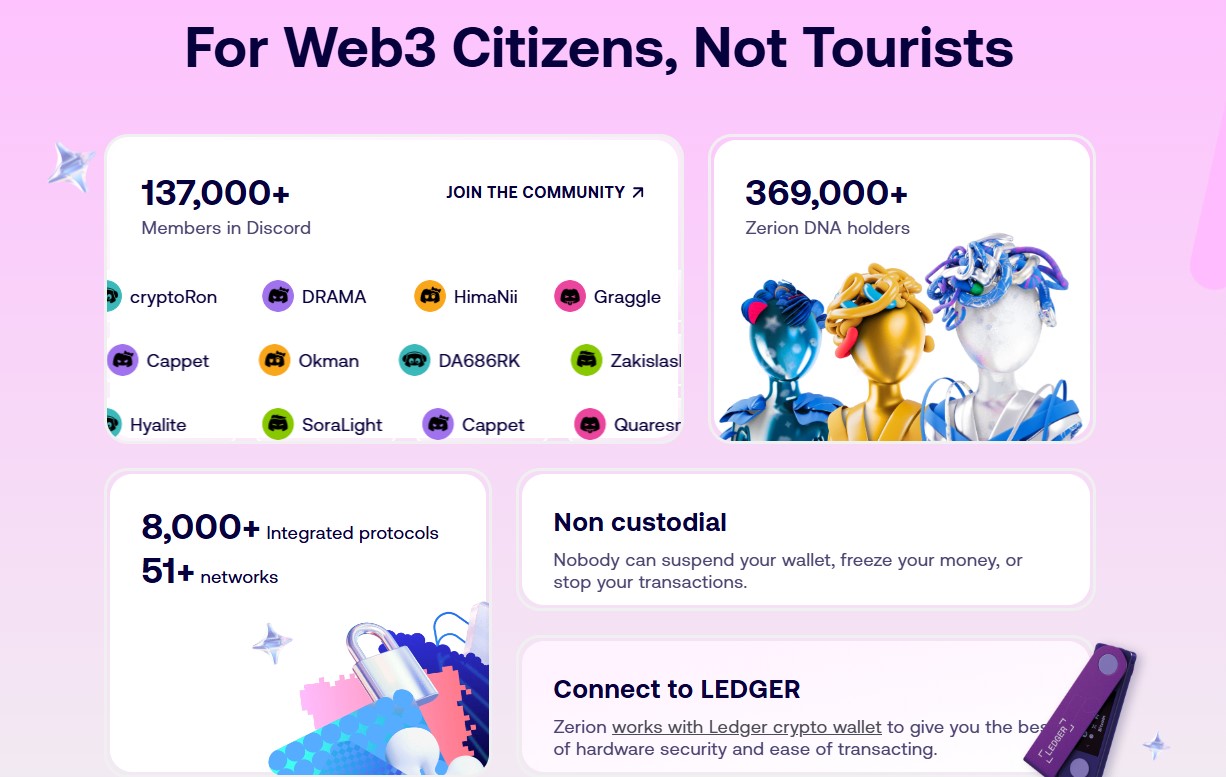

Zerion wallet feed launches early access today: Is a token launch imminent?

币界网·2025/12/16 11:23

Pi Network stock price consolidates as analysts closely watch the next move

币界网·2025/12/16 11:15

StraitsX Stablecoins Unleash Power: XSGD and XUSD Launch on Solana’s Blazing Network in 2025

Bitcoinworld·2025/12/16 11:12

Flash

- 12:02Wall Street's renowned bearish investor has a bearish view on the 2026 market and anticipates that the Federal Reserve will speed up interest rate cuts.BlockBeats News, December 16th, Wall Street's renowned short seller Peter Berezin-led market research firm BCA Research released its latest report "Return of Nasdog," providing a cautious outlook on the future market. The core viewpoint is that the artificial intelligence boom will come to an end, and at the same time, U.S. economic activity will significantly slow down. BCA Research stated that the issue of overinvestment in the field of artificial intelligence should have been apparent long ago. By 2025, the proportion of U.S. investment in technology and software as a percentage of GDP will reach 4.4%, approaching the level of the Internet bubble era. Considering that the annual depreciation rate of artificial intelligence assets is usually around 20%, this means that tech giants will bear $400 billion in depreciation costs each year, an amount that even exceeds their total profits in 2025. BCA Research also mentioned that the expected price-to-earnings ratio of the S&P 500 Index in early 2026 will reach a high of 22.6 times, much higher than the historical median of 18 times. The already fragile stock market will find it even harder to sustain under the impact of the collapse of the optimistic narrative surrounding artificial intelligence. BCA Research predicts that "by the second half of 2026, almost all sectors of the U.S. stock market will collapse." However, this will also prompt the Federal Reserve to accelerate its interest rate cuts in the second half of 2026. By the end of 2026, the federal funds rate will drop to 2.25%, and the 10-year U.S. Treasury yield will fall to 3.1%.

- 11:56Visa to Enable U.S. Institutions to Settle Transactions in USDC via SolanaBlockBeats News, December 16th, today Visa announced that it will allow US institutions to use the USDC stablecoin for transaction settlement on the Solana blockchain. Cross River Bank and Lead Bank are among the first banks to use this service. Visa, as a design partner of Circle's Arc blockchain, will also support it once the Arc network is launched.

- 11:54Jefferies data: S&P 500 component earnings growth may accelerate year by year until the end of 2027According to data compiled by Jefferies, the bottom-up target prices aggregated by sell-side analysts indicate that the earnings growth of S&P 500 constituent companies will accelerate year by year until the end of 2027. Over the next three years, earnings are expected to achieve double-digit growth consecutively, a scenario that historically coincides with above-average returns for the S&P 500 index. Despite concerns about excessive market concentration and overvaluation, strong corporate earnings—the key pillar supporting the three-year bull market in equities—remain solid.

News