News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(September 15)|EDCON 2025 Ethereum Developer Conference Set to Open Soon; Major Token Unlocks Scheduled This Week; Tether Launches New USD Stablecoin for US Market2Chainlink Could See Further Gains After SBI Partnership, Bitwise ETF Filing and Large Exchange Outflows3Ethereum Co-Founder Says AI-Led Governance Could Be Exploited, Urges Info-Finance Oversight

Shiba Inu’s Price Forecast: Will SHIB Overcome Resistance and Aim for $0.0001?

Cryptonewsland·2025/09/15 10:24

Breaking Down ONDO’s 15% Surge: What Sparked the Price Rally?

Cryptonewsland·2025/09/15 10:24

SEC Chair Expands Project Crypto, Calls for Clear Rules on Digital Assets

Cryptonewsland·2025/09/15 10:24

Worldcoin’s Price Doubles, Analysts Predict Next Altcoin Breakouts

Cryptonewsland·2025/09/15 10:24

Galaxy Digital Buys $1.55B in Solana as Price Falls 3.85%: Bullish Signal or Bearish Warning?

Cryptonewsland·2025/09/15 10:24

Solana "Signal King" goes live, longtime "ally" Multicoin bets on DAT

ChainFeeds·2025/09/15 10:22

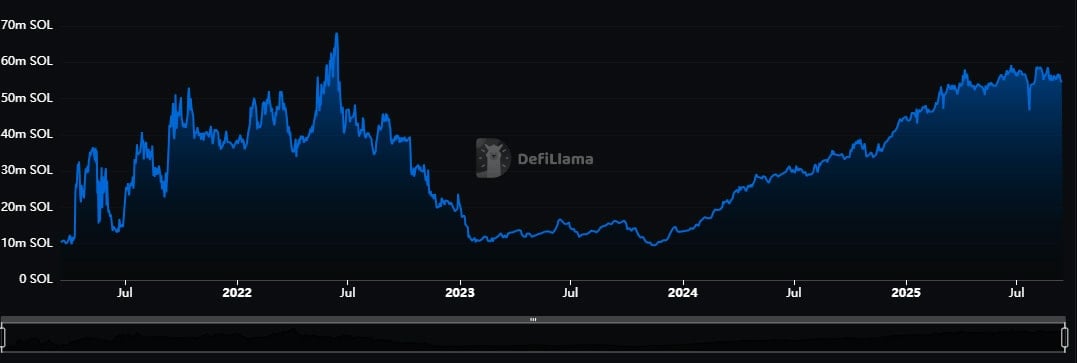

Solana DeFi TVL Hits $13,38 Billion as Users Surge

Portalcripto·2025/09/15 10:21

XRP Price Could Skyrocket, Analyst Projects New Jump With Fed Cut

Portalcripto·2025/09/15 10:21

Upcoming US Fed meeting could push Bitcoin above $120 and usher in altcoin season in 2025

Portalcripto·2025/09/15 10:21

SEC to Warn Firms Before Crypto Crackdowns

SEC Chair Paul Atkins signals a softer stance, promising warnings before crypto enforcement actions.A Break from Past Aggressive TacticsImplications for the Crypto Industry

Coinomedia·2025/09/15 10:18

Flash

- 10:29London Stock Exchange launches blockchain private fund platform and completes first transactionChainCatcher news, the London Stock Exchange Group (LSEG) announced that its blockchain-based private fund platform, Digital Markets Infrastructure (DMI), has completed its first transaction. The first clients are investment management company MembersCap and digital asset exchange Archax, with the transaction completing the fundraising for MembersCap's MCM Fund 1. LSEG stated that DMI covers the entire asset lifecycle, improves efficiency from issuance to settlement, and will be compatible with existing blockchains and traditional financial services.

- 09:54QCP: BTC ETF sees large inflows for five consecutive days, altcoin market cap hits 90-day highChainCatcher News, QCP released a market report stating that the cryptocurrency market has returned to normal after the volatility triggered by last week's CPI data. Although the data showed that tariffs caused some inflationary pressure, there were no major surprises, providing a green light for risk assets. Institutional capital inflows have significantly strengthened: BTC spot ETFs have recorded large inflows for five consecutive days, and after the SEC postponed its decision on the ETH staking ETF, ETH saw its largest single-day inflow in two weeks on Friday. Despite the postponement of ETF decisions, both XRP and SOL rose, with the market viewing the delay as inevitable rather than a rejection. As BTC consolidates within its range, the altcoin market has performed impressively: CMC's Altcoin Season Index has reached 72, and the total market capitalization of altcoins has reached $1.73 trillion, both the highest levels in 90 days. BTC has recovered from the September low of 107k, but is still fluctuating within a range. Market participants believe that with digital asset supporter Paul Atkins serving as SEC Chairman, traders seem to be accumulating high-beta cryptocurrencies in anticipation of what they see as the inevitable approval.

- 09:54Societe Generale and Standard Chartered predict the Federal Reserve will cut interest rates by 50 basis pointsAccording to ChainCatcher, citing Golden Ten Data, analysts at Société Générale believe that the Federal Reserve's moderately restrictive stance has been maintained for too long, resulting in an "over-tightening" situation. Therefore, a more substantial policy adjustment is necessary, specifically a 50 basis point rate cut. Standard Chartered is also the only institution predicting that the Federal Reserve will cut rates by 50 basis points this week. Currently, the market generally expects a 25 basis point rate cut, and traders believe the probability of a 50 basis point cut is only about 4%.