News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 17)|U.S. seasonally adjusted nonfarm payrolls for November increased by 64,000; BlackRock transferred approximately $140 million worth of ETH to a CEX2Bitget US Stock Morning Brief | Fed Independence Reaffirmed; NFP Beats Expectations; Tech Rally Lifts Market (December 17, 2025)

Shiba Inu Price Prediction: Shiba Inu Price May Drop Again Before Rebounding

币界网·2025/12/17 21:53

Caroline Ellison’s Pivotal Move: Former Alameda CEO Enters Halfway House After FTX Prison Sentence

Bitcoinworld·2025/12/17 21:42

YouTube to pull music data from Billboard’s charts because it doesn’t like its ranking formula

TechCrunch·2025/12/17 21:33

Tether Launches PearPass: P2P Password Manager Without Cloud Servers “No Serves to Hack”

Coinspeaker·2025/12/17 21:12

Analysis Firm Warned: “‘This is the Average Purchase Level for Bitcoin Investors, Price Should Not Fall Below This Level’”

BitcoinSistemi·2025/12/17 21:12

SWIFT Could Soon Integrate XRP Ledger. Here’s the Latest

TimesTabloid·2025/12/17 21:03

City Protocol Partners with Cwallet to Simplify Web3 IP Onboarding for 37 Million Users

BlockchainReporter·2025/12/17 21:00

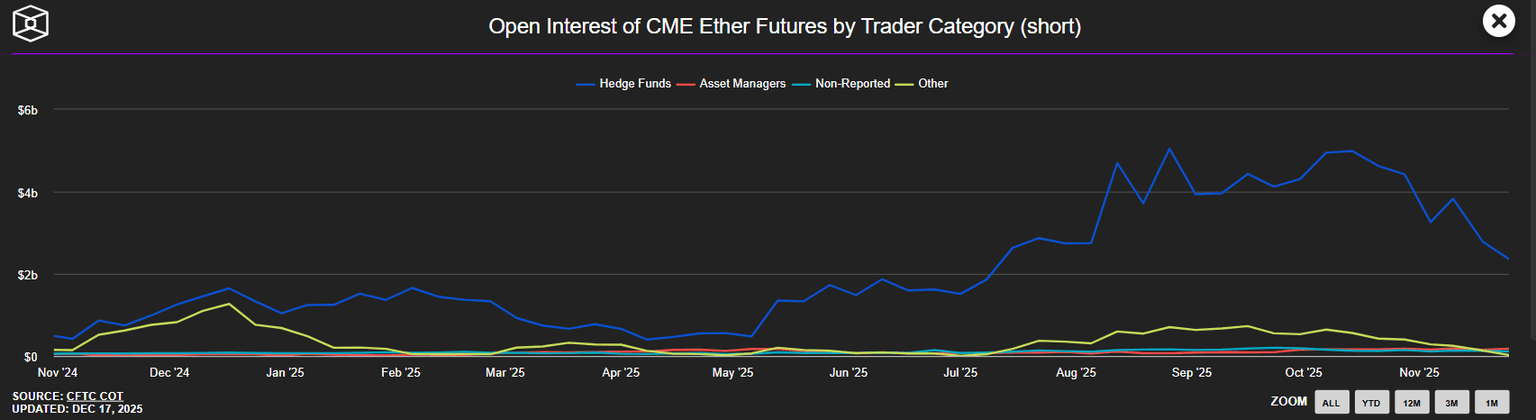

Ethereum Price Prediction: Liquidations Increase, ETH Short Positions Decrease

币界网·2025/12/17 20:56

Flash

21:51

The US Dollar Index rose by 0.23% on the 17th.Jinse Finance reported that the US Dollar Index rose by 0.23% on the 17th, closing at 98.368 in the foreign exchange market.

21:08

The Dow Jones Index closed down 228.29 points, with both the S&P 500 and Nasdaq also declining.ChainCatcher news, according to Golden Ten Data, the Dow Jones Industrial Average closed down 228.29 points, a decrease of 0.47%, at 47,885.97 points on Wednesday, December 17; the S&P 500 Index closed down 78.75 points, a decrease of 1.16%, at 6,721.51 points; the Nasdaq Composite Index closed down 418.14 points, a decrease of 1.81%, at 22,693.32 points.

21:03

Federal Reserve Board issues new policy statement to promote banking innovationThe Federal Reserve Board on Wednesday withdrew its 2023 policy statement and issued a new policy statement to promote responsible innovation by regulated banks. Vice Chair for Supervision Michelle W. Bowman stated that the Federal Reserve Board is ensuring the safety of the banking industry by creating pathways for innovative products. The new policy statement creates avenues for both insured and uninsured state member banks regulated by the Federal Reserve Board to participate in certain innovative activities.

News