News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

- 08:16Data: A certain whale address sold approximately $5.5 million worth of ETH spot and switched to 7x leveraged long positions on ETH.ChainCatcher news, according to monitoring by Lookonchain, the whale address 0x76AB switched to leveraged long positions on ETH after selling ETH spot. The specific operations are as follows: 1. Sold 1,654 ETH, receiving 5.49 million USDC; 2. Deposited the obtained USDC into the Hyperliquid platform; 3. Opened a 7x leveraged long position, corresponding to 11,543 ETH (worth approximately 38.4 million USD). The liquidation price for this leveraged position is $2,907.6.

- 07:59The Indian government is significantly strengthening cryptocurrency enforcement trainingChainCatcher news, according to Financefeeds, the Indian government is significantly ramping up cryptocurrency enforcement training to address increasingly complex crypto-related financial crimes. This training involves multiple agencies, including the Financial Intelligence Unit of India (FIU-IND), the Enforcement Directorate (ED), and the Narcotics Control Bureau (NCB). The focus is on blockchain forensics, on-chain analysis, crypto asset seizure, and wallet address identification technologies. This initiative is a direct response to the requirement for Virtual Digital Asset Service Providers (VDASP) to register mandatorily with FIU-IND, as well as India's shift from regulatory ambiguity to structured supervision. The training aims to equip law enforcement personnel with the ability to track, seize, and prosecute crimes involving Virtual Digital Assets (VDA).

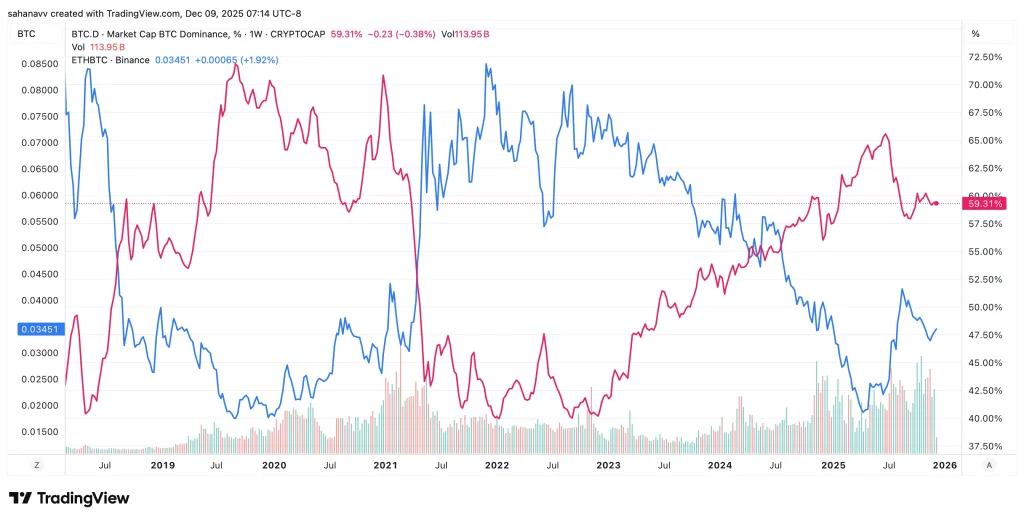

- 07:41Wintermute: Crypto Market Liquidity Exhibiting "Cyclical Reuse" CharacteristicsJinse Finance reported that digital asset market maker Wintermute has released its latest report, indicating that the current cryptocurrency market is undergoing a period of deep consolidation, primarily driven by liquidity recycling. Market capital is noticeably withdrawing from high-risk assets and is continuously concentrating on the two leading crypto assets—bitcoin and ethereum. This round of strategic capital rotation, which began at the end of 2025, suggests that against the backdrop of increasing macroeconomic uncertainty, both institutional investors and experienced retail investors have shifted to a “selective risk-taking” strategy, prioritizing asset quality and liquidity as their main considerations.