News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

Revealed: The $88.3M Bitmain Wallet Ethereum Acquisition That Signals Major Crypto Moves

Bitcoinworld·2025/12/18 15:48

Former Pump.fun Dev Sentenced to Six Years in Prison for $2 Million Solana Fraud

Decrypt·2025/12/18 15:34

Intuit taps Circle’s USDC to add stablecoin payments across TurboTax and QuickBooks

The Block·2025/12/18 15:33

Best Meme Coins to Buy: DeepSnitch AI Surges 85% as Investors Expect T1 CEX Listings in January

BlockchainReporter·2025/12/18 15:21

Crypto market sideways as bitcoin altcoins underperform in a volatile week

Cryptonomist·2025/12/18 15:18

Price Compression And Support Tests For XRP Today In A Bearish Higher Timeframe Trend

Cryptonomist·2025/12/18 15:15

Intraday buyers emerge as Solana news highlights SOLUSDT under pressure below key averages

Cryptonomist·2025/12/18 15:15

Canary Capital Files for Staked Injective ETF, Will INJ Price Recover From 30% Monthly Drop?

Coinspeaker·2025/12/18 15:09

Trump Media is merging with fusion power company TAE Technologies in $6B+ deal

TechCrunch·2025/12/18 15:09

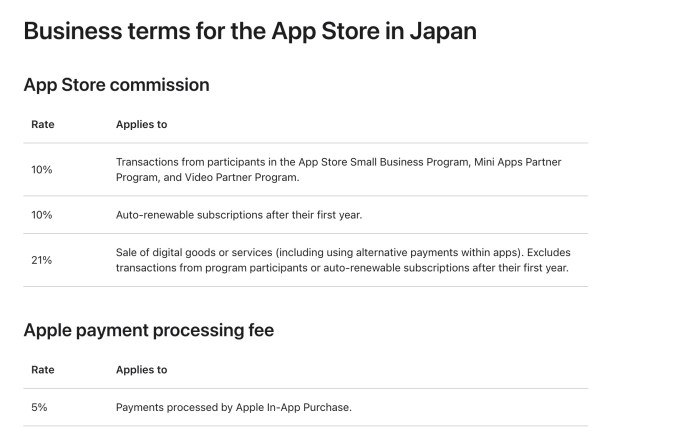

Apple opens up its App Store to competition in Japan

TechCrunch·2025/12/18 15:09

Flash

15:59

NEAR token has been simultaneously issued on the Solana networkBlockBeats News, on December 18, Solana officially announced that NEAR tokens have now been simultaneously issued on the Solana network.

15:58

NEAR Token has been cross-chain issued on the Solana networkBlockBeats News, December 18, the Solana team announced that the NEAR token has now been cross-chain issued on the Solana network.

15:50

Ondo partners with LayerZero to launch Ondo Bridge, initially supporting Ethereum and BNB ChainForesight News reported that Ondo and LayerZero have launched Ondo Bridge, which is now live on Ethereum and BNB Chain, and will soon support more EVM chains. Users can transfer over 100 Ondo tokenized exchange stocks and ETFs across chains. Any protocol, wallet, or application integrated with LayerZero can add Ondo tokenized exchange stocks and ETFs.

News