News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

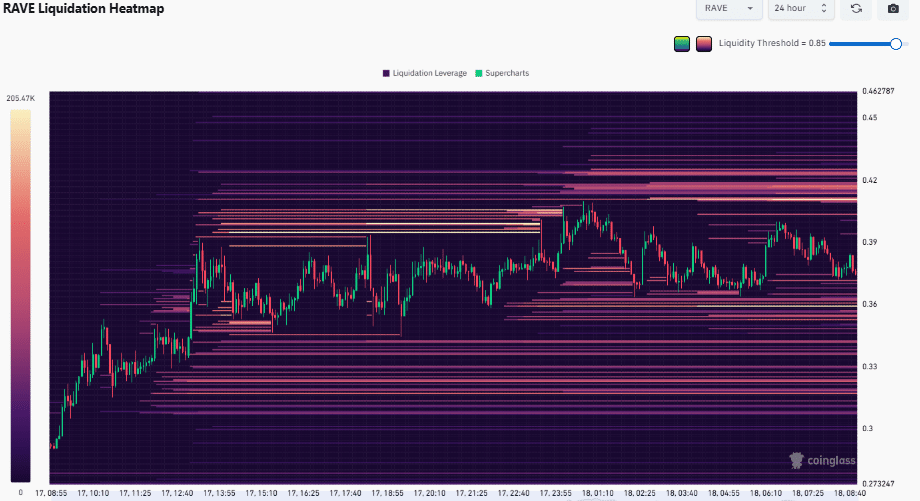

RAVE rallies 29%, but is the post-launch correction already over?

AMBCrypto·2025/12/19 03:03

Stability World AI and Cache Wallet Collaborate to Redefine Asset Recovery and Digital Ownership

BlockchainReporter·2025/12/19 03:00

Solana, Aptos Move to Harden Blockchains Against Future Quantum Attacks

Decrypt·2025/12/19 02:50

Revealed: Bitmain’s Massive $229.3 Million Ethereum Purchase Signals Bullish Confidence

Bitcoinworld·2025/12/19 02:42

Revolutionary aPriori Chainlink Partnership Unlocks Seamless Cross-Chain Trading

Bitcoinworld·2025/12/19 02:27

Revolutionary SportsFi Platform GolfN Drives Global Expansion with Major Brand Partnerships

Bitcoinworld·2025/12/19 02:15

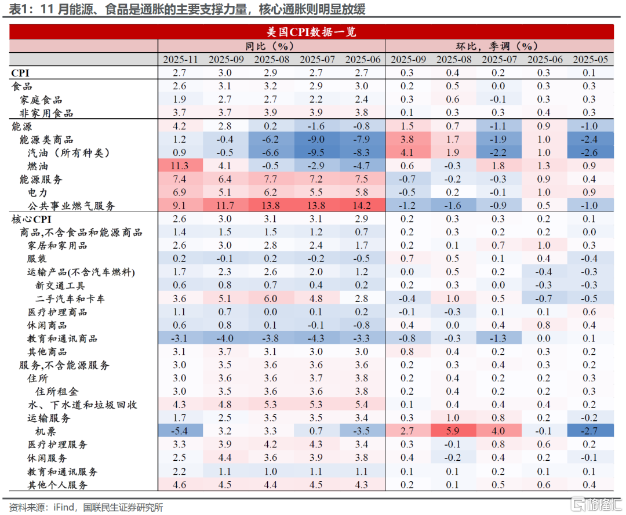

US CPI Surprises, Is There a Turning Point for the Doves?

AIcoin·2025/12/19 02:06

Game-Changing Appointment: Mike Selig Takes Helm as New CFTC Chairman

Bitcoinworld·2025/12/19 01:57

Flash

03:08

Hong Kong Financial Services and Treasury Bureau: Studying the legal and regulatory framework for the issuance and trading of tokenized bonds. the "Web5 Ecosystem" summit was held in Hong Kong. At the meeting, Chen Haolian, Deputy Secretary for Financial Services and the Treasury of Hong Kong, stated that government departments are studying the legal regulatory framework for the issuance and trading of tokenized bonds, exploring optimization measures, and promoting the adoption of tokenization technology in Hong Kong's bond market to enrich the variety of products in the tokenization and digital asset sectors. In addition, the Hong Kong Monetary Authority is implementing digital currency projects, including promoting commercial banks to launch tokenized deposits and facilitating the trading of real tokenized assets. (Jin10)

03:07

「Buddy」 practiced buying the dips and selling the rips, significantly reducing their Ethereum long position during last night and this morning's downturn, and then adding to their position again during a minor rebound.BlockBeats News, December 19th, according to Hyperinsight monitoring, during the market downturn last night and this morning, "Buddy" significantly reduced their Ethereum long position, and then during a slight market rebound just now, once again increased their long position by 250 ETH.

At the time of writing, their 25x Ethereum long position is 4,500 ETH, a net reduction of 1,075 ETH from yesterday's 19:00 position of 5,575 ETH, with a liquidation price of $2,777.51.

02:58

Aptos Proposes Post-Quantum Signature Improvement Proposal AIP-137BlockBeats News, December 19th, Aptos announced the proposal of an improvement proposal AIP-137 to introduce post-quantum signatures, planning to support post-quantum digital signature schemes at the account level to address the long-term risks that quantum computing development may pose to existing encryption mechanisms. The scheme will be introduced as an optional feature that does not affect existing accounts. According to the proposal, Aptos intends to support the hash-based signature scheme SLH-DSA, which has been standardized as FIPS 205. (Cointelegraph)

News