News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Explosive Theta Labs Lawsuit: Former Execs Accuse CEO of Fraud and Price Manipulation

Bitcoinworld·2025/12/17 05:27

Pi Network stock price remains under pressure, momentum weakens

币界网·2025/12/17 05:15

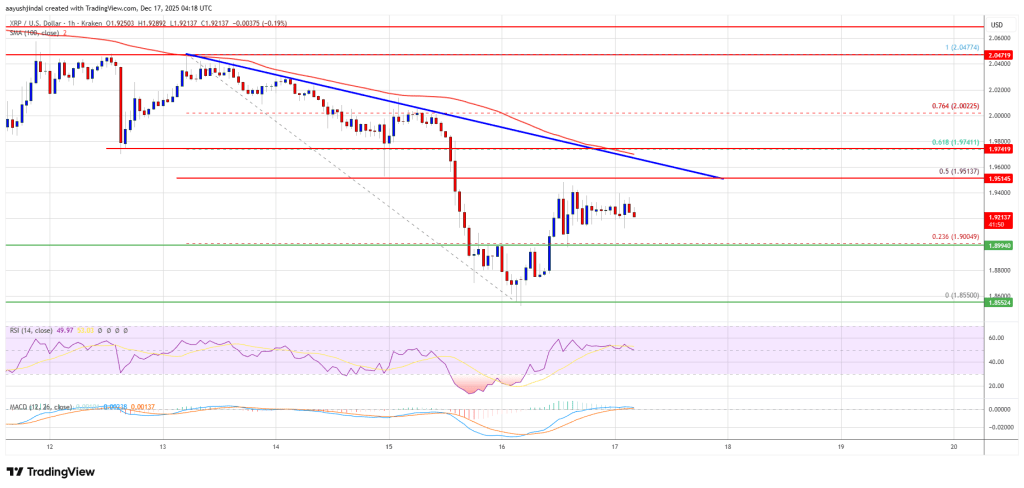

XRP price recovery appears fragile—can bulls break through the price ceiling?

币界网·2025/12/17 05:15

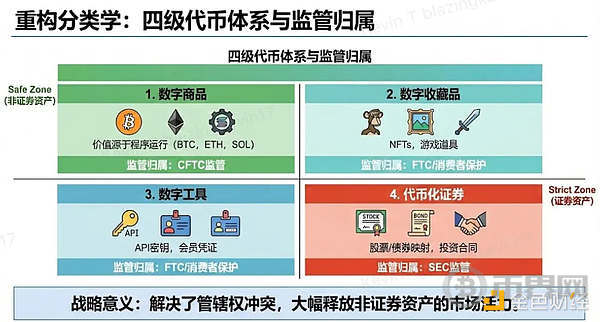

Pantera: 2025 will be a year of structural progress for the crypto market

币界网·2025/12/17 05:15

Urgent Crypto Fraud Crackdown: US Senators Launch Bipartisan SAFE Act to Protect Investors

Bitcoinworld·2025/12/17 05:12

Trump to interview pro-crypto Christopher Waller for next Fed Chair: WSJ

The Block·2025/12/17 04:45

Ethereum Spot ETFs Face Alarming $223.7M Exodus: 4th Day of Major Outflows

Bitcoinworld·2025/12/17 04:45

Bitcoin ETF Shock: $277.4 Million Flees US Funds as BlackRock Leads Outflow

Bitcoinworld·2025/12/17 04:42

Flash

- 05:35Sources: Japan's cryptocurrency tax reform may not be officially implemented until January 2028PANews, December 17 — According to CoinDesk, Japanese political sources have indicated that the country's cryptocurrency tax reform—specifically the shift to a “separate self-assessment taxation” scheme—may not be officially implemented until January 2028. Previously, the market generally expected that, since the amendment to include cryptocurrency under the regulation of the Financial Instruments and Exchange Act is almost certain to pass in next year's parliament, the new tax regime could be introduced in 2027 alongside this law. However, according to political insiders, the actual process may be slower than anticipated. One source stated: “Currently, there is a lack of grounds to accelerate the (tax reform) process. The government is more focused on investor protection measures and needs to observe the situation after the implementation of the Financial Instruments and Exchange Act before launching the new tax system. Based on the normal process, it is expected to take effect from January 1, 2028.” Under Japan's current tax system, profits from cryptocurrency trading are classified as “miscellaneous income,” which must be combined with salary and other income for comprehensive taxation, with a maximum marginal tax rate of up to 55% (including local resident tax). The industry and investors have long called for the adoption of a separate self-assessment taxation system, similar to stock investment, with a unified tax rate of 20% for cryptocurrency, in order to reduce the tax burden and promote market development.

- 05:26Former Theta Labs executive sues CEO for alleged fraud and market manipulationAccording to TechFlow, on December 17, Decrypt reported that two former Theta Labs executives, Jerry Kowal and Andrea Berry, filed a whistleblower lawsuit in California, accusing company CEO Mitch Liu and Theta Labs of fraud, token market manipulation, and retaliation against whistleblowing employees. The lawsuit alleges that Liu used Theta Labs as a personal trading tool, inflating the price of THETA tokens through misleading partnerships (including exaggerating ties with Google), undisclosed internal token sales, and NFT market manipulation. The plaintiffs described a long-term pattern of self-dealing, claiming that Liu carried out a "deliberate pump-and-dump scheme," harming the interests of investors and employees. As of press time, Liu and Theta Labs have not commented on the matter.

- 05:19Former Theta executive accuses the company’s CEO of fraud and retaliationPANews, December 17 — According to Decrypt, two former executives of blockchain company Theta Labs have filed whistleblower lawsuits in California, accusing the company and its CEO Mitch Liu of years of fraud, market manipulation, and retaliatory behavior. Former executives Jerry Kowal and Andrea Berry filed lawsuits in Los Angeles Superior Court, alleging that Liu used Theta Labs and its parent company Sliver VR Technologies to inflate token prices through misleading partnerships and undisclosed insider token sales, while retaliating against employees who raised concerns. The attorney representing Jerry Kowal pointed out that Mitch Liu used Theta Labs as a personal trading tool, engaging in fraud, self-dealing, and market manipulation. Liu's carefully orchestrated pump-and-dump schemes repeatedly wiped out the value for investors and employees. The alleged schemes also include "generating fake bids for NFTs," some of which were related to high-profile collaborations with celebrities such as Katy Perry. Berry's complaint also targets Theta's previous statements about Google, accusing the company of publicly misrepresenting a routine cloud services agreement as a strategic partnership. The complaint also highlights two other instances of self-dealing, alleging that "Theta's so-called 'partners' were actually other companies created and wholly owned by Liu."

News