News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

For every $1,000 traded, a rebate of $0.03 is earned. It is precisely this seemingly small rebate that enabled the trader to grow from $6,800 to $1.5 million.

Heavy rain can't dampen the enthusiasm.

The Hong Kong Monetary Authority has released a consultation paper, CRP-1 "Crypto Asset Classification," aiming to establish a regulatory framework that balances innovation and risk control. The paper clarifies the definition and classification of crypto assets, as well as regulatory requirements for financial institutions, aligning with international standards set by the BCBS. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

Could Ethereum become one of the most strategic assets of the next decade? Why do DATs offer a smarter, higher-yield, and more transparent way to invest in Ethereum?

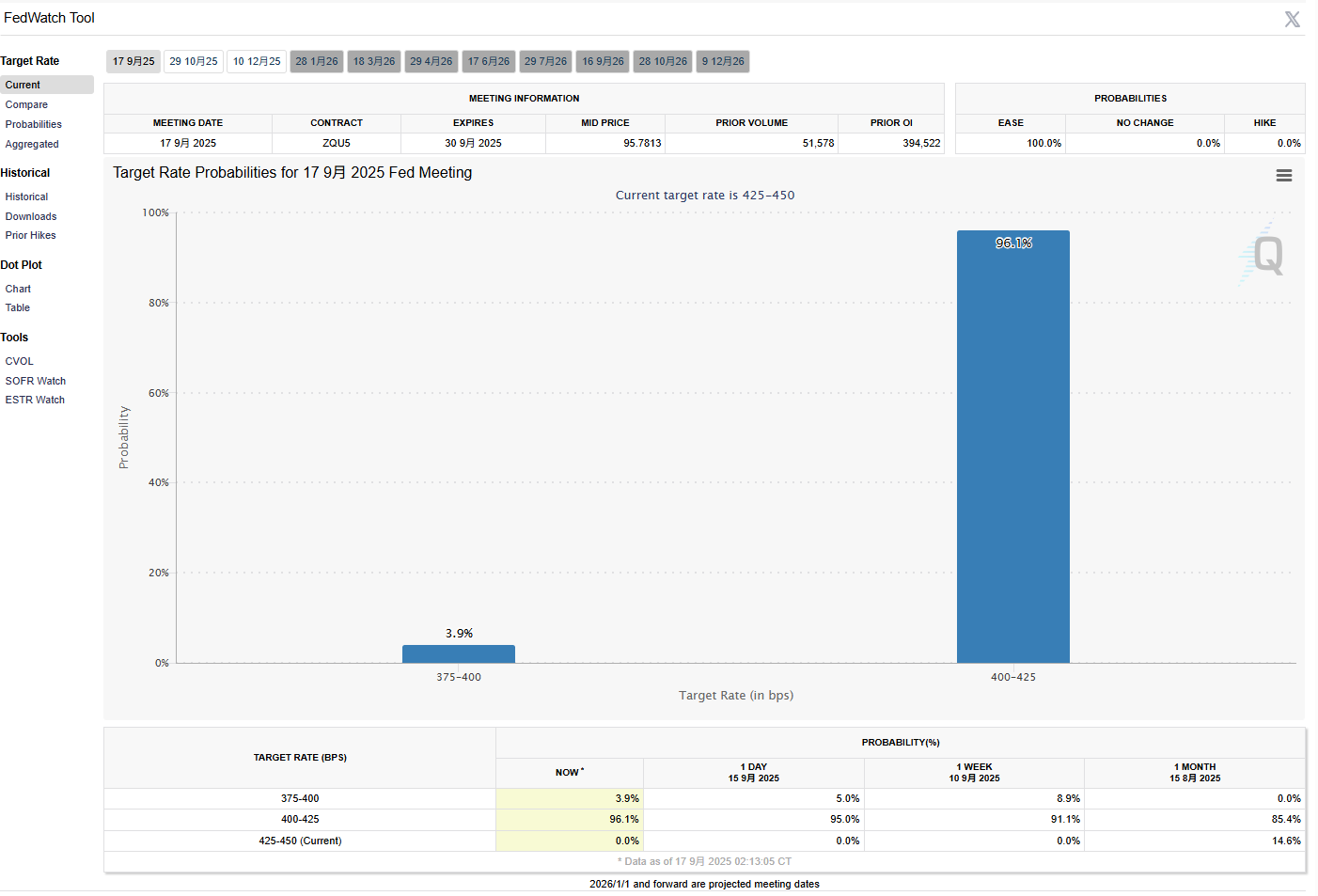

Any indication the FOMC is less dovish than anticipated could weigh on crypto, industry watcher says

- 16:04BlackRock Adjusts $185 Billion Investment Portfolio, Betting on U.S. Stock Market Performance and AI TrendsBlockBeats News, September 17 — An investment outlook report shows that the world’s largest asset management company, BlackRock, is “raising its risk allocation”—significantly increasing its holdings of U.S. stocks and expanding its exposure to the artificial intelligence (AI) sector within its $185 billions model portfolio platform. The outlook report points out that, thanks to the “top-tier earnings performance” of the U.S. stock market, BlackRock has increased its allocation to U.S. equities in its series of model portfolios at the expense of reducing holdings in international developed market stocks. After the adjustment, the overall stock holdings in these portfolios are overweighted by 2%. Data shows that on Tuesday, as BlackRock completed its asset allocation adjustment, its corresponding ETFs saw capital flows in the billions of dollars. This adjustment to the model portfolios is seen as a “vote of confidence” in the U.S. stock market rally: since the beginning of this year, driven by the investment boom in the AI sector and market bets on an imminent rate-cutting cycle by the Federal Reserve, the S&P 500 Index has reached record highs. BlackRock stated in its investment report that the relatively strong earnings performance of U.S. companies will continue to drive U.S. stocks higher, noting that since the third quarter of 2024, U.S. corporate earnings have grown by 11%, while earnings growth for similar companies in other developed markets has been less than 2%. (Golden Ten Data)

- 16:04SEC Cryptocurrency Special Task Force to Organize a Series of Public MeetingsBlockBeats news, on September 17, the U.S. Securities and Exchange Commission (SEC) officially announced that the Crypto Assets and Cyber Unit is actively preparing to arrange opportunities for stakeholders to meet with crypto-friendly Commissioner Hester Peirce and her team. In order to promote open dialogue and transparency, the SEC will publish the agenda and the list of representatives participating in each meeting.

- 16:04Mavryk Network completes $10 million financing round, led by MultiBank GroupBlockBeats News, on September 17, L1 network Mavryk Network announced the completion of a $10 million funding round, led by MultiBank Group. Mavryk Network will expand its real-world asset (RWA) tokenization initiative, tokenizing real estate in the United Arab Emirates valued at over $10 billions through MultiBank's RWA platform.