News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

Is the DA war coming to an end? Deconstructing PeerDAS: How can it help Ethereum reclaim "data sovereignty"?

Odaily星球日报·2025/12/18 07:14

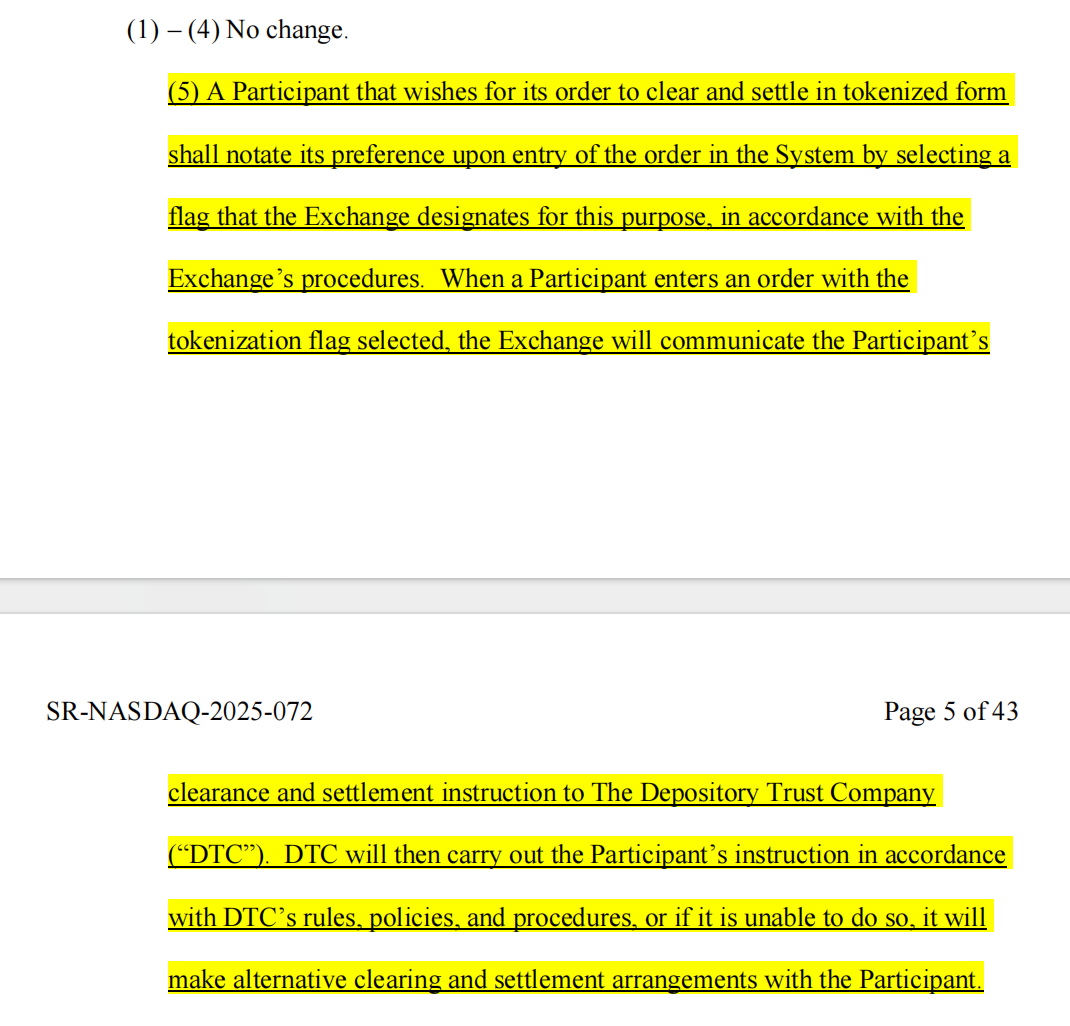

Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

Odaily星球日报·2025/12/18 07:14

Why did the "Insider King" fall into his own trap on October 11?

