News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

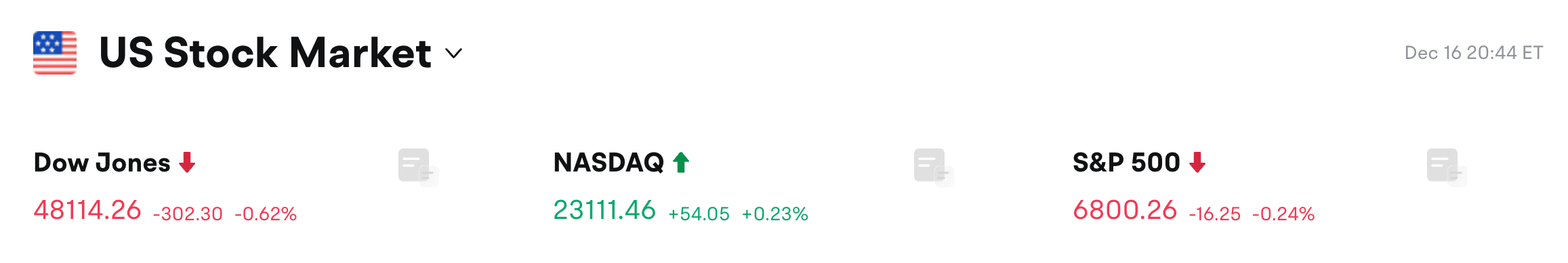

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

