News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 24)|Ethereum achieves real-time L1 block proof; Solmate surges 40% after $300M financing; Stable’s $825M pre-deposit raises insider concerns2Bitcoin falls below $115,000—is this a delayed reaction to the sale of 80,000 BTC?3Research Report|In-Depth Analysis and Market Cap of aPriori (APR)

Standard Chartered Forecasts Bullish Bitcoin Future Despite Trade Tensions

Theccpress·2025/10/24 15:09

BlackRock Acquires 1,884 Bitcoin for Its ETF

Theccpress·2025/10/24 15:09

Dogecoin price chart projects 25% gains, but first, this must happen

Cointelegraph·2025/10/24 14:36

AI gives retail investors a way out of the diversification trap

Cointelegraph·2025/10/24 14:36

Can Ethereum reclaim $4K? ‘Smart trader’ whale raises ETH long to $131M

Cointelegraph·2025/10/24 14:36

Western inscriptions debut? x402 gold rush floods into PING

PING currently has a market capitalization of over $30 million, with a 24-hour trading volume exceeding $20 million.

ForesightNews 速递·2025/10/24 14:32

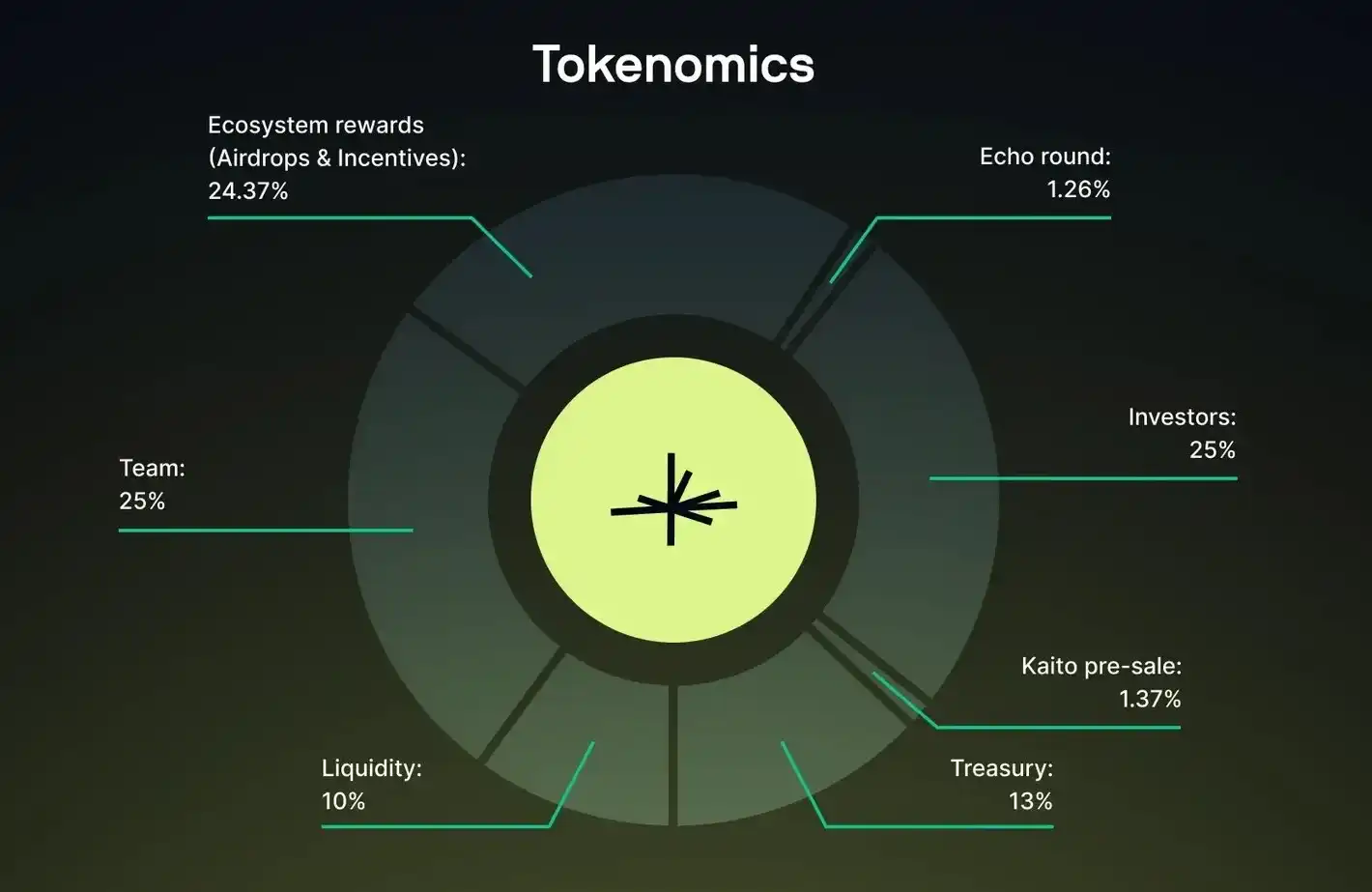

Will MegaETH, with a pre-market value of 5 billions and using an English auction, deliver excess returns?

Polymarket predicts that there is an 89% chance that MEGA will have a trading price exceeding a $2 billions FDV within 24 hours of issuance, and a 50% chance of exceeding a $4 billions FDV.

ForesightNews 速递·2025/10/24 14:31

Ethereum Faces Heavy Selling | Long-Term Trend Still Bullish

TheCryptoUpdates·2025/10/24 13:33

Exclusive Interview with Brevis CEO Michael: zkVM Scaling Is Far More Effective Than L2

The infinite computing layer leads the way for real-world applications.

BlockBeats·2025/10/24 12:44

Limitless surprise TGE: Secret launch to avoid sniping, but unavoidable market doubts

The secretive launch did allow Limitless to avoid technical sniping, but it also made it more difficult for outsiders to trace the early flow of funds.

BlockBeats·2025/10/24 12:43

Flash

