News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

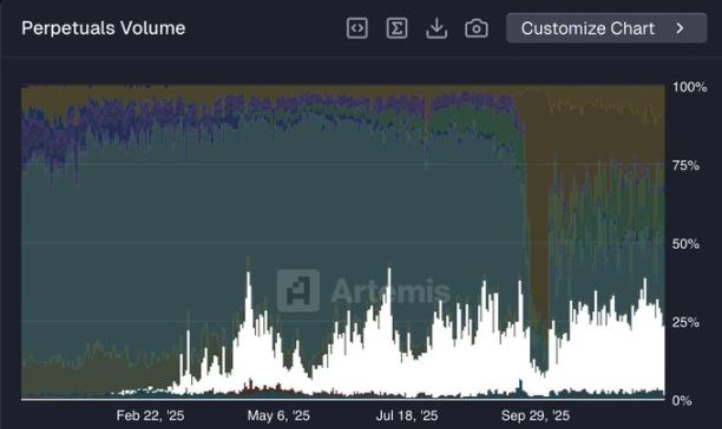

With its market share plummeting by 60%, can Hyperliquid make a comeback?

AIcoin·2025/12/17 09:13

Russia Rules Out Bitcoin Payments "Under Any Circumstances"

币界网·2025/12/17 09:05

Odaily Editorial Tea Talk (December 17)

Odaily星球日报·2025/12/17 09:04

Bitcoin Christmas Rally: By the end of 2025, will "Santa Claus" deliver gifts on time?

AIcoin·2025/12/17 09:02

EtherFi Joins ETHGas Marketplace to Enable Gasless Ethereum Transactions and Boost Validator Economics

BlockchainReporter·2025/12/17 09:00

Flash

- 09:29Japan Bids Farewell to 30 Years of Ultra-Low Interest Rates as Market Expects 25 Basis Point Rate Hike on FridayAccording to the Bank of Japan, the probability of a "25 basis points rate hike in December" has reached as high as 98%. If the rate hike occurs as scheduled on Friday, December 19, Japan's benchmark interest rate will rise from 0.50% to 0.75%, marking the highest level since 1995 and signifying Japan's official farewell to the ultra-low interest rate era that has lasted for 30 years.Currently, both authoritative institutional polls and underlying economic data show a "universal consensus": a Bloomberg survey indicates that all respondents predict a rate hike to 0.75% this week, while Reuters also shows that over 90% of experts hold the same view.On the other hand, regarding the "Bank of Japan's January rate decision," the probability of "no change" is currently the highest, remaining above 90%.

- 09:28Barron's: US jobs data did not significantly change expectations of an interest rate cut, putting pressure on Bitcoin and causing it to fall.Barron's Weekly pointed out that due to the latest US employment data failing to significantly change the market's expectations for future Federal Reserve rate cuts, Bitcoin prices faced downward pressure, reflecting that macro employment indicators still have a significant impact on the short-term trends of digital assets. The current "mixed" signals from employment data have not driven stronger expectations for rate easing, thereby putting pressure on Bitcoin and other crypto assets.

- 09:28Amazon shares rise over 1% in pre-market tradingJinse Finance reported that a certain exchange's US stock price rose by more than 1% in pre-market trading. It is reported that the company is in talks to invest over $10 billion in OpenAI and provide its self-developed chips.

News