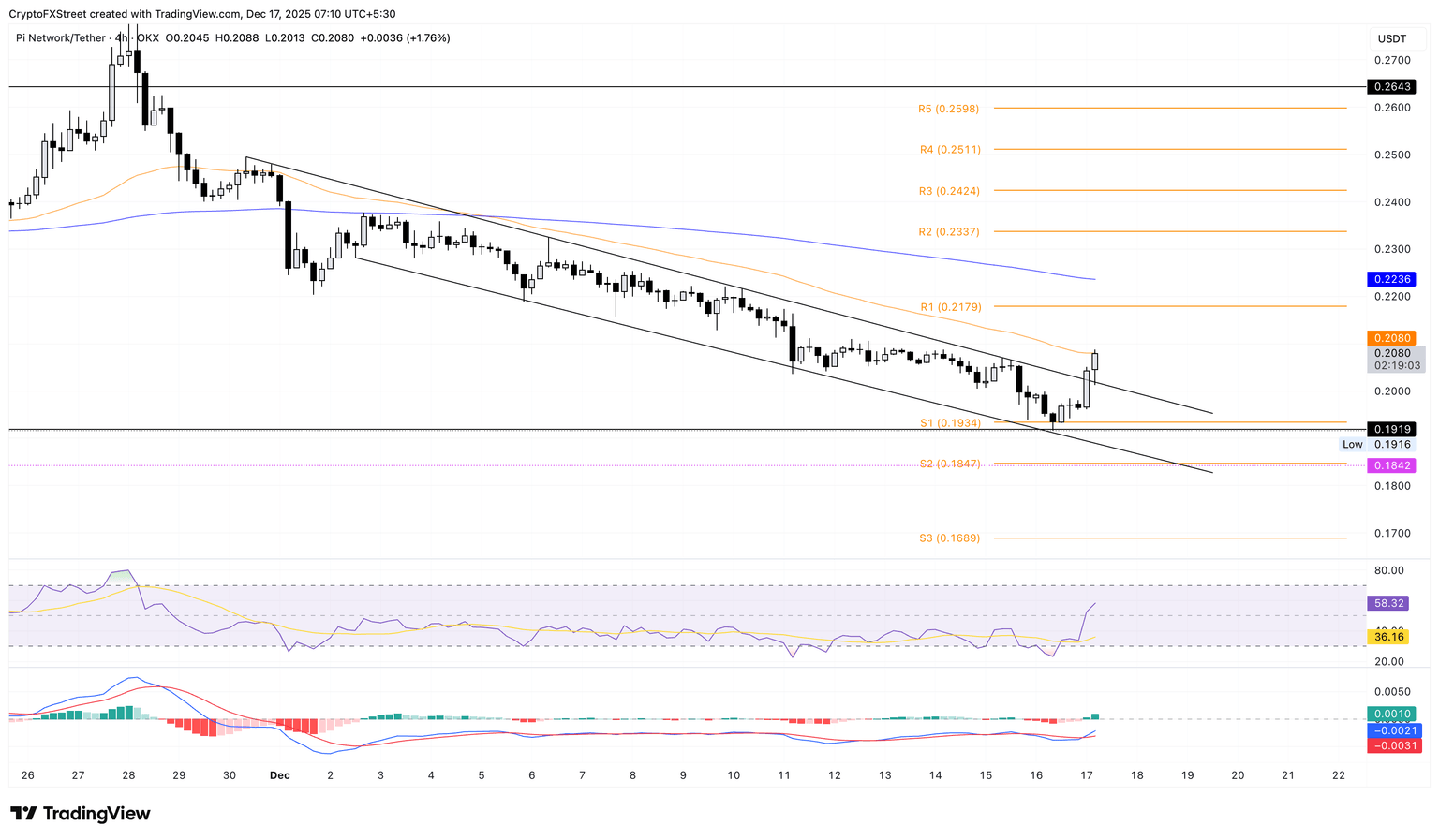

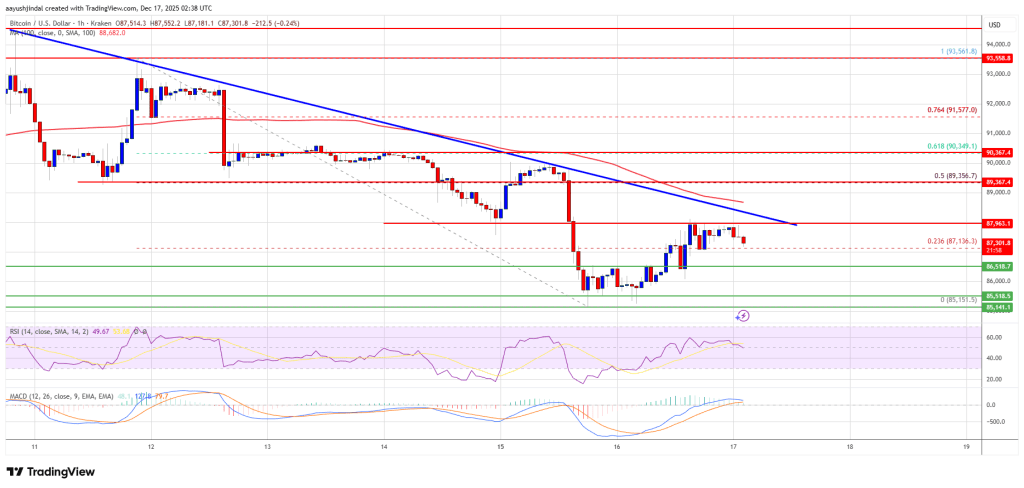

Bitcoin price regroups after decline—Is a directional breakout imminent?