- 16:04Bloomberg: TeraWulf's $3.2 billion bond issuance makes it the first crypto mining company to raise funds in the high-yield marketForesight News reported, citing Bloomberg, that TeraWulf has become the first cryptocurrency mining company to raise funds in the high-yield market through a $3.2 billion junk bond issuance. This transaction marks the largest junk bond deal led by Morgan Stanley since the famous 1989 leveraged buyout of RJR Nabisco. The deal attracted over $11 billion in orders, thanks to a "backstop" guarantee provided by Google, a subsidiary of Alphabet Inc. This guarantee will take effect once the data center is operational and leased by the UK startup Fluidstack. According to sources, to ease concerns about unfinished infrastructure, about a week before the transaction launched, TeraWulf's senior management hosted nearly 40 potential investors at a site near Buffalo, New York, for more than three hours of Q&A. In addition, creditors will receive a 7.75% yield, significantly higher than the 5.7% average yield for bonds with similar ratings, which also contributed to the success of the deal. According to sources, cryptocurrency miner Cipher Mining Inc. is the next target and is expected to issue several billions of dollars in junk bonds, which will also be backed by Google. Morgan Stanley is charging substantial fees for its role. The investment bank advised on TeraWulf's convertible bond deal in August and is now working with Cipher to issue similar bonds.

- 16:04pump.fun acquires trading terminal Padre; PADRE token will no longer be used on the platformForesight News reported that pump.fun has announced the acquisition of the multi-chain trading terminal Padre, with the acquisition amount undisclosed. Padre will continue to operate as usual, including token trading on each launchpad and decentralized exchange on Solana, BNB Chain, Ethereum L1, and Base. The PADRE token will no longer be used on the platform, and there are no further future plans. pump.fun stated that this acquisition will upgrade the pump.fun user experience.

- 16:03Resupply has initiated a proposal in the Curve community to mint 5 million crvUSD for supplying to the sreUSD Llamalend market.Foresight News: The lending protocol Resupply, based on Llamalend, has initiated a new proposal in the Curve community, suggesting the minting of 5 million crvUSD to be directly supplied to the sreUSD Llamalend market. The proposal aims to strengthen the overall supply system by improving the dynamics between reUSD, sreUSD, and crvUSD. DAO voting is currently underway, with about two days remaining for the vote.