AIcoin·2025/12/18 07:07

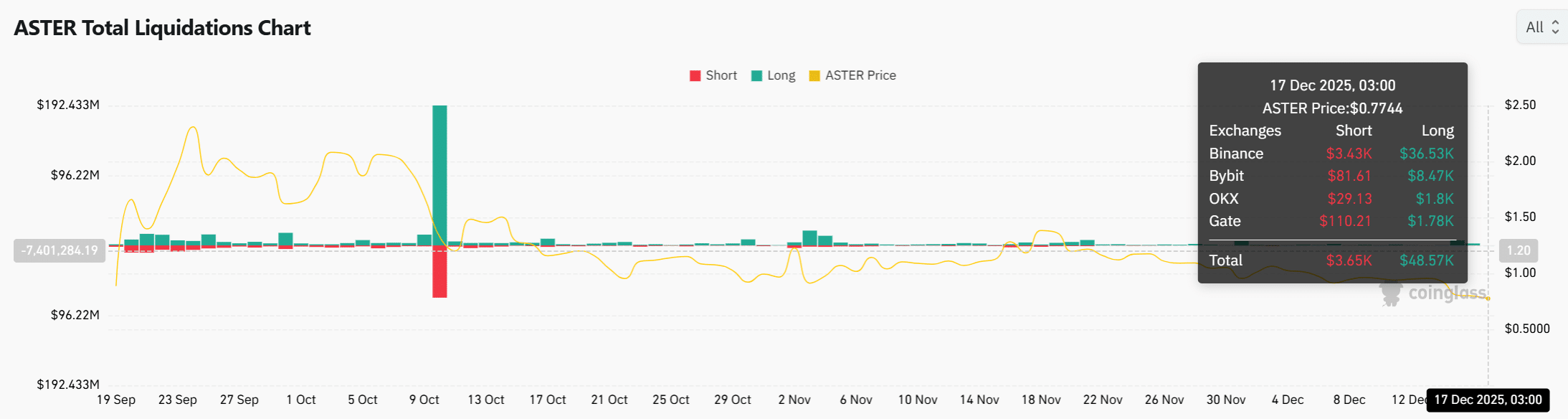

ASTER price sinks as whale losses deepen – Is $0.6 next?

AMBCrypto·2025/12/18 07:03

Dark Defender: Narrative Will Continue to Shift In Favor of XRP. Here’s why

TimesTabloid·2025/12/18 07:03

Revealing the Edge: Longs Hold Slight 50.57% Lead in BTC Perpetual Futures

Bitcoinworld·2025/12/18 06:42

MSCI Crypto Delisting: The Alarming $15 Billion Threat to Bitcoin Markets

Bitcoinworld·2025/12/18 06:27

Bitcoin's Price Ceiling Tightens as Loss-Holders Sell

Decrypt·2025/12/18 06:09

Caroline Ellison Shifted to Community Custody Before 2026

Cryptotale·2025/12/18 06:06

Bitcoin Price Resistance: The Critical $95K Test That Could Make or Break the Rally

Bitcoinworld·2025/12/18 06:03

Flash

07:26

UBS: US data flashes red, giving the Fed reason to implement "insurance" rate cuts next year. according to analysis by UBS, the employment data released this week reveals potential weakness in the U.S. labor market, which could serve as a basis for the Federal Reserve to further cut interest rates early next year.

Affected by the government shutdown, data delayed by the U.S. Bureau of Labor Statistics (BLS) shows that non-farm payrolls increased by only 64,000 in November, remaining basically flat compared to April. Meanwhile, the unemployment rate has continued to rise in the latter part of this year, currently reaching 4.6%.

These data depict a picture of economic pressure at the end of the year. For example, the number of people involuntarily working part-time in November reached 5.5 million, an increase of 909,000 from the previous month. The Bureau of Labor Statistics explains that these people prefer full-time work but are forced to work part-time due to reduced hours or inability to find full-time positions.

In addition, the youth unemployment rate rose month-on-month to 16.3%, and the number of people unemployed for less than five weeks reached 2.5 million in November, an increase of 316,000 from September. This indicates that new entrants and job changers in the labor market are facing difficulties in finding stable positions. Although the full employment report for October was not disclosed, this week’s data confirms that federal government employment decreased by 162,000 in October.

Paul Donovan, UBS’s Chief Economist, pointed out in a report to clients that these data “sound multiple alarms.” He added that due to the government shutdown exacerbating the low survey response rate of the Bureau of Labor Statistics, the quality of the data itself should be treated with caution.

However, Donovan also stated that the report does not raise excessive concerns about the resilience of U.S. consumers, as employment in the food service industry continues to grow, indicating that the trend of entertainment consumption is still ongoing. Nevertheless, the health of the labor market may have enough hidden concerns to justify a “precautionary rate cut” by the Federal Reserve next year.

07:21

Opinion: Recent US employment data is "worrying", giving the Federal Reserve reason for a "precautionary" rate cut next yearBlockBeats News, December 18, according to analysis by UBS, employment data released this week reveals potential weakness in the US labor market, which could provide grounds for the Federal Reserve to cut interest rates further early next year. UBS Chief Economist Paul Donovan noted in a report to clients that this data "rings alarm bells in several areas." Due to the government shutdown exacerbating the low response rate to the Bureau of Labor Statistics surveys, the quality of the data itself should be treated with caution. Elyse Ausenbaugh, Chief Investment Strategist at JPMorgan Wealth Management, agreed that the October data was particularly "concerning." She stated that this report reinforces the market's view of the Federal Reserve's current policy path. The "insurance" rate cuts over the past few months were prudent moves that have brought rates back to a more neutral level. She believes that a further rate cut in the first quarter of 2026 may be appropriate, but for now, the economy remains stable and the Federal Reserve can afford to patiently observe before taking further action. (Golden Ten Data)

07:21

RIVER briefly reached 3.46 USDT, with a 24-hour increase of 62.44%Foresight News reports that according to Bitget market data, RIVER briefly reached 3.46 USDT and is now quoted at 3.3 USDT, with a 24-hour increase of 62.44%.

News