币界网·2025/12/17 03:17

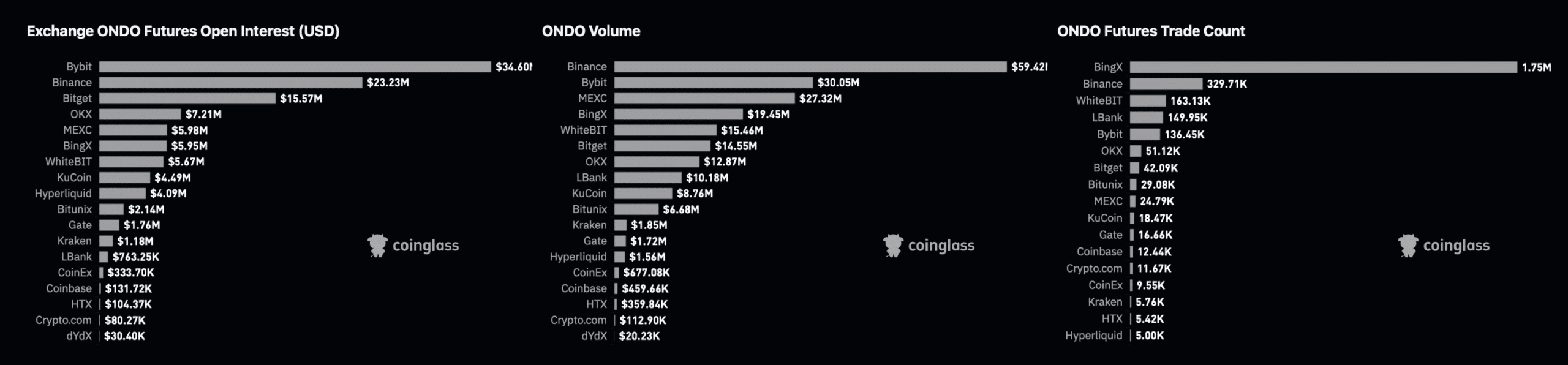

Two main reasons why the current decline of ONDO is only temporary.

币界网·2025/12/17 03:14

Mapping 2 reasons why ONDO’s current dip is only temporary

BlockBeats·2025/12/17 03:03

How much capital can Hyperliquid’s major move "Portfolio Margin" bring?

BlockBeats·2025/12/17 02:48

Won-Dollar Exchange Rate Soars: Hits Critical 1480 Level for First Time in 8 Months

Bitcoinworld·2025/12/17 02:42

The real impact of quantitative easing policies on cryptocurrencies

币界网·2025/12/17 02:36

Flash

- 03:15An Ethereum whale transferred 500 million USDT from Stable across chains to repay debts on Aave.according to Emmett Gallic's monitoring, this early Ethereum whale associated with the cryptocurrency exchange BTSE settled its debt on the decentralized lending platform Aave after transferring 500 million USDT out of Stable via cross-chain. It is currently unclear why this entity initially invested funds into the Concrete liquidity pool. The entity's current collateral assets on the Aave platform include 278,000 Ethereum (worth 886 million USD) as well as a 10-year long position of 447,000 Ethereum (worth 1.3 billion USD).

- 03:15The Hyper Foundation proposes to consider the HYPE held by the Aid Fund as burned, permanently removed from circulation and total supplyBlockBeats News, December 17th, the Hyper Foundation posted on social media proposing a validator vote to formally acknowledge that the Aid Fund HYPE has been burned and these tokens will be permanently removed from circulation and total supply. As background, the Aid Fund automatically converted transaction fees to HYPE during the L1 execution process. Similar to a burn address, the Aid Fund's system address has never had a private key controlling its funds. Unless there is a hard fork, the funds are theoretically unrecoverable. A "yes" vote indicates that validators agree to burn the Aid Fund HYPE tokens. Since these tokens have existed in a system address without a private key, no on-chain action is required. This vote constitutes a binding social consensus that will never authorize any protocol upgrade to access this address.

- 03:11The total net inflow for the US Solana spot ETF in a single day was $3.64 million.According to Deep Tide TechFlow, on December 17, SoSoValue data shows that on December 16 (Eastern Time), the total net inflow of Solana spot ETFs was $3.64 million. On December 16 (Eastern Time), the SOL spot ETF with the highest single-day net inflow was Grayscale SOL ETF GSOL, with a single-day net inflow of $1.88 million. Currently, GSOL's historical total net inflow has reached $100 million. Next is Bitwise SOL ETF BSOL, with a single-day net inflow of $1.35 million. Currently, BSOL's historical total net inflow has reached $606 million. As of the time of publication, the total net asset value of Solana spot ETFs is $926 million, with a Solana net asset ratio of 1.28%, and the historical cumulative net inflow has reached $715 million